This guest post was authored by Maketo Munyaradzi, a Business Analyst with telecoms consultancy firm Rubiem Technologies. He has vast experience working in the SADC region at operators like NetOne Zimbabwe, Africom Zimbabwe, mcel Mozambique, MTL Malawi and Telecom Namibia. In this series of articles, Munyaradzi discusses Fraud and Revenue Assurance in Telecoms.

In the previous article we discussed “Overview of Fraud and Revenue Assurance Management”. We promised to discuss about the six prominent areas of revenue leakage in telecoms, which are;

In the previous article we discussed “Overview of Fraud and Revenue Assurance Management”. We promised to discuss about the six prominent areas of revenue leakage in telecoms, which are;

- Product and Offer Management

- Order Entry and Provisioning

- Network and Usage Management

- Rating and Billing

- Finance and Accounting

- Customer Management

- Partner Management

According to a market research report released by global research firm, Frost & Sullivan (May 9 2011), Zimbabwe’s mobile communications revenue will reach US $ 1.34 billion by 2016, with 20.1% compound annual growth rate. This is only achievable if these firms consider and monitor tightly the revenue assurance cycle. Let’s look at the prominent areas in depth;

The first leakage point relates to the product and offer management. It primarily relates to commercial issues associated with product conception that may result in the development of unprofitable products and services, as well as the timing of product launches and special offers which may be made from time to time. An article on this blog, A “How not to launch an internet based product” lesson from Econet , shows a good example of a product which may experience some failure in its initial days as a result of poor commercial planning. The product in question, VoIP, is very prone to fraud (we will discuss this in future articles).. Product conception should be aided by market research and forecasts, customer consumption trends, pilot launch to test market. A lot of resources go into developing new products such that failure of the product to bring revenue after launch is a revenue leak.

The product design phase, revenue assurance should be about making a complete assessment of the product or service, ensuring that it is a sturdy product and not susceptible to fraud. It is also about asking questions to test its suitability for the market: how will it be provisioned, how will customers pay for it, does the correct infrastructure exist to support it, what partners are involved in the revenue chain and how will relevant monies be shared? When the Econet launched its product, “VoIP”, their website voip.econet.co.zw, was basically not ready for public viewing, meaning customers could not be able to utilize the service. An oversight on any part of the life cycle of a product from conception until launch brings about serious revenue flaws.

The second leakage point relates to the process of capturing and fulfilling orders from both domestic subscribers and commercial organizations. Issues range from errors in customer contracts, service activation faults or delays that impact on revenues and/or costs as well as the coordination of suppliers and third parties costs.

At the Order management & provisioning phase, revenue assurance should be about making a complete assessment of verifying that local number portability information (interconnects, service providers, peers, access, etc..) are configured in the network elements, customers are fully registered in the Billing/CRM systems (will discuss this in the next article), check level of cancellations by customers on services and deviations between the CRM and Billing systems.

Using the Econet example, their website was not ready to be used by customers: does it mean that the service was already registered and available to be billed? Another example is when a customer applies for a service but due to data capturing errors or typo errors the services are captured incorrectly, instead of getting a 256kbps connection it’s captured as 64Kbps: thisresults in loss of revenue.

The third leakage point relates to the accurate accounting of service usage within the network and the management of that information from collection at the switching infrastructure to delivery to the rating and billing process.

Issues identified here include network security and integrity, management of network equipment, network routing, recording and management of usage information, data integrity and data transfer within an organization. The revenue assurance will also focus on the internal and external issues such as verifying that the messaging platforms (SMSC) generate usage accurately and generate records with correct information.

The fourth leakage point relates to the rating and billing process, from tariff identification, pricing and invoice production. Rating and billing issues range from subscriber management, charging and invoicing errors including tax calculations and the handling of usage information within the rating and billing environment.

The fifth leakage point relates to the finance arena and in particular the accurate reporting of the financial performance. Finance and accounting issues are associated with general ledger mapping from the billing environment, tax payments with government agencies, incomplete processing of information from the billing environment and incorrect posting of entries in the chart of accounts.

This is also vested with the receivables management, the collections of monies after the invoice has been issued. Issues here cover failures in the cash collection process, subscriber identity issues and the write-off of bad debt. You will agree with me, when we portrayed in the first article that general consensus in management is that between 1 to 3% of revenues are unbilled and that between 2 to 6% of billed revenues are unpaid. No wonder why we have an increasing number of debt collection companies in the country. On the flip side of this we also look at the cost involved in recovering the monies. This provides another risk as the cost may balloon and chew away the revenue to be collected.

The sixth leakage point is customer management and customer care. In this phase the revenue assurance should focus on customer adjustments and rebates, subscriber identity issues, incorrect charging and discounting among other issues. Promotions are at times to boost sales but if not monitored there is a tendency of abuse.

The seventh and final leakage, “partner management”, relates to management of third parties, primarily business-to-business interactions with organizations such as content providers, interconnect partners, dealers, roaming partners, wholesale partners and resellers. Thus a new range of issues arises:

- How to allocate interim and part payments

- How to calculate interest

- How to share revenue received

- When to bill prepaid accounts

- Problems of denial of transaction or receipt of goods

- Taxation problems.

We have witnessed mobile operators merging and demerging, liquidated and abandoning line of products. Yes this happens for one reason or another but the main driver is that the business will no longer be profitable. Cell C South Africa purchased a 50% stake in virgin mobile and later sold the stake. Econet Wireless abandoned the once popular Ecolife product.

Another example is an article published in the Herald (18 May 2007), a employee employed by Econet Wireless allegedly manipulated the mobile phone service provider’s system and produced his own airtime cards that he sold in the city between October 2006 and May 2007, prejudicing the company of $530 million. In the article, “Telecel Unearths Recharge Cards Fraud worth US$ 1.7 Million” published on this blog (February 15 2010) is another example.

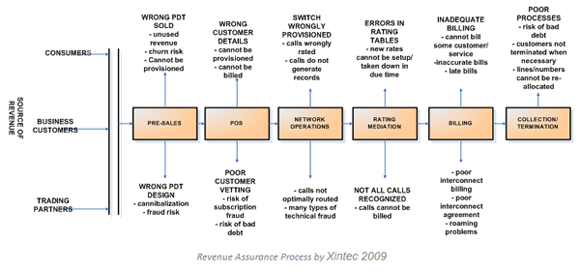

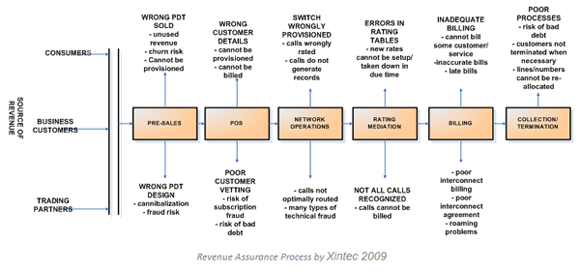

All the examples above are trying to portray the extent of fraud and the impact through the revenue assurance cycle as described. In a nutshell, as suggested within the mobile, internet providers, the poor network capacity is due to mobile operators failing to meet high demand from consumers after the dollarization of the economy in 2009, though drastic efforts are being carried out to curb the trauma. All these six prominent areas can be summarized diagrammatically as shown below;

Remember, in all these six prominent areas there are processes, people and technology. In the next article we will discuss in depth processes affecting a telecoms operator and how they can be taken advantage of. Are you experiencing revenue leakage within your organization? Let’s discuss.

12 comments

These guys made a mess of Africom commercial billing systems. I dont know what he can honestly tell us about revenue assurance…

To earnestly answer your question, the Billing system deployed at Africom is one of the best in the region. Maybe you may explain for the benefit of the readers what challenges you are facing coupled with revenue assurance without having a personal vendetta. i understand very well that from experience deploying and using the system are two different things. Your challenges will greatly help many ….

@e7f17b022ca918f1ba49f1e072dd3831:disqus 1. Maybe the best CRM and Billing in the region (which I doubt) but poorly implemented at Africom

2. The system does not Integrate the back-end (Buying and Accounts) and front-end (Sales) functions e.g. The Retail Agents use 2 different platforms simultaneously for invoicing and customer activation. Quotations are not automated.

3. The system is full of bugs. Sends me wrong amounts on my invoice all the time

A good CRM and Billing brings all the information flowing through a company

regarding their customers/prospects into one centralized location. This

information should then be accessible to everyone within the company

who is responsible for the satisfaction of those clients and prospects.

Thank you for your reply. I will not delve much into the modules as this is propitiatory. My emphases is not to discuss a specific organization but will answer you in general.

Your point number 2, I understand very well that it is integrated to the ERP system (will not mention it) and from my understanding the Billing/CRM system is the master and all transactions are send periodically to the ERP system. Is this not happening?? This is governed by Business Rules and policy documents. May you revise these as well if there are any change controls. May you check the contracts for modules with regard to buying department if that module is not functioning or was it included. When invoicing customers this is the process. Customer completes an application form —-> captures in the CRM system (after all vetting requirements) —–> customer will go and pay in the POS against account created in the CRM——> service activated and walk away with a service. So we should have two systems in play both the Billing/CRM and the ERP (mainly POS).

On Quotations you require an e-workflow system to manage that. It can only be implemented when an organization stabilizes and grow to a certain size. You may agree with me that many organizations are using manual system for Quotation and are succeeding. However you may implement it with agreement to management as it involves delving into budgets.

Please not that there are many Billing/CRM systems and all these systems are used by your next competitor. What differentiates is what have you purchased and how have you implemented the system (processes). Note that the processes change from time to time and needs enforcements to enrich customer experience. All the issues you discussed are based on the contract, business rules and policies and i challenge you to review them, prescribe correction to management and that’s value add to your organization. All systems they go through a life cycle of which the first is optimization before they expire.

Thank you for feedback, indeed it will help many. Lastly let’s discuss these issues in general as all are proprietary.

Please note as well your statement, “A good CRM and Billing brings all the information flowing through a company regarding their customers/prospects into one centralized location”, this refers to the Enterprise Service Bus (ESB), do you have it in place? However it’s recommended to mature organization with large infrastructure. We will discuss all these components in the next articles

maybe the eye needs some spectacles

@The Eye ”

A good CRM and Billing brings all the information flowing through a company

regarding their customers/prospects into one centralized location” just want to comment that centralisation of information is not the duty of Billing/CRM systems but of Enterprise Architecture Integration. the organisations might decide to go the service oriented route and implement a SOA. We will then talk about ESB (Enterprise Service Bus) to centralise all information

Thank you indeed @e7f17b022ca918f1ba49f1e072dd3831:disqus and @442e8641dae1e4fbef438c99ec45c2f2:disqus . My basic contribution here was systems implementation should be done with the full participation of users. In the case of many organizations these systems are arbitrarily set-up and rigorous, crush training is done with the hope that the users will catch on real quick. But alas most SOAs are not service oriented at all. They are like Oil and Water with operations.

@The Binocular I like your more complete assessment of Market Intelligence systems. However you will notice we were intentionally narrowing or reducing as to be almost general in our focus of SOA in order to be relevant to many the small businesses in Zimbabwe.

the guru is lost

It’s good and

ieteresting topics shared by.. And help me in my erp for batter

understanding.. Keep more sharing..

Online ERP Demo

Opentaps Analytics allows in-depth look at customer and sales data. It

uses data transformation using Pentaho and generates reports using

Jasper Reports.