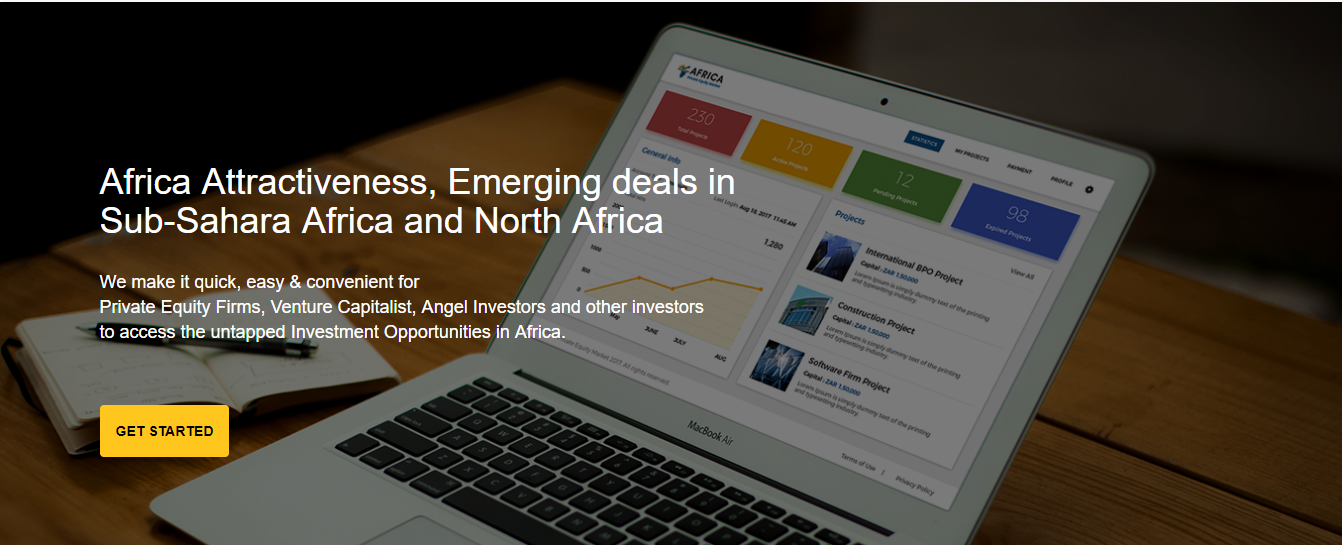

I have good news for all aspiring African entrepreneurs with their business that is starving from lack of funding. A firm called, Africa Private Equity Market has launched a platform where ambitious entrepreneurs can source for funds by digitally pitching their projects online to a network of investors.

Securing funding for a business in Africa can be hard because banks require collateral which small businesses owners don’t have and banks charge unbearable interest on their loans which toll heavily on corporations.

This is what Africa Private Equity Market is trying to help entrepreneurs and corporations to avoid by bringing investors within their reach and provide funding to them directly.

Africa Private Equity Market with some of Europe’s well-known investors such as Venionaire Capital and European Super Angels Club. So, you can add the math for yourself and see that the platform is legit.

The CEO of Africa Private Equity Market, Trust Gadzikwa came to our offices and walked us through the Africa Private Equity Market platform. What urged us to write this article is that he said that he was desperate to find entrepreneurs and companies which are in need of funding because the investors on the platform were complaining to him about a lack of listed projects.

Who is it for?

Despite its location, the platform serves every entrepreneur located in Africa meaning that entrepreneurs from North Africa and Sub-Saharan Africa access the investor market through Africa Private Equity Market website.

But above all, the platform caters for entrepreneurs with viable business and tried & tested innovations.

Africa Private Equity Market gives them the opportunity to source funding by showcasing their projects. The platform categorizes entrepreneurs into 4 types according to the type project.

- Start-ups (High Tech-innovations)

- Small – Medium Enterprises

- Corporations (Merger & Acquisitions)

- Public-Private Partnerships (PPPs)

Will my project be accepted?

Prior to listing a project on the platform, it will be vetted and you will be given the opportunity to amend it so that it fits the platform’s requirements.

Do I pay a fee to be listed?

Well……No and Yes. You don’t pay any fee if you post a maximum of 5 projects. But you will pay a certain a certain fee if you decide to post more than 5 projects.

The fees can be seen as subscriptions. Th Subscriptions plans are for all size of capital requirements:

| Plan | Projects To Post | Required Amount |

|---|---|---|

| Free | 5 Projects | < – $499 999.00 |

| Basic | 10 Projects | $500 000.00 – $4 999 999.99 |

| Premium | 10 Projects | $5 000 000.00 – $99 999 999.99 |

| Advanced | 10 Projects | $100 000 000.00 – > |

In my personal capacity, this platform can be the real deal, especially for Zimbabwean companies and entrepreneurs considering that foreign direct investment has been on a worrying decline.

9 comments

This sounds good. I am interested in that.

Thanks for posting this. It seems ICT innovation drive plus this is gonna help many startup and technovators to launxh their producta and businesses well and with good muscle.

Subject to confirming the other nuances and small print, this does look like a real deal for the SMEs. We will be sure to market it aggressively to our clients!

Well done Trust.

I’m interested in Tiger Wheel & Tyre franchise, will I get a start-up funding ?

Kindly email trust@giantafrica.org

I’m interested in getting the McDonalds franchise for Zimbabwe – do you think i can get the funds from you guys Trust Gadzikwa

Africa Private Equity Market is a Fintech platform, giving African entrepreneurs the privilege to access funding by digitally pitching their projects (summary) online to a credible network of investors. Africa Private Equity Market is not the investor, but a gateway which investors are using to source deals in Sub-Sahara and North Africa. The investors are drawn from the private equity community and they include:

1. Private Equity Firms

2. Venture Capitalist

3. Angel Investors

4. Other Investors

Hence if the project satisfy the investor’s investment criteria, He/She will initiate communication with the project owner via our Chat room, for their due diligence.

For more question kindly email me on trust@giantafrica.org

hey thats gret deal .nice one bro .

hey thats gret deal .nice one bro .