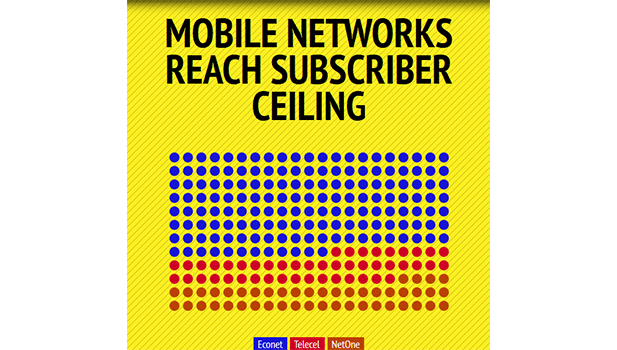

For the first time, mobile penetration has exceeded 100% mainly driven by subscriber growth from Econet Wireless and Netone. The country’s second largest operator was apparently at receiving end of the network wars that characterised 2013 as it not only registered the slowest subscriber growth, but actually lost some subscribers between 2012 and 2013.

The final 2013 mobile and internet penetration stats released by POTRAZ not only reveal the cut throat nature of the industry, but also the positive byproduct of competition which is more people connected in this case. Our MNOs added a combined 904,952 active subscribers between Q4 2012 and Q4 2013 bringing the mobile penetration to 103.5%.  Econet has anchored the subscriber growth contributing a little over half of the total subscriber growth. In 2013 Econet was all over the place – I say that with a positive tone. The company’s EcoCash product scaled to a point where it’s now regarded as the standard in mobile money picking up more subscribers along the way.

Econet has anchored the subscriber growth contributing a little over half of the total subscriber growth. In 2013 Econet was all over the place – I say that with a positive tone. The company’s EcoCash product scaled to a point where it’s now regarded as the standard in mobile money picking up more subscribers along the way.

Interestingly though, Econet’s subscriber growth has been slowing down since 2011 and it’s apparent that a ceiling has been reached. Between June 2011 to December 2011 they added 1,486,000 subscribers, before marginally growing with 1,586,267 during the same period in 2012. In 2013 Econet’s subscriber growth was fell to just under half a million subscribers between March and 2013.

This pattern may suggest that Econet’s subscriber growth may have reached somewhat of a ceiling with little room for notable future growth. The story is the same for Telecel which added 675,000 in between June 2011 and December 2011, slowing subscriber growth to 579,000 between June 2012 and December 2012.

In 2013 Telecel’s subscriber growth slowed further to 114,424 between March 2013 and December 2013. On the other hand, Netone lost 466,616 subscribers between June 2012 and December 2012 but went on to add 352,722 between March and December 2013.

With a ceiling reached, MNOs will now focus on retaining and milking the most from their existing subscribers especially the high value ones. Telecel’s Red promotion in particular is one example were MNOs are going for “high value corporate clients”. Telecel’s Marketing Director Mr Octivius Kahiya recently said “our revenue market share has improved significantly in spite of the flat subscriber base growth due to this new focus (on high value clients)”.

Moving forward, the war for subscribers that characterized 2013 won’t feature unless instigated by the smaller players. Commanding more than half of the market share and owning a diverse portfolio products, Econet can be forgiven for being content – at least when it comes to subscribers.

The only growth avenue for Telecel and NetOne is to aim at Econet’s subscribers and judging from the experience of 2013, this is a route they may not be eager to walk again.

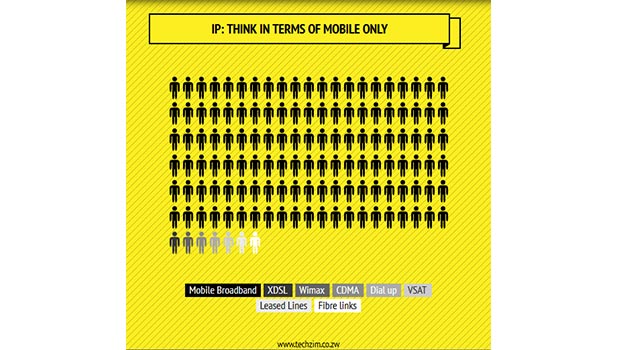

Data the new area of growth

The saturated mobile penetration presents double edged dilemma for the MNOs.Thanks largely to expansion efforts by MNOs, Internet Penetration in Zimbabwe is now at 40% with mobile broadband accounting for 98.9% of that figure. This is probably the only area MNOs can tap into growth outside VAS but the downside is increased access to data means consumers have greater access to cheaper communication methods, eating out of voice and text revenues.

The internet penetration stats releases by POTRAZ for 2013 POTRAZ do not narrow down to the numbers by operator, but in the previous year, Econet accounted for 97% of the mobile broadband figure. This was largely a result of Econet being an early bird and Telecel and NetOne should now have a greater share of mobile broadband market figures.

The internet penetration stats releases by POTRAZ for 2013 POTRAZ do not narrow down to the numbers by operator, but in the previous year, Econet accounted for 97% of the mobile broadband figure. This was largely a result of Econet being an early bird and Telecel and NetOne should now have a greater share of mobile broadband market figures.

Outside the MNOs, CDMA from Powertel and Africom has grown 83.4% between March 2013 (12,959) and December 2013 (78,091). Although there is strong reason to doubt the credibility of these figures, they may represent an increased demand for internet in the home and falling prices in this connection type.

3 comments

Who said Africom and Powertel are not MNOs. Why are you taking it for granted that everyone knows what an MNO is, especially when you do not even know what an MNO is?

On a licensing level Powertel and Africom are Internet Access Providers not Mobile Network Operators.

What is an MNO