It has been a couple of weeks since the government/RBZ introduced its latest shock grenade in the form of Statutory Instrument 127 of 2021. They riled the entire economy by trying to dictate what exchange rate businesses use when conducting operations. They also banned USD cash discounts and any incentives to induce USD payments. This was all done to shore up the faltering official foreign currency auction whose rate has remained suspiciously low over the course of a year.

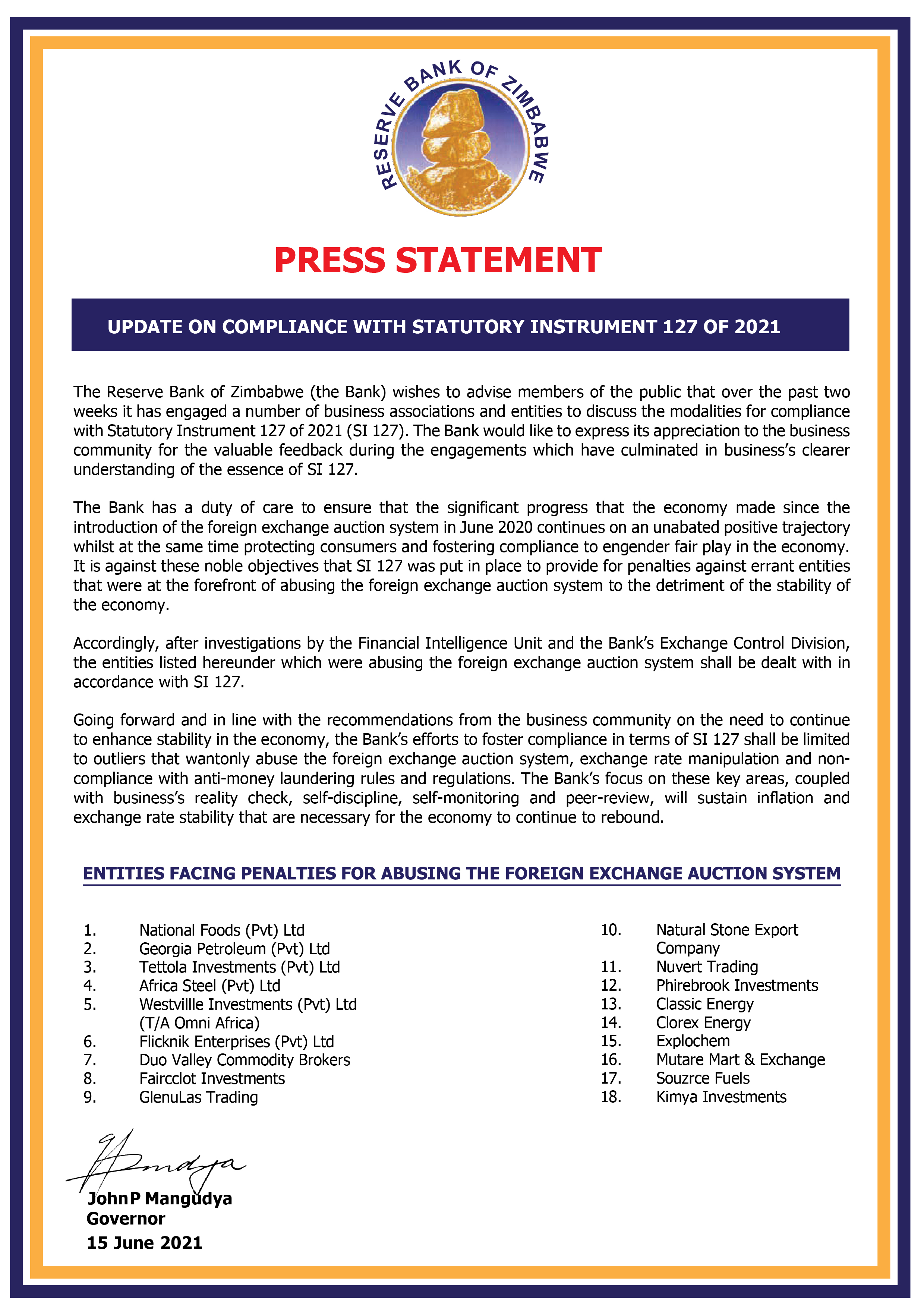

The Statutory Instrument also included a set of punitive measures to be meted upon those found to be violating this law and its provisions. Now, the central bank’s Financial Intelligence Unit (FIU) has publicly named and shamed a list of so-called abusers. The following companies were included on the list:

- National Foods (Pvt) Ltd

- Georgia Petroleum (Pvt) Ltd

- Tettola Investments (Pvt) Ltd

- Africa Steel (Pvt) Ltd

- Westville Investments (Pvt) Ltd Trading as Omni Africa

- Flicknik Enterprises (Pvt) Ltd

- Duo Valley Commodity Brokers

- Faircclot Investments

- GlenuLas Trading

- Natural Stone Export Company

- Nuvert Trading

- Phirebrook Investments

- Classic Energy

- Clorex Energy

- Explochem

- Mutare Mart and Exchange

- Souzcre Fuels

- Kimya Investments

Is that it?

The RBZ’s press statement goes on to make it sound like these entities (auction abusers) are somehow solely responsible for wrecking the entire economy. While I am forced to concede that it was wrong of these companies to participate in the foreign exchange auction and then go on to violate the rules of the auction I do sympathise with them too. Businesses in Zimbabwe are operating in a very tough economic environment and need every leg they can stand upon.

Also, after the lots of noise that has been made by the authorities about how entities were abusing the auction, I sort of expected a bigger list with more recognised companies on it. I barely recognise just under half of these companies. The rest are mysteries to me. It’s kind of underwhelming if you ask me.

Lopsided rules

I especially take issue with how rules are being made by the authorities as we go with some companies granted seeming concessions. For example, some well-known entities continue to only demand foreign currency in payment and yet nothing is happening to them. For some, it turns out they are allowed to do so because of certain laws that have already been passed. For example, fuel companies are already allowed to sell fuel in USD only if they import that fuel using free funds.

Why are informal businesses not allowed to sell their own products in foreign currency only if they have imported these goods using free funds? What possible justification can the government have for perpetuating such discrimination?

Also, it turns out a lot of well-known entities are no longer allowed to access foreign currency on the auction. Of note is a qualifying statement from Delta Corporations released as part of its financial statements. They seem to imply that they are no longer getting foreign currency from the auction. In fact, quick calculations show that about two-thirds of the economy does not get its foreign currency from the auction. I am still struggling to understand the logic behind forcing everyone to use the official rate.

Talking about the official rate. It makes little sense to use it anyway! Yes I mean even if you are getting your foreign currency from the auction it will be in violation of business principles and accounting standards for you to use the official exchange rate in your costing operations. Why? Because no one is getting their foreign currency at the official rate anyway. You are reading this right. It’s almost improbable that any business is getting its foreign currency at the official rate.

That is because the so-called official rate is an average mean. Each business bids in the RBZ Auction and gets foreign currency at a different rate. Certain blessed entities are getting their foreign currency at rates as low as $82 ZWL because the RBZ in their esteemed wisdom deems these businesses more important than others. Others at the same auction are actually getting their foreign currency at a rate of $89 ZWL.

At the heart of Finance is a simple rule that underpins each accouning operation:

Revenue must be matched with expenditure incurred in generating that revenue.

In other words, you must only ever use the cost you incurred and not makeup costs. This means by forcing everyone on that auction to use the official rate the RBZ is erring again. Each business must use the actual rate at which it acquired the foreign currency to do its costing operations including arriving at the price. That would be the magic solution that will clear everything up.

Preaching to stones

I am just preaching to stones here. Nobody will listen to this. The mighty bank and powers be have made up their minds. The thing though is that the fundamentals of Economics have a way of always prevailing even in the face of legislation.

You should check out:

Finance Minister Mthuli Ncube said that the government had a budget surplus of ZWL$9.8 billion in Q1 2021. Now, that’s just over US$100 million (by the RBZ auction rate) and that’s a lot of money. So we discussed what a budget surplus is, if it is a good or bad thing in the Zimbabwean context, and how the government could possibly use all that money.

What’s your take?