The draft policy framework document presented last week by the Ministry of ICT yesterday had some interesting stats on the state of the ICT industry in Zimbabwe. The statistics cover mobile penetration, fixed telephony, mobile broadband penetration and the amount of incoming and outgoing international bandwidth. We thought to share some of that data here, especially the mobile broadband subscribers. These statistics were provided by Postal and Telecommunications Regulatory Authority of Zimbabwe (Potraz).

The mobile internet subscribers stats cover only the GSM mobile operators, Econet, NetOne and Telecel. We’re guessing the CDMA operators (mainly Africom, PowerTel and Broadacom) don’t have numbers significant enough to be included here, or someone at POTRAZ incorrectly doesn’t consider them mobile operators.

The mobile internet subscribers stats cover only the GSM mobile operators, Econet, NetOne and Telecel. We’re guessing the CDMA operators (mainly Africom, PowerTel and Broadacom) don’t have numbers significant enough to be included here, or someone at POTRAZ incorrectly doesn’t consider them mobile operators.

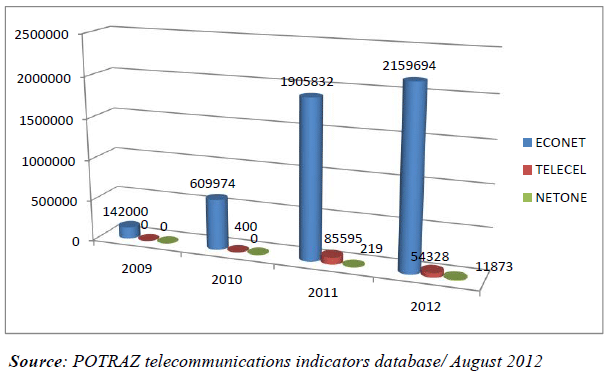

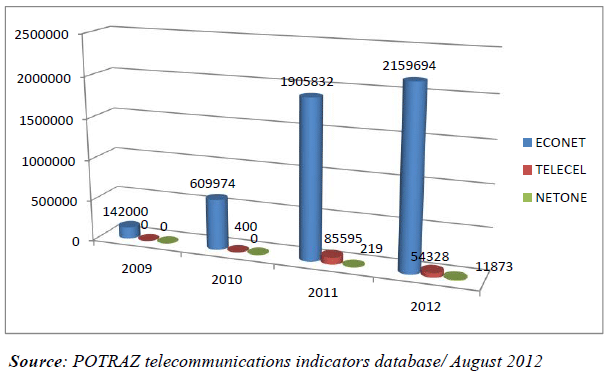

That nonetheless, according to the stats as of August 2012, Econet Wireless accounted for 2,159,694 mobile internet subscribers, Telecel Zimbabwe 54,328 and NetOne, 11,873. That makes a total of 2,225,895 mobile broadband subscribers in Zimbabwe, about 18% of Zimbabwe’s population estimate.

According to the statistics, just 3 years ago the mobile broadband subscribers were just 1% of the country’s population.

10 comments

Eish, Econet hath competitors choking in its dust

A MATH TASK

Let:

A is the set of mobile broadband subscribers ≈ 2 200 000

B is the set of bank account holders ≈ 1 500 000

A1 ⊂ A: where A1 is the number of broadband subscribers with a smartphone or desktop access

B1 ⊂ B: where B1 is the number of bank account holders from current vPayments integrated banks

Task:

1) Estimate the size of A1 and B1.

2) Find:

i) Find the current market cap for vPayments, i.e A1 ∩ B1

ii) Find the potential market cap if vPayments manages to integrate all banks, i.e. A ∩ B1 when B1 ≈ B

Bonus marks (non-Math):

Assume a new set C that represents the set of EcoCash account holders ≈ 1 700 000 and C1 ⊂ C where C1 is the number of EcoCash subscribers with mobile broadband access.

a) Estimate the size of C1.

b) Given that the rate of growth of C1 is much greater than that of B1 i.e ΔC1/Δt >>> ΔB1/Δt, how should this affect both the short term and long term strategies for vPayment integrations expansion?

c) How should current and potential market caps and rates of growth affect the price points for both vPayments without EcoCash, with EcoCash and EcoCash itself?

d) Given your experience and knowledge of business and progress in Zimbabwe, how do you view the prior mentioned entities to actually and realistically change over time, say end of 2013?

A human being with time (pointing)

Lol

I imagine you keyed in the ascii codes for those symbols too

Lol, i got the new article notification whilst i was working a math question bank site for O-level. So i was in the ‘html math zone’ i guess

Dude, am not chuffed….trying to take me back 12 years in time… hehehehe!!!

Telecel and Netone are pathetic competitors. No wonder we get ripped off.

ko mobile broadband yacho iWiMAX here kana kuti GPRS havasi kutaura!

Are you saying Telecel has 54 328 subscribers? Check again! It dosent make any sense at all!

According to the POTRAZ stats, the company has that number as mobile broadband subscribers, yes.