The current liquidity crisis in Zimbabwe has hit mobile money really hard. A report by the telecoms regulator in Zimbabwe, POTRAZ, says mobile money transactions in the last quarter of 2016, October to December, dropped 35% from the previous quarter.

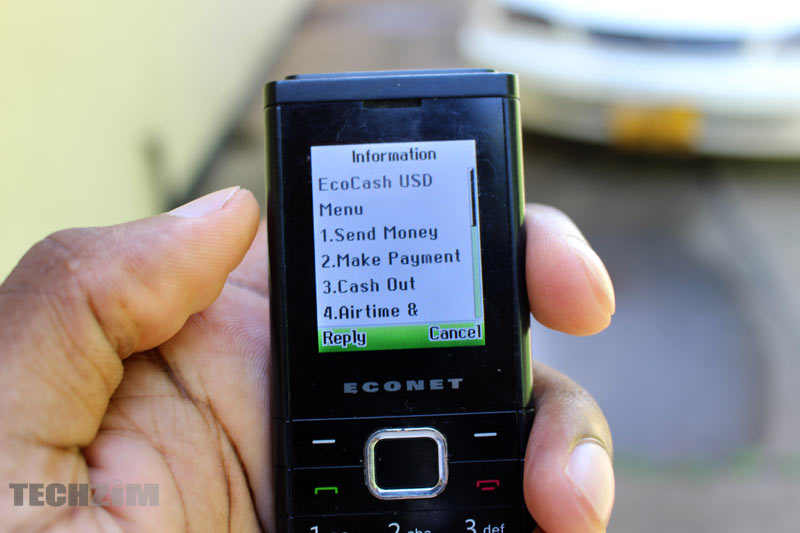

Since 99% of all the mobile money transactions in country are EcoCash transactions, mobile money in Zimbabwe really just means EcoCash.

Unfortunately the regulator wouldn’t provide any further details, which is quite unhelpful.

However, using numbers in the previous quarter’s report, the total value of cash-ins and cash-outs was US $872 Million (split almost evenly between the two). A 35% decline would mean that it’s now around $568 Million with cash-ins and cash-outs around $285 Million each.

The regulator does say though in the report that there’s cause for worry that if this continues, mobile money won’t make sense anymore as a business:

“This shows the impact of cash shortages is having on mobile money transactions, which if not addressed, can cause further decline in mobile money transactions, rendering Mobile money business unviable due to low volumes.

The numbers that would have been interesting to see would be how much merchant payments are now done via EcoCash. My assumptions is these are on the increase as they don’t require any cashing in or out; salary is deposited by employer into individual’s account; individual transfers the money to EcoCash wallet; drives to a service station and buys their fuel using EcoCash, goes to Pick n Pay and pays using EcoCash.

I hope POTRAZ considers making these available in the next report, or a revision of this one. Econet could make these numbers available too so their shareholders are assured it’s not a doom and gloom scenario that this 35% drop suggests. Unless it is. In which case they’ll just wait for when they release the year ended February 2018 financials.

19 comments

3 sugars with my tea please…

The report by Potraz is too incomplete to be informative. Obviously Cash-In and Cash-Out transactions are in decline why cash in when you can’t cash out? It would be more comprehensive if the Bank-Wallet transaction stats where included. More likely that a person would preserve whatever cash they have for (no other way) cash needs then move around whatever electronic money they have.

“This shows the impact of cash shortages is having on mobile money transactions, which if not addressed, can cause further decline in mobile money transactions, rendering Mobile money business unviable due to low volumes,” Potraz. IT ONLY SHOWS HOW SHALLOW POTRAZ DEFINES MOBILE MONEY. Doesnt cash shortages facilitate the need for mobile money transactions?????? Help me.

You are assuming that everyone has a bank account, and they can always transfer money from bank to wallet to facilitate transactions if there are cash shortages, well the marjority is unbanked. Besides not all banks are intergrated with mobile money platforms.

This lack of information is definitely a ploy by POTRAZ to paint a gloomy picture for Ecocash with the aim to trigger an exodus from the platform. I suspect anything Econet is being targeted by POTRAZ in the Government’s (Ministry’s) bid to topple Econet as a market leader and pave way for its Netone and Telecel investments.

It is Techzim trying to paint a bad picture about Ecocash. The report does not single out Ecocash, but the decline is for all 3 providers in total.

lol, but the same POTRAZ has said time and time again that EcoCash is 99% of all mobile money transactions in ZImbabwe. Check Q3 2016 report.

I have just checked on it, it says 97.8% in 3rd quarter not 99% as you allege. So to attribute all the 35% decline in total cash-ins and cash-outs to Ecocash is mathematically erroneous. Besides the industry is dynamic and statistics do not remain constant, probably it declined from 97.8% in the 4th quarter. So yes you are wrong!

Where were you when EcoCash was being praised through POTRAZ reports?

Double agent!

You’re probably reading the wrong report. Download it here: http://www.techzim.co.zw/zimbabwe-potraz-telecoms-reports

Here’s a screenshot

And something happened at Telecel and NetOne to change increase their marketshare drastically in 4th quarter?

As an ecocash user I have felt the pinch first hand. Many businesses are no longer accepting ecocash and it has lost the convenience it once had. Add to that the ridiculous limits being imposed and it’s near;y useless. Econet needs to do something about this. Perhaps Onewallet can take advantage of this and gain some market share?

POTRAZ- ““This shows the impact of cash shortages is having on mobile money transactions, which if not addressed, can cause further decline in mobile money transactions, rendering Mobile money business unviable due to low volumes…” This only shows how shallow the regulator defines Mobile Money. http://www.techzim.co.zw/2016/04/mobile-money-credible-solution-zimbabwean-cash-crisis/

35% is 35% regardless of how the regulator interprets it☝? Your avoiding the actual issue by attacking an opinion on it lol

Zim is not faced with liquidity crisis its cash crisis. Liquidity is measured by both cash in banks and hard cash. Actually its highly liquid.

You cannot say Zimbabwe is highly Liquid? even the cash in banks has drastically reduced due to the current bank run

what did you expect When most who cash in expect the same amount to be cashed out. What many have been terming mobile money is actually a means to send cash to someone too far to hand cash. In essence we haven’t been using mobile money, we were just using mobile platforms to change the hands that are holding the cash. For mobile money to work, they must first eliminate the need to cash-out, i.e one does not need to handle cash for anything since everything can be “swiped”, “ta’ed” or “mobile monied”. But in an environment where every other service you want is pamusika / pamushika-shika with the exception of a few, mobile money was doomed from the start. PS …and who cashes in knowing some red-eyed cash vulture is going to charge you extra when it’s time to cash-out? only desparate people.

A cockroach named Mike

Without the full context of the global mobile money volumes then this figure and conclusions are not valid. What if transfers have actually gone up in direct contrast to reduced cash transactions? The mobile money platform owners would still be making their money on those movements. It is not as if they only charge for cash transfers.