In 2018, Zimswitch, at its Payments Conference announced that it would be bringing a bulk payment solution called ZEEPAY. The product builds off the immediate settlement services we all use by way of ZIPIT. So we can all get caught up here’s what Zimswitch’s ZEEPAY can do.

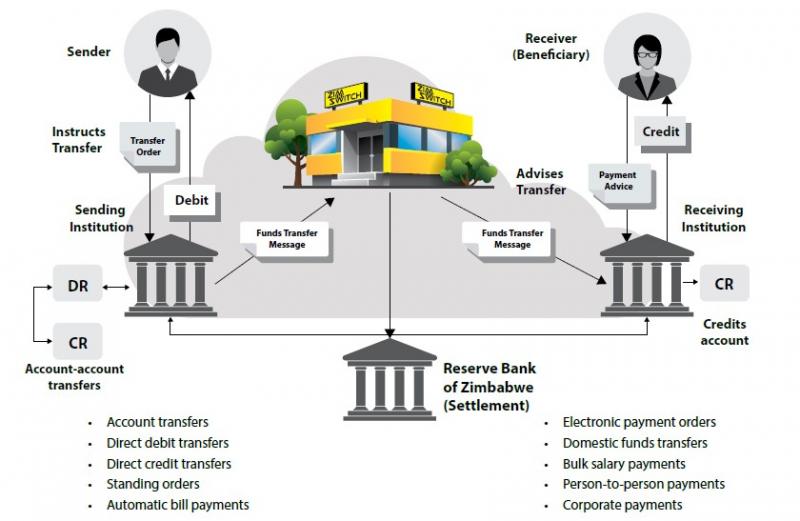

ZEEPAY is a secure, cost effective and efficient solution that facilitates electronic funds transfers (bulk or single) across the Zimswitch Automated Clearing House (ACH) using the ISO20022 standard. ISO20022 is a global standard that is fast becoming the accepted messaging standard worldwide across financial services, and has quickly become the de facto standard where all Electronic Funds Transfer (EFT) payment systems will eventually migrate.

Zimswitch

Payment types

Through ZEEPAY you can process:

- Electronic Funds Transfer Credits (batch)

- Real-time Credits (RTC)

- EFT Debits

The solution as was it was in 2018, is aimed at Banks, Microfinance firms, Insurance companies, Utilities (ZESA and Municipalities), government agencies and any other institution that deals with bulk payments. For example, a microfinance company can use it to manage interbank disbursements of loans and loan repayments.

Companies can use the solution to do salaries and Insurance companies will be able to, according to Zimswitch, efficiently collect premiums.

So why is ZEEPAY coming back now?

Zimswitch’s payments solution is set to go live next week. However, it’s been three years since we last heard of ZEEPAY and one has to wonder what has taken so long for it to come to market proper. What could have kept it on the shelf for all this time?

The first port of call for speculation is pricing. As with anything to do with payments and finance the charges/fees conversation is inescapable. However, I have my doubts that this was what kept ZEEPAY in the cupboard for just over three years.

The final point for hypothesising is competition. There are already some very established players in the market like Paynet for example. And this is something that we spoke about when we reported on ZEEPAY back in 2018. At the time we thought that Zimswitch would be looking to leverage its close relationship with Zimabwe’s banks.

However the time gap leads me to believe that any allegiances might not have been enough to take the leap. It might also be the case that Zimswitch was still working out the kinks in the system or that they felt since the company was anoited as the national payments switch last year, for whatever reason, the market is now ready for ZEEPAY.

What’s your take?