Recently Deloitte released its Mobile Consumer Survey 2015-16 for Africa under its Technology, Media, and Telecommunications research arm.

The report covers consumer trends and topics across 5 African countries, namely Kenya, Nigeria, South Africa, Uganda, and Zimbabwe and provides insight into mobile consumer issues and trends in Africa.

Some of the key highlights on mobile internet and data consumption noted by the report are as follows:

1. Shifting African consumer demographic

According to the report, 1 in 2 Africans regularly use their smartphones on public transport, at work and while shopping with age and network speed playing a large role on the number of times the device is used.

The younger demographic of mobile consumers is more likely to use their phones as they go about their daily activities, with 1 in 3 African consumers checking their smartphone every 5 minutes.

Mobile data is still the most dominant internet consumption medium in Africa.

As Africa’s population is expected to reach 1, 5 billion by 2025, a younger data-hungry population is expected to drive explosive mobile data growth in the next 10 years.

The report further notes that a thriving younger middle class is expected to develop and by 2020, Deloitte expects an additional 100 million young African middle-class consumers.

This new middle class is anticipated to spend more on mobile data, spending on average $2-$4 daily, making a jump from spending less than $2 a day!

3. Wider choice of internet connectivity

3G/HSDPA dominate mobile data connectivity and 4G/LTE usage is expected to grow in the next 2 years as consumers begin to access more data-hungry content.An increasing number of consumers are getting connected via wifi at home or at work.

However, an increasing number of consumers are getting connected via wifi at home or at work and the wifi access trend will continue to grow as Africa urbanisation levels increase.

As mobile network operators continue to offload mobile data onto wifi networks, public wifi, shopping malls, and other retailers are now able to provide consumers access to paid and free wifi hotspots.

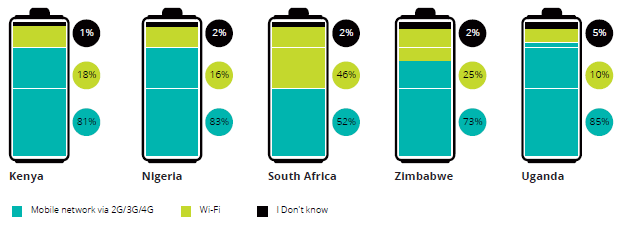

Mobile network connectivity via 2G/3G/4G makes up 73% of internet connectivity used in Zimbabwe in comparison to 25% via wifi and 2% not knowing.

image credit- Deloitte: Type of internet connectivity most often used by consumers

The report states that customer satisfaction is a key differentiator in markets where mobile operators are selling the same product.

The price of data drives a significant part of customer satisfaction with customers looking for cheaper uncapped data packages for the lowest prices.

Providing your consumers with tools to monitor and control their data usage can also increase data usage with 18-20% of African consumers admitting that the lack of information and controls to measure data usage is a restraint on increased data consumption.

3. Mobile Data Satisfaction

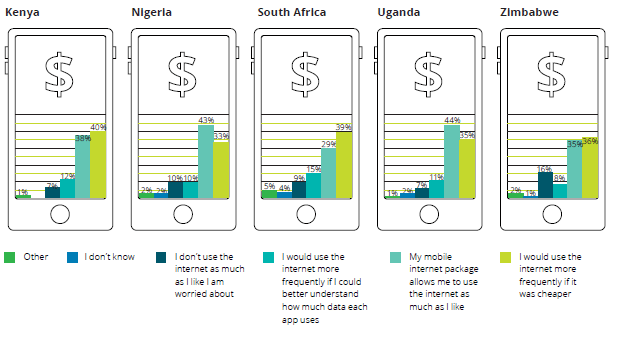

36% of Zimbabweans would use the internet if it was cheaper, whereas 35% of consumers are satisfied that their mobile internet packages allow them to use the internet as much as they like.

8% of Zimbabweans believe that they would use the internet more if they could understand how much data each app uses and 16% are worried that they don’t use the internet enough, missing out on news and information.

20% of Africans are willing to pay more for access to faster internet speeds presenting an opportunity for mobile network operator’s strong revenue growth and margin increase by offering tiered-pricing models linked to speeds offered.

image credit- Deloitte: Satisfaction of phone owners with mobile internet service provision

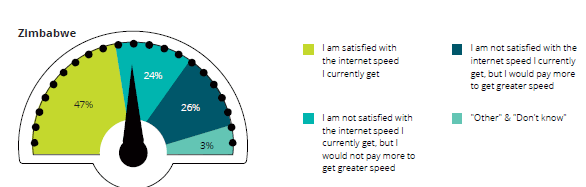

46% of Zimbabwe is satisfied with the mobile internet speed they get.

The majority of Zimbabwe is not satisfied with the mobile internet speed they get, with 24% not willing to pay more to get faster connectivity and 26% willing to pay more for better connectivity.

image credit- Deloitte: Satisfaction of mobile phone owners with internet speeds

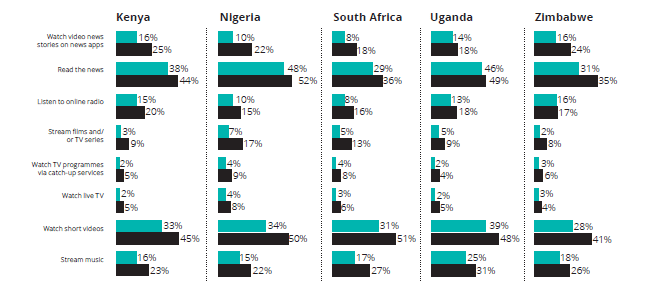

Africa has developed a music streaming culture and consumers are more willing to watch short-form videos as they are reading the news.

According to Deloitte’s data, Zimbabweans seems to have a keen interest in reading the news and watching short videos, justifying the top 10 local websites list we once published.

image credit- Deloitte: Most popular mobile device activity

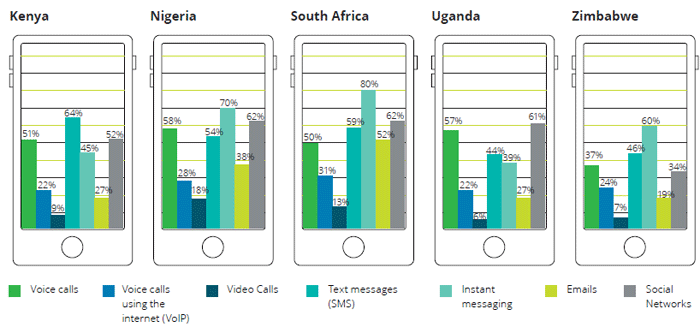

4. Different forms of communication over the phone

MNOs are struggling with declining voice and SMS revenue globally with OTT platforms offering consumers cheaper alternatives to communicate.

In Zimbabwe, 60% of smartphone users primarily communicate via Instant Messaging (Whatsapp, facebook messenger, IMO, etc), with 46% in favor of traditional SMS communication.

37% of users in Zimbabwe prefer to make voice calls, with 24% preferring to make internet calls (WhatsApp call, Viber, skype etc)

Social networks take up a considerable 34% and emails still relevant with 19%.

It is only video calls, at 7%, struggling to gain traction in a market that has seen drastic changes in consumer trends.

image credit- Deloitte: forms of communication over your phone

According to the report, Mobile Network Operators are providing the following to stay as relevant as possible:

- Operators are offering bundled voice and data packages with unlimited voice and messaging as mechanisms to incentivise consumers and boost voice and SMS usage.

- These bundled products together with the low penetration of IM capable mobile devices in the surveyed markets offer some protection for the operators’ traditional revenue streams.

- VoIP technologies are also gaining strong traction in African markets as regulators are increasingly legalising and promoting the fair-treatment of voice traffic carried over the operators’ data networks.

- The popularity of free VoIP applications such as Skype and Viber is likely to increase as smartphones become more pervasive in the surveyed markets and the offered speeds and reliability of mobile data networks improve.

Some of the key findings on the mobile internet go hand-in-hand with issues we have been reporting over the past weeks.

Local mobile network operators are experiencing revenue declines in voice and SMS while mobile internet revenue is on the rise.

Mobile internet offers the cheapest medium to access the internet across Africa, and will continue to serve as the dominant service.

Different platforms are starting to work on mobile as mobile penetration rates have increased in Africa.

M-websites, m-commerce, and m-learning are good examples of adopting platforms for mobile users.