It’s a well-known fact, the only bank Zimbabweans will trust with their hard-earned money is the National Mattress Bank-NMB. The fact that there is actually a bank called NMB is of course coincidental but still part of the joke. What is not a joke is the suffering we have endured at the hands of Zimbabwe’s Fiscal and Monetary authorities who continue to unleash horrors upon horrors under the guise of fixing the economy. That’s why the government’s latest measures to lure people back into the formal financial system will almost certainly fail again.

Actions have consequences

One side effect of shock tactics preferred by the government has been almost universal mistrust of Zimbabwe’s banking system. No sane business or person will deposit their hard-earned money if they can avoid it. If you are really wondering why here is a recap for you:

- Things started to go horribly wrong at the turn of the new Millenium as political and economic turmoil gripped Zimbabwe. The value of the local dollar plummeted. There were multiple cash shortages before 2005. The government did things like introduce bearer’s cheques and traveller’s cheques which were all supposed to be temporary. Each time the RBZ and the government lied and the temporary currency became permanent.

- The government pulled money out of circulation twice before 2009. Each time this happened the public suffered. During one such operation, Operation Sunrise, people were supposed to exchange their old Zimbabwean bills for the new currency in two weeks. If they had large sums of money it would be confiscated if they failed to explain its source. This was supposed to thwart cash barons instead they bribed their way out of trouble but rural people and the elderly lost their wealth with the snap of a finger.

- Then the good old GNU came. People lost all their pensions, savings and deposits in 2009. The stability of the GNU era seemed to suggest it was all worth it. Banks operated normally for a while and people had to build from scratch.

- Then in 2013, it all went belly up. The government went back to its unfaithful ways of printing the RTGS dollar and in essence pilfering USD out of people’s accounts. Eventually, government apologists started touting the nonsense that only those who deposited USD and exporters were entitled to foreign currency. This incomprehensive nonsense was supposed to justify it but it was a slap to people who had faithfully trusted the system.

- Then in 2018 the government, still claiming USD, RTGS and Bond Notes were on par, ordered that USD and RTGS accounts be separated.

- Months later they recognised that USD and RTGS were not equal and started using a fixed rate which they, in their infinite wisdom pulled out of thin air.

- They also hiked the IMT tax to 2%, putting a chill on electronic transactions

- Then in the middle of 2019 with little warning, they attempted to scrap the multicurrency system and tried to force people to give them their foreign currency at a fixed rate in exchange for ZWL/RTGS.

- Having failed to ban the multicurrency system they restored it again last year under the pretence that it was meant to ease people’s suffering as we were about to go into a lockdown.

- They promised a market-based auction-rate but to this day the hand of the RBZ weighs heavily upon that auction which is governed in such a way that almost guarantees a rate which the authorities deem acceptable.

- Then they unleashed Statutory Instrument 127 of 2021

I probably missed a lot of other such policies along the way but during the multi-decade crisis, Zimbabweans have learnt two things:

- If you can help it, don’t deposit your money. The RBZ has been very liberal with the truth countless times in the past. Who knows one day you wake up and you will be told you cannot withdraw USD again because you are not an exporter. You will be asked to justify why you need to withdraw. You don’t have to tell your matress what you plan to do with your money.

- Always prefer USD to local currency. Not only can the local currency depreciate rapidly with little warning but who knows we have a sudden Operation Sunrise where the government attempts to trap those with ZWL notes. They cannot do the same with USD though as they are not the issuing authority. You can always find someone who wants USD in exchange for goods or service whether it’s in Zimbabwe or elsewhere.

The RBZ is right deposits are essential

For a man with little love for the RBZ and their current track, I bet this is rather surprising but the RBZ is right. A cash USD economy is not exactly conducive for the formal economy as a whole. Be as it may the Bank has itself to blame that it is likely going to fail to convince the transacting public to trust it again.

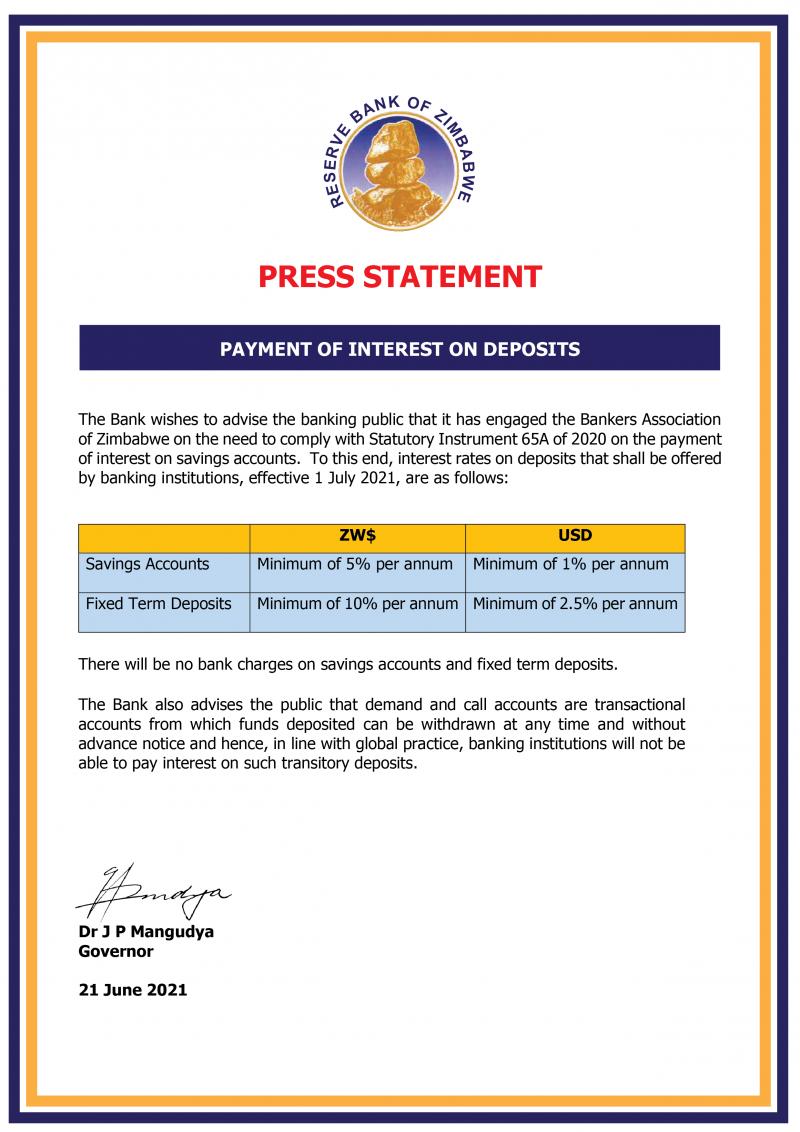

I mean seriously after all they have done? Besides this interest is nothing but pittance considering the bank charges involved. Even from an investing point of view, what kind of idiot will deposit their money so they can earn 1% interest per year and then get charged 2% to move it? You are better off buying Dogecoin or Bitcoin then. The deposit terms the RBZ is offering are all risk and little reward.

You should also check out:

Finance Minister Mthuli Ncube said that the government had a budget surplus of ZWL$9.8 billion in Q1 2021. Now, that’s just over US$100 million (by the RBZ auction rate) and that’s a lot of money. So we discussed what a budget surplus is, if it is a good or bad thing in the Zimbabwean context, and how the government could possibly use all that money.

7 comments

When people are used to margins or mark-ups of 30% and above (in USD terms) in sales and profitability such figures are no place near enticing. However, depending on the inflation outlook (not the actual outcome), the rates are actually in the region of “reasonable” in normal economies.

The headache people have is not being used to normal environments of low inflation and small margins on return on investments. The current ‘stability’ is even looked at suspiciously. lol…

If people can’t grow their money, at a bare minimum it shouldn’t lose its value. Individuals will be the least to use the banks to store money, but maybe the more established enterprises may make more use of the banks now, but only if it makes sense for their cash flows and any leverage it may give them in so doing.

Pity that the banks have been forced to do this. What kind of banking industry makes more profits from bank charges anyways!

U lose your money the minute you walk into a bank.

I opened a Nostro account with a certain bank last week.

I wanted a bank card.They did not tell me their Nostro does not have a bank card.I had already made a deposit of 40 USD.

Since they did not have a card I decided to close my account…and guess what..I lost 15 USD (minimum deposit) plus 3 % withdrawal charge in a few minutes.

I manged to get just over 20 dollars out of the 40 I had deposited.the same day.

Whichever way you lose big time.

I would rather take my chances with the Mattress bank.

At least the banks steal some of your money , robbers with raid that NMB deposit in its entirety

Kwese kubirwa, I’d rather take my chances with the robbers though lol.

All these tactics will fix every problem except the correct one. As of right now Steward Bank is still holding onto my salary from last month. Myself and my workmates that bank with Steward are the only ones to not get our money so far. Whether there is interest or not the public is very correct to not trust these so called banks with its money. The bank is failing as far as I can see.

This Government is the only one that is delayed and tired. I just feel like jumping back into bed when the open their mouth. So unmotivated to do anything to work with the government. Be fresh and exciting.

Offering interest as an incentive for people to bank money is not really an incentive in this day and age, and this applies globally not just locally. Interest rates are so very low in most countries 1% plus or minus is usually what you get. This is why you have çryptocurrencies now wanting to stage a coup d’etat in the world’s financial system. There was the global credit crunch in 2008 caused by banks, and this triggered disenchantment with the banking financial system. So these things in my view are not just limited to Zimbabwe as some will want to believe, the world’s financial system is completely rigged, which explains why Bitcoin and çryptocurrencies have been raging in recent times and gaining popularity, the truth is there is a general worldwide discontentment with the way the Fed, and reserve banks, and the entire banking system have been behaving. People are seeking to create their own money free from government interference through cryptocurrencies. So instead of looking at a small part of the picture People need to open their eyes wider and realize that these are global challenges