Yesterday we gave you a heads up on Econet’s possible plans to launch/re-launch its EcoSure product this morning. We expected the launch to be about introducing further product development adding more value to the existing burial society/life insurance service and we were almost right.

Econet under its EcoSure brand has launched a new service “Thwala-Sonke” a first of its kind in Zimbabwe. Thwala Sonke (Takura-Vese/Carry Them All) is a new affordable life insurance service with the following key features:

(Please note this is an update from the event, adjustments will be made)

Existing policy member inclusion

Existing EcoSure policyholders can add family members, direct and extended family members to their current policy

Unlimited beneficiary inclusion

yes, you can now add family members, direct and extended, to your single policy. This includes children, in-laws (up to 70 years old) and spouses. The 70-year-old exclusion is probably from a risk assessment point of view? an individual can have up to 3 policies, as a policyholder, a dependent (only once) and as a member of a burial society. A policy can be taken up by anyone who is over 18 years of age and notification will be given to dependents that you may add.

Cross mobile network inclusion

in what is probably the most distinct feature of this product, the service is not limited to just Econet subscribers, you can also access Thwala-Sonke from Telecel and NetOne!

Affordable pricing structure

as we mentioned in yesterday’s heads up, EcoSure pricing has remained consistent over the past two years, and keeping with this, Thwala Sonke has maintained the same pricings, these are:

Funeral Cover Sum Assured Premium

EcoSure Lite $500 $0.50

EcoSure Basic $1,000 $1.00

EcoSure Standard $2,000 $2.00

EcoSure Premium $5,000 $5.00

Cultural Adaption

The Thwala Sonke product aims to adapt insurance into Zimbabwean cultural practices. It is moving away from “colonial” insurance practices bound by acts and insurance legislation that are not flexible to the social and economic environments most Zimbabweans are under. The policy allows for family members to have that extra financial assistance needed when faced with funerals.

Financial Inclusion agenda

The topic of financial inclusion was continuously commented on throughout the launch. The team at Econet believes that they have achieved the first step of opening the doors of financial inclusion to all Zimbabweans through its EcoCash platform. They mention that insurance is their next step to financial inclusion/empowerment for all Zimbabweans through the use their mobile phones.

So how do you get it?

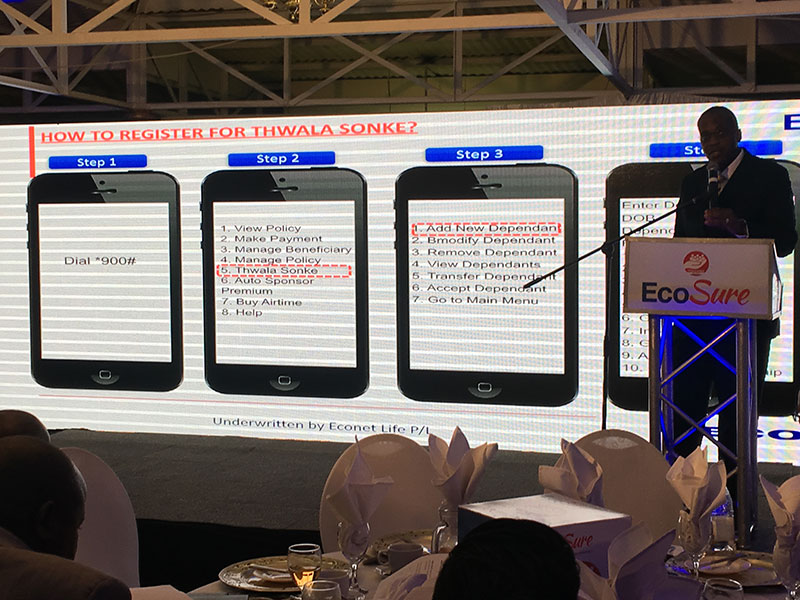

Firstly To get on to the Thwala Sonke service you simply go through the following steps:

- Dial *900#

- Choose the option 3: Thwala Sonke

- Under option 3, you can either: add new, modify, remove , accept, view, transfer dependents

- Under add new dependent, you can add a spouse, son, daughter, parent, grand-parents, in-laws or adopted children

We will give a review of the product and make any adjustments as this is an update from the event.

One response

Why is it that i am charged 3usd per month when i joined for 1usd pre month prenium?