Since information started coming out about Zimswitch’s new Vpayments internet payments gateway, we have received many questions from readers both in the comments and in our email. Mostly, developers and internet entrepreneurs are curious to know how they can start using Zimswitch Vpayments on their websites. Last week, we met the Zimswitch team and they provided answers to some of those questions.

Introduction

Zimswitch, a national switching company recently introduced an internet payment gateway service called Vpayments. Being a financial switch basically means they provider interconnection between their member banks. Zimswitch member banks account for about 95% of the 1.5 million banked population in Zimbabwe. After hyperinflation and dollarisation, many Zimbabweans moved away from the banks, but now they are moving back, with the number of banked individuals holding a bank account expected to exceed 3 million by the end of 2013.

So what is Vpayments?

It’s an online payment service modeled on PayPal. It handles the complex process of interchanges that must occur between banks, merchants, and online shoppers making possible for merchants with bank accounts in Zimbabwe to accept payments from banked customers online. Unlike PayPal though, so far Vpayments requires you to be a banked customer with one of their network member banks. But being banked doesn’t necessarily mean you need the traditional bank account; it can just be an easy to get ‘lite’ bank account like those you get with CABS Textacash, POSB mobile banking or FBC Mobile Mula.

To understand Vpayments, a helpful way is to think of it as an online Zimswitch Point of Sale device. That is, as long as you bank with a member bank, you can use Vpayments to pay for products on a website that has the option from the convenience of your office or your own home, wherever you have Internet access. Payments are in real time just like POS devices meaning an internet merchant can verify the success of a payment immediately and proceed with the transaction.

Which banks are integrated to the Vpayments?

The Vpayments service is under pilot tight now with 4 banks, the following:

- CABS (certified)

- POSB (certifying)

- Trust Bank (certifying)

- CBZ (certifying)

According to Zimswitch, the pilot will be online with all 4 banks within the next two weeks. Each of the 4 banks has a number of pilot merchants they are working with, one of which is classifieds.co.zw. Classifieds is being considered one of the service’s key merchants bringing as it’s bringing a potential 750 merchants to the platform and many thousands of products and services. Other merchants may include internet providers, supermarkets like spar, fast foods, general online shopping stores etc…

Zimswitch is planning to have all the banks that are currently on Zimswitch Shared Services integrated to Vpayments by mid-2013.

Which of these banks can I walk into right now and have my Vpayments merchant account setup?

Zimswitch couldn’t speak on behalf of the banks but indicated that the banks are keen to sign up merchants into their pilot if there’s demonstrable business already taking place. In short if you approach one of these banks, chances are they will tell you they are still piloting Vpayments.

Our advice if you can’t wait for the few-more-weeks Zimswitch is promising is to present a convincing case to the relevant people at the bank and, if that fails, to try another one. It’s still in pilot so don’t expect to just walk in and come out 20 minutes later with a vPayments merchant account.

What will it take for your bank to integrate and allow you to sign up as a merchant or customer?

16 of the 19 Zimswitch member banks are already on Zimswitch Shared Services platform, i.e. the bigger platform Vpayments is part of that incorporates ZimSwitch Mobile, ZIPIT, the ZimSwitch Utility Payments gateway, POS Hosting and other hosted services such as “Instant Banking” and Internet Banking.

16 of the 19 Zimswitch member banks are already on Zimswitch Shared Services platform, i.e. the bigger platform Vpayments is part of that incorporates ZimSwitch Mobile, ZIPIT, the ZimSwitch Utility Payments gateway, POS Hosting and other hosted services such as “Instant Banking” and Internet Banking.

For a bank to offer Vpayments they will not need any additional physical Vpayments infrastructure investment as the service is part of ZSS. In short they just need to get their internal people and process flow sorted for the service and then request Zimswitch to enable the service for them via a certification process.

I am a developer how can I integrate Vpayments in the websites I build

Zimswitch has an API resources document available for download on their site, you can find it here.

I am not a developer; I just want to have Zimswitch Vpayments on my site

Once you have a merchant account with your bank, find a developer and ask them to integrate Vpayments to your eCommerce website. There are also some web development companies that are coming up with ready to use Vpayments accepting eCommerce websites. Webdev for example is coming up with a rent-a-cart service that will allow non-technical people to start accepting payments in a relatively easy fashion. We haven’t used or demoed this service yet so we can’t say more on how it will work.

WebDev is also selling Vpayments modules for the most common cart systems such as OpenCart – prices start from $90. Visit the Vpayments portal (https://secure.zss.co.zw/vpayments) or the ZimSwitch website (www.zimswitch.co.zw) for more information.

I want to buy using Vpayments

As a customer you have to have a bank account and that bank has to be integrated to Vpayments. If this is in order, you will sign up for a vPayments account on the Vpayments website: https://secure.zss.co.zw/vpayments. Signup you will link the new Vpayments account to your bank card account. You can link several bank accounts from different banks to your single Vpayments account and get to choose which bank account to want to pay with when you buy stuff.

Zimswitch will basically verify that the bank card you linked to the new Vpayments account is yours by requiring you to enter certain information, as well as by debiting your bank account with a random amount (less than $1.00). You must then confirm that amount from whatever bank statements you get (mobile banking, internet banking, standard statement etc) on your Vpayments account and, after doing that successfully, your Vpayments shopper account will be ready to use across all merchants regardless of which bank the merchant uses.

Can I link my EcoCash wallet to Vpayments?

Not currently.

Can I have an option to accept other means of payment on my website?

Yes, that’s really up to you. You can accept MasterCard, Visa, PayPal, Cash, Bank transfers and other means in addition to Vpayments. Vpayments is simply a new option available. It’s game changing in that so far it hasn’t been convenient because of restrictions major payment gateways have in place for people using their services from Zimbabwe.

What will it cost me to use Vpayments?

This is mostly up to the bank holding the merchant account in much the same way POS works but transaction will be charged through an MSC (Merchant Service Commission) from about 1% to 5% of the transaction value.

I don’t have a computer or smartphone; can I pay using Vpayments from a basic feature phone?

So far, only the desktop website version is ready for public use so basically your computer and smartphones are good to go but some feature phones may have some issues. Zimswitch says they are aware of this needs reality and are working on a mobile version that will work on a wide range of basic feature phones including those low cost Chinese feature phone.

What security is in place for a customer to have a product or service delivered when they pay via Vpayments?

For Merchants Vpayments has two types of account (well 3 actually, but let’s explain this for now); a Standard Merchant type and a BuySafe Merchant type. It’s up to the merchant to setup the type of merchant account they want, but basically for merchants selling physical goods a BuySafe account, and a badge that says so on their shopping cart, assures their customers that the payment is being made into a temporary escrow account and will only be passed on to the merchant after the goods have been delivered satisfactorily.

For Merchants Vpayments has two types of account (well 3 actually, but let’s explain this for now); a Standard Merchant type and a BuySafe Merchant type. It’s up to the merchant to setup the type of merchant account they want, but basically for merchants selling physical goods a BuySafe account, and a badge that says so on their shopping cart, assures their customers that the payment is being made into a temporary escrow account and will only be passed on to the merchant after the goods have been delivered satisfactorily.

As a shopper, when you see the BuySafe badge on a merchants Vpayments page, this should assure you that even if you don’t know this merchant and you are not sure if the goods will come or not, BuySafe ensures your money doesn’t go to an unscrupulous merchant. And now to their third type;

What other types of merchants are there?

The third type of merchant is called a Super Merchant. It’s a merchant that signs up other smaller merchants. This comes in hand for sellers that don’t want to go through the process of approaching a bank to setup their own merchant account. Such sellers can just approach a Super Merchant and have their account setup conveniently via them.

A Super Merchant example being worked on right now is a new rent-a-cart service to be launched by Webdev in the coming weeks; basically ‘rent-a-cart’ will allow anyone to have a new domain and have an eCommerce website setup for them immediately and start accepting payments without having to go through the hoops of establishing the standard Vpayments account with a bank. To be a mini-merchant one however still needs a bank account (ordinary bank account) with a bank integrated to Vpayments.

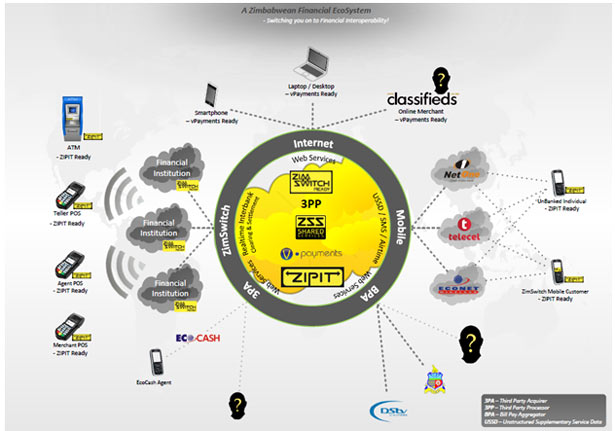

What other things can you do on the ZimSwitch Shared Services platform?

Here’s a diagram showing the Zimswitch ecosystem right now.

You can download a PDF version of this diagram here. The classifieds.co.zw example of merchant you see there is basically Vpayments solving a payments problem for classifieds in much the same way PayPal did for eBay.

If you have any questions not covered here, please enter them in the comments and we’ll make sure we get the answers for you and possibly update the article with them.

36 comments

So much for “empowerment”.

Most developers in Zimbabwe are not companies but sole proprietors and partnerships to the extent that “existing business” is hardly a viable condition.

There are so many barriers to this thing being adopted by many web developers. The banks also have their own stringent conditions.

And just what “demonstrable” business taking place do they expect when there was no online/electronic/web-based payments platform in Zimbabwe. This is nonsense. They must simply let people connect and if they make money then good. I would not be urpised if this thing ends up a thing for big companies like Zesa like in the case with kingdom’s ebanking platform powered by eTranzact.

If i can ask someone to pay me by depositing money directly into my personal bank account without any proof of “demonstrable business”, then why the heck is “demonstrable business” a requirement with vPayments?

“demonstrable business” discourages the set up of completely new businesses.

Unless perhaps I misinterpreted the term “demonstrable business”

how we understand it is that this loose “condition” is only for the pilot stage. Essentially, this is something like a guy saying they’re not ready yet for everyone but are keen to test with those already pushing volumes.

Ok, and i sure hope so for the sake of thousands of young entrepreneurs in Zimbabwe with better ideas than Faceebook, Amazon and Google. Hopefully the “test” condition won’t become the standard.

“thousands of young entrepreneurs in Zimbabwe with better ideas than Faceebook, Amazon and Google” you are kidding me right? name one… don’t worry, i’ll wait

You just made me laugh for the first time today (after 4 pm). I am not kidding.I used to be a sceptic of Zimbabwean talent especially because of Joomlaring that is ram,pant in Zim. But that was until i saw original stuff, original code that i woke up to the reality on the ground. Unless i exaggerate but the few people i got to know of made me realize that there indeed is talent out there. In all the cases, the problem has been monetization and legal hurdles i talked about somewhere I suppose in a “negative” post. Even one mobile payments source told me it had a massive number of applicants who just couldnt make the grade as merchants because of registration issues but ideas were there. (And then when you say it here in the comments section you are called “negative”! ha!) I suppose you can wait, but what i have seen is enough.

Mr Chikomo, please stop rambling (and laughing i guess?) and address my inquiry… name just one of these “THOUSANDS of ideas BETTER than Facebook, Google and Amazon.” You barely spoke of a “mobile payment solution”. Would that be the grand idea? What would this revolutionary payment system be i wonder? The billion dollar, billion user idea? I have no qualms with Zim folks, i love them to death. Just don’t exaggerate stuff all the time to sound smart then ramble when asked for clarification. You are the one usually knit picking statements out of articles, just thought i’d do the same to you.

I love your attack on me. I cant name any. For now. The thing is all the folks whose stuff i saw are worried about “idea theft” and if i mention anything now I would be betraying their trust. I dont want people claiming i gave some people their idea and producing a comment on techzim about something they showed me and then claiming someone else did the same thing that later was shown on Techzim. You also got me wrong. The thing with the “mobile payment solution” is that a unauthorised source told me that they had heard plenty of enquiries and even seen projects from entreprenurs who they could not take on as merchants because of the licensing/regulatory issues. I never said someone createed a mobile payment solution. So i know there are many people who have projects that they would want out there but cannot right now because of monetization issues. I have also come to appreciate that there indeed are Zimbabweans whop can write code. In the past all i saw was Joomla projects, but thankfully I have had people show me their software products they created from scratch. For me that is a start. You cannot prove that an idea is a billion dollar idea until it has had a chance in the market. adfter all, facebook was and still is just another community site. of course now people say a social network but Friendster and all others were already “having it” before Facebook. Since you said you can wait, why not?

Zimbabweans indeed have brilliant ideas; some ideas possibly

at par or greater that your Facebook, Amazon,Google. Ideas need not be global for them to be great they can be regional and still be great. The only thing is that in Zimbabwe unlike Europe, USA e.t.c. Your brilliant idea will have to face more obstacles (Market Absorption, Sceptics like Mr Chirau who only believe in ideas from the west, Patent rights and other legislation, Venture capital funding e.t.c).

Tell me what is so brilliant about tweeter? It only takes Oprah/CNN to talk

about tweeter once and before you know it everyone including Mr Chirau is calling it a brilliant innovative idea…what we need to concentrate on is building a solid incubation framework that allows our young stars to effectively prototype and launch their ideas..this thing of touting facebook,amazon and talkin about how brilliant Zuckerburg is will get us nowhere…

Changamire, you have my utmost respects. I couldnt’ have said it better myself. I am always at pains trying to convince many unbelievers that the knowledge to create software or even websites is the same world over. Somehow there is an expectation that a Zimbabwean, regardless, cannot do anything, or even achieve anything.

at no point did i single out Zimbabweans, i just referred to his statement regarding thousands of bigger ideas than Facebook, Amazon etc. It so happened that Zimbabwe was included in that. You see guys, i know people have big ideas but be realistic, there aren’t that many billion user, not billion dollar, but billion user ideas out there. For example these mobile payment ideas you are talking about, are they bigger than VISA, MasterCard? Many ideas can generate a billion dollars, very few can generate a billion dollars.

Facebook, Amazon, Google are billion user ideas, now again tell me of these thousands of ideas??? Earth to Prosper and Changamire…”get real folks”

Who knoew that Facebook or even Mpesa was a billion dollar idea? like i said before:

I rest my case.

best you rest. lol

Kwabeza, in all this madness…where is VISA & Mastercard? Surely given the challenges we are facing and the decades they will take to iron out, we should be promoting VISA/Mastercard (and Paypal if the word sanctions could be deleted from the dictionary). Hate me but the truth is, a locally designed payment solution is a decade away from being 100% usable on a real system and till them, we might as well use VISA/MC, they have been tried and tested…and they work!!!

ZimSwitch really needs a competitor. This is not as exciting as i thought it would be. That’s just me though…

Hi there TechZim readers. We will try and answer any and all questions posted on this article to your satisfaction.

The platform is designed to enable ALL retailers to sell their goods on-line in Zimbabwe, regardless of their turnover. As mentioned in the article, there are two types of integrations available.

1) Standard Vpayments merchant. This is designed for Zimbabwean merchants who are able to get a merchant bank account set up. These are extremely common, and not considered difficult to open. In order to integrate the site to Vpayments, either hand the API referenced in the article to a developer, or purchase a pre-built Vpayments module from a development company.

2) Sub-Merchants: For much smaller merchants (for example an individual) who can not justify a traditional merchant bank account or the $90 pre-developed Vpayments modules, there is the super merchant model as described in the article. This enables “super-merchants” to connect any size “sub-merchants” or individual sellers through their super-merchant platform. This enables informal traders and “one time sellers” to use the platform.

In order to prevent fraudulent use of the system, it is mandatory for any Vpayments customer (buyer or seller) to have a legitimate bank account that they can link to their Vpayments account. This enables the platform to securely process all transactions, and ensure that both the customer and the seller are sufficiently protected.

Please note the API is free, and available to anyone with Internet access.

Thank you for your helpful answer that answered most of my worries. Anyway, I just dont want to see another “eTranzact”, a payment system so closed to just a few as to be almost useless to small internet entrepreneurs. It was my fear that your system will just become another useless technology that serves the purposes of only the few big corporates. Anyway, we shall see how it goes. i am in no hurry to add vPayments yet. I will wait a few more months.My final suggestion is that you make the public aware of vPayments and what security features to look out for e.g. https, padlock and key etc. if people are robbed in the first days, the whole future of your platform may be not so good. And ever seen any public eTranzact material for its users like how it works etc even in the papers or on TV….That’s why only the Kingdom Bank website (and Interfin under curatorship) uses them.

You’re rather negative

You are entitled to your opinion. I consider myself “concerned” about history repeating itself and not “negative” Proudly negative.

I dont really understand some of the negative comments already emerging here. To me as an entreprenuer this is great news! I guess my vision allows me to see beyond the obstacles that are fueling some peoples apparent disatisfaction. Welldone ZSS. To me, you are pioneering. I dont get why people are expect something thats 100% perfect 2weeks BEFORE launch or even in the months to follow. Remember Facebook 2 years ago?…It was pathetic. But over time it has evolved to fit their target consumer more.

I am glad that this is being launched before Econet had a go at the online payments platform, at least now when they do, they wont have a complete monopoly like eco-cash and the competiton will only mean better things for us to come.

A bit of advice to ZSS, take time to really showcase your product to companies to make them understand it and know how to use it and its potential benefits. Zimbo’s may be ready for this tech but half of them don’t know it yet.

And a quick question, I already have a website that is operational, will a developer be able to integrate vpayments without taking it offline and roughly how long will it take if the developer is relatively competent?

Thanks Time for the positive feedback and the advise… Most welcomed!

Your question: How long to integrate.. really depends entirely on the skill level of the individual. Anywhere from one to two weeks from what we have seen so far. Our hope is that some development teams will build a collection of options for the popular shopping cart systems (eg. OpenCart) and make them available to the public for a low fee. My suggestion for now would be to use a company like WebDev or similar who already have Vpayments modules available that you can just “snap-on”.

As to downtime, there is no reason you should need any. Assuming you have a test site where you can confirm functionality and the likes, it is just a case of enabling the new module.

Good luck and let us know if you need anything further.

The ZSS team

A question: Im running a joomla site and the main component exclusively uses paypal to process payments. It is a membership based site so no “physical” products are actually bought. So in lamens terms, how would a developer or an “advanced novice” go about changing the payment system from paypal to v-payments?

Hi Tapiwa

Thanks for the question!

If you have Paypal integration already then you must also have a cart. (is this Virtumart?). From there, you can either develop your own payments module within Virtumart (or whatever cart system you are using) using the API referenced in this article, or purchase a pre-built module from someone like Webdev. (I believe Webdev is still working on the various Joomla versions for general release).

At an “advanced novice” stage, I would suggest you purchase a pre-built one – but the choice is yours. Have a look at the API and see if you think it is within your current skill set.

Thanks for the advice. The API link both from here and from your site are giving me an error 503 page?

The given developer API documentation link is throwing an HTTP 503 error (http://www.zimswitch.co.zw/assets/docs/Vpayments%20API%20and%20Developer%20Documentation.pdf)

Hi Sorry for the delay replying.. some firewall tightening to blame.. network guys are on it now. Thanks!

Uh oh..now its a 404 error :-p

Hi tinm@n please note that the issue with the Zimswitch Website has been resolved and the documentation is now available for you to download. Apologies for the inconvenience.

Working now. Thanks!

Up to 5% commission on transaction amount is a big rip off. Ndokunonzi kuita mucheka dzafa manje uku. Think about all the costs involved in bringing a product to market – then to have someone take 5% of the final sale amount just to pass the money from the customer to the seller is ridiculous. Imagine a business whose final profit margin on every item sold is 20%, you taking 5% from the transaction amount means you are now taking a cool 25% off that business’s final profit margin – and for what – just sitting at some vantage point and watching the money exchange hands! How do you justify taking a percentage of the transaction amount anyway? What is the difference in costs to yourselves if the transaction amount is $20 or $20,000? Do you propose that merchants should pass this cost to the customer in order to preserve their profit margins which are already tight? Remember that merchants can still accept payments through other means so how can they maintain uniform prices?

You do know itunes takes about 25% of every sale, even the $0.99 singles but people like Akon still make millions selling their music. So if you think the 5% is going to ruin your business maybe you’re in the wrong type of business? Lets get creative people.

But I do support some sort of differentiation in the commision like maybe 5% for transactions uptop a certain amount and then the commision decreases as the amount gets higher.

Hi Marek and Tapiwa

Thanks for the comments. Just to clarify, the Merchant Service Commission is agreed between the bank and themerchant. (Vpayments has nothing to do with it!) The bank simply sets the commission by merchant on their own Vpayments console. Some merchants will carry little risk and high volumes, so they will be able to negotiate a lower MSC (say 1.5%). Others will be higher risk and so not be able to negotiate such a favourable commission. The good news is that merchants will be able to pick which bank they use – and so make the choice themselves.

The ZSS Team

does zimswitch vpay have a minimum price to pay. if someone buys stuff costing 20 cents on my website do they process it?

They are meticulous on the stitching and material of the clothes that they purchase so that it

passes their standards. Snowboarders, surfers and climbers exercising extreme sports know well that the high quality of gear should never be jeopardized.

Most every resale piece will sell at a fraction of the original price.

[…] all other services on the market – ZimSwitch’s Vpayments, Pay4App, PesaPal, FloCash – at the core, Paynow enables anyone with a website or app to start […]

[…] all other services on the market – ZimSwitch’s Vpayments, Pay4App, PesaPal, FloCash – at the core, Paynow […]

[…] all other services on the market – ZimSwitch’s Vpayments, Pay4App, PesaPal, FloCash – at the core, Paynow enables anyone with a website or app to […]