M-vendr, the Zimbabwean founded fintech startup that was accepted into 500 Startups recently just revealed to us their monthly transactions on their Point of Sale token retailing platform has risen to 3 million from about 30,000 around this time last year. Michael Charangwa, the founder, says they are looking to grow even faster with the launch of a new cross border value remittance service this month.

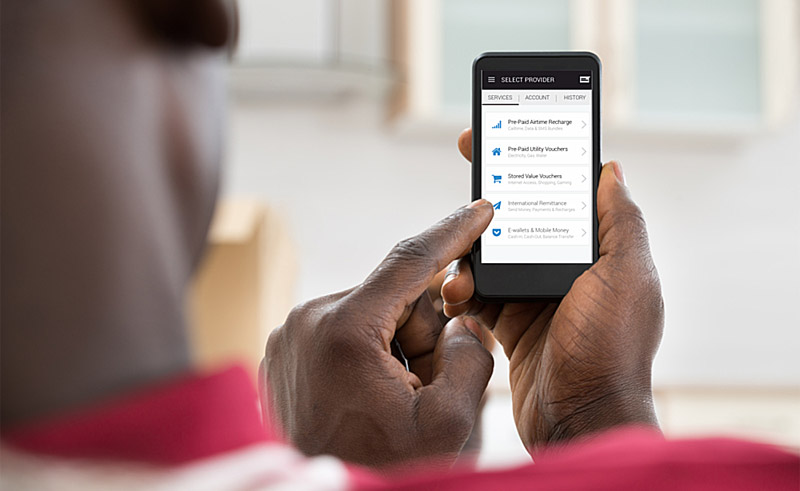

Value remittances means it’s not the regular cash other companies do. M-vendr is using their existing street trader driven smartphone based prepaid token selling to enable migrants in Africa to buy tokens like prepaid electricity, airtime and other such products for relatives back home. Customers can also remotely make bill payments for such services as DStv. The transactions are instant meaning your relative in SA can buy prepaid electricity for you via M-vendr and the token delivered immediately to your phone.

In the case of Zimbabwe, it’s relatives in South Africa, Bostwana, Zambia and Malawi that ofcourse come to mind. Zimbabweans have migrated to these countries in large numbers. But outside Zimbabwe, migration from African countries like Mozambique, Malawi, Zambia, DRC, and others to South Africa for economic reasons is quite common. M-vendr is looking to solve the problems these migrants have helping their relatives home with monthly expenses.

The startup’s competition is ofcourse companies like Mukuru, EcoCash and Mama Money who are targeting the same unbanked migrants by enabling them to remit small amounts of cash back home. It’s significantly sized market that banks and global remittances companies like Western Union and Moneygram has not focused on.

One could ofcourse argue that Mukur and Econet’s cash is more flexible and therefore better than buying digital tokens and paying for bill services but the utility in M-vendr’s solution is that cash has risks – by just directly paying for the electricity, DStv bill, airtime or other product, the sender is assured the need has been met.

In fact, in some cases, this reduces the need for the recipient (elderly parents for example) to have to deal with the hassle of cashing out then moving from agent to agent unsuccessfully attempting to buy electricity tokens. Given these advantages, it’s not unlikely Mukuru, EcoCash, Mama Money and other will consider adding the value remittances option to their current offering.

M-vendr says in the announcement senders can access the service via some 25,000 small retailers, street traders using M-vendr’s app across 10 countries namely South Africa, Nigeria, Tanzania, Kenya, Uganda, Botswana, Mozambique, Zambia and Zimbabwe.

As indicated previously, M-vendr are now pursuing a white label approach and found, Michael Charangwa says they have since sign up some 17 white label clients. Essentially this means they focus on making the system work, and leave the marketing and customer interface to local brands in the markets they operate. We asked Charangwa how this works exactly and here is his explanation:

So say you were a white label partner in Zimbabwe. You would hold an operator balance with us with say $1,000. Retailers/vendors would download your fully branded app and when they want to trade, they deposit money into your Zimbabwean account, say $50 . Once you check your bank statement, you can then transfer the $50 from your operator balance to load this user’s vending balance. So when a transaction happens, say a customer comes to this vendor and wants to send R350.00 DStv, our system does an instant conversion and amount payable would be say $35 by customer. The transaction is completed instantly with Multichoice SA, and the vendor’s balance goes down by $35 less their 7% commission. Done..

6 comments

Great value addition. This is a great initiative paving the way in expediting the process of economic integration and value inclusion within the continent. Thumps up indeed

Ko, does anyone know where I can find one of these agents who do this service?

so it means i can pay for my south african dstv subs from this app

Hi Mai Curious, yes you can visit any of our partners Points of Sale service points to remit a DSTV payments, Airtime, Electricity and more to South Africa. In Zimbabwe, these are UltraPoint and Easi.

The Numbers are not adding up

The app has a mere 500 downloads on the playstore and honestly speaking, I have never met anyone who has used this service. Maybe I am living in outer space, but I am a Zimbabwean Techie living in Zimbabwe and I am usually a first adopter.

Might be overlooking something but may you guys please reconcile the disparity between transaction volume, meagre app downloads and your visibility absence in Zimbabwe (can’t speak of other African Nations).

Between, where are Victor Mukandatsama and the Helicopter Inventor? (working together now?? :-))

Read the part in the article about being White label. They moved away from marketing M-vendr directly to street traders. Check this for their partners https://mvendr.com/network-partners.

That aside, what do you think of the business model, remittances? in general, how big their opportunity is, what they could do better etc…?