When we discussed Old Mutual joining the domestic USD remittance race, someone called it the ‘fintech and remittance gold rush.’ It really is a gold rush. Today, we are talking about another financial institution, Stanbic, launching its solution.

Stanbic Bank has been pushing its new product called Unayo, calling it the hottest kid on the block. They say with Unayo, you can send USD locally, no bank account needed. When I saw that, I thought, NMB gave us NMB Remit last week, this should be Stanbic’s remittance solution.

Well, Unayo is not quite like NMB Remit, CBZ Remit, CityHopper and other domestic remittance solutions from banks. It’s even less like EcoCash, Mukuru and InnBucks. Although they are all united by the fact that they allow the sending of USD in Zimbabwe.

We touched on why banks are resorting to launching such products last time when we said,

So, even banks had to find a way to help people transfer money to each other. This, despite the fact that a good number of those people have bank accounts. It’s because although 47% of Zim households have bank accounts, a tiny fraction has access to USD bank accounts.

You’ll hear banks say, “we have introduced a fast, affordable, and convenient way to send and receive money locally!” – and you’ll wonder what they are talking about. Haven’t banks allowed for the transfer of money forever?

It’s all about tapping into the USD that freely flows on our streets without ever touching a bank account.

Unayo

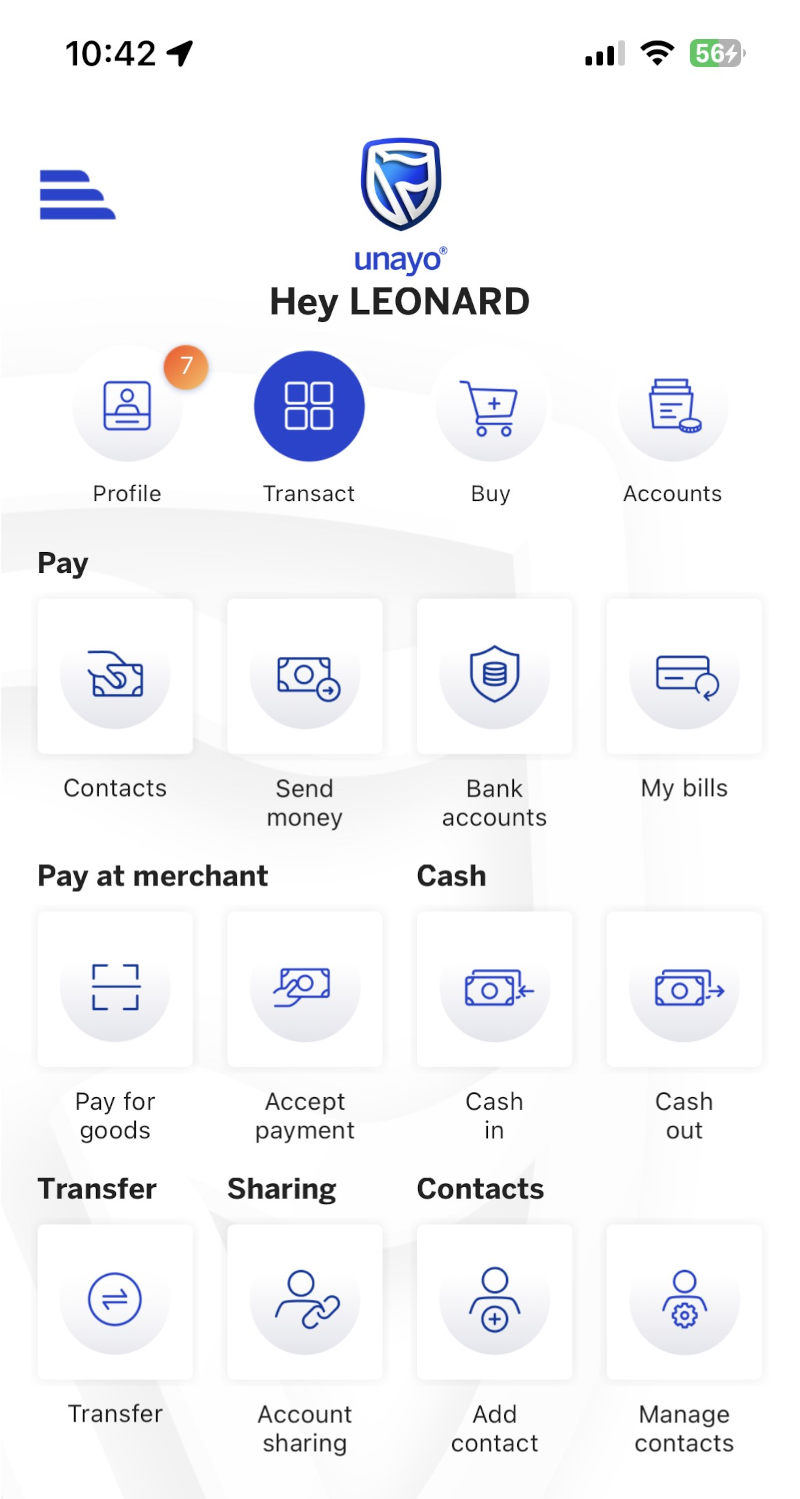

Unayo Homepage

Unayo is pretty much Stanbic’s attempt at making the Nostro account more accessible. An Unayo account is similar to a Lite bank account if you know what those are. Just that this one is a Lite USD bank account, or a Lite Nostro account if you prefer.

With an Unayo account, you will be able to pay for goods, send money to other Unayo account holders and also to bank accounts.

You can have a maximum balance of $1000 on the Lite Unayo and $2000 on the Pro Unayo account.

In terms of charges, you will be charged 2.75% (0.75% being Stanbic’s cut and 2% being tax) to send money and 2.5% to withdraw. The likes of EcoCash and InnBucks will run you back 5% in total, after taxes whilst Unayo will cost 5.25%.

The ability to send to bank accounts is one of the major advantages of an Unayo account. You cannot send USD to a First Capital Nostro account using EcoCash or InnBucks for example, but you can with an Unayo account. It is a Lite bank account after all.

So, if you regularly have to send USD to some Nostro account then Unayo is the product you have been waiting for.

You will be charged 3% to send to bank accounts, 1% + 2% tax.

Opening the account

You can open an Unayo account from the Unayo app (Android, iOS and Huawei) or even USSD (*360#). You will have to supply a copy of your ID in person if you use USSD though. You can upload digital copies via the app. At the time of writing, the USSD option does not seem to be working.

For the Lite Unayo account all you will have to do is upload an ID, take selfies and a 5-second video. For the Pro Unayo account, you will add Proof of Residence and map your address on a map. All this in addition to providing information on your name, D.O.B and the usual.

Assisted Services Mode

With this special Unayo feature, you can grant access to your Unayo account to someone else and have them transact using your account.

This is great. Instead of sending money to someone so that they can make a payment, all you do is give them access to your account and they can use your account to make the payment. You save on money transfer costs.

At least that’s how they explained the feature to me. I’m skeptical that this is how it’s going to work because I think it would be abused.

It sounds good but…

If we’re being honest, Unayo is not really offering anything new here. They are entering a crowded and competitive market and all they have to show for themselves is ‘transfer to bank accounts’. I’m not sure that’s enough to move the needle.

I’m struggling to answer the question, “who is Unayo for?”

What Unayo is, is a Lite Nostro account and I’m not sure there is huge demand for such accounts.

Here is what I think is working against them:

Ease and speed of opening an account

When compared to bank accounts, an Unayo account is easier to open. However, when compared to the other solutions on the market, it is not.

I created an Unayo account around 1pm on Wednesday and only got confirmation that my account had been opened at around 10am on Thursday. This means you can’t just use Unayo in a pinch to send money.

I remember someone I needed to send money to telling me that the most convenient service for them was Mojo Mula. I was not registered for the service but I just stepped to a counter, got a little form, filled it out and in less than 2 minutes I had used the service to send money.

So, for remittances, money transfers, I see no reason why someone would want to leave whatever solution they use right now for Unayo. Not even when someone requests you send using Unayo.

Branch network

With Unayo, you can only cash in and cash out at Stanbic branches or ATMs. There aren’t 20 such locations in the country and most of them are in Harare. That means most people are nowhere near an Unayo outlet.

This makes it inconvenient, especially when compared to the likes of InnBucks with close to 300 locations. InnBucks managed to carve out marketshare for itself because it could count on its huge branch network.

It may not be too much of a hassle for you to open an Unayo account and maybe you can even convince the people you regularly send money to to open theirs as well. However, you’ll probably get the, ‘can you send via EcoCash or Mukuru please.’

No online /cross border payments

EcoCash has its MasterCard integration which allows users to pay for goods and services online using their EcoCash accounts. That sets EcoCash apart on the market.

Unayo does not allow for online payments, which is a bummer but in line with most of the competition.

Unayo is not just in Zimbabwe, it is available to users in pretty much all the countries that Stanbic operates. You can even apply for and open an Unayo account as a non-citizen of South Africa, for example.

However, you cannot transfer from a Zimbabwean Unayo account to a South African one. If you have money in your Unayo account that you need to use on a trip to S.A., you have to withdraw it and find another way, a prepaid USD card being one of the best options you have.

Stanbic does have a prepaid USD card but it’s only available to Stanbic account holders, unlike the other banks’ prepaid USD cards that can be issued out to non-account holders.

What do you think?

We might be missing something here but it does not appear as if Unayo will shake the industry up. Unless you told me there was a huge chunk of the population in need of Lite Nostro accounts, I’m not high on Unayo’s chances.

Unayo needs network effects, since one can only do Unayo to Unayo transfers and yet they do not have the network. How are they going to convince people to join the Unayo program? I don’t see it.

Unayo offers some interesting business and merchant accounts but again, I think the network effects are working against them.

What do you use for your domestic USD remittance needs? Do let us know what you look for in a remittance and payment service provider? Does Unayo sound good to you? Spill it all in the comments section below.

Also read:

NMB Remit joins crowded domestic remittance market, can it make a mark?

Old Mutual Zimbabwe launches a Fintech business, Old Mutual Digital Services

11 comments

People wake up real early to get a chance to withdraw usd. There are always queues at all remittance agencies. You can wait in line and cash will run out before you can get it. Yet you keep calling the domestic remittance market “crowded”

You are mixing up two different things.

Those queues are for international remittances into the country from our friends and relatives in the diaspora and the companies that offer services in Zimbabwe as well as wherever they are living is limited so there will always be queues. Because there’s basically almost no other option to receive money.

But the domestic scene is a whole different story almost every bank even POSB is now part of the domestic remittance game don’t forget wana econet, netone and innbucks that’s a lot of players providing the service of sending USD domestically. It’s crowded!

Exactly. Zim is too small a market to support all these players. The banks are being lazy with their solutions, they are just launching their own ‘remit’ solution and hoping people will flock to it. Although tbh, I don’t think even they are confident they will succeed at any meaningful level.

Looking at the ‘banks’ we have CBZ Remit, POSB Remit, NMB Remit, Steward Remit, CityHopper, Unayo, NBS InstaCash and counting. It’s crowded.

Yaaa they are trying but I don’t see how people are going to switch from innbucks to unayo it’s Not possible so I think their unayo project will be a flop

There’s virtually no reason why the masses would flock to this over InnBucks.

Ko mabanks ano offer mavisa card ndeapi uye macost avo akamirasei. Ini hangu ndinoshandisa ecocash nekuda kwemastercard. Asi kukava neimwe ine visa ndingatizirako

Stanbic offerrs a quite solid visa debit card but be prepared for strict KYC Requirements when you wish to open an account with them

Yes, like has been said there, almost all the banks have solid Visa/Mastercard debit cards but be prepared to deal with stringent KYC requirements. Proof of res, source of income, confirmation of employment and that kind of thing.

You could always try their prepaid USD cards instead. Those are easy to open, especially one like BancABC’s and CBZ’s. They actually have some advantages over the EcoCash one too. See some of them compared on the link below:

https://www.techzim.co.zw/2021/12/giving-zims-prepaid-usd-cards-the-tinder-treatment/

😊thanks

Upmarket experience under one roof. That’s what I imagine they bring to their clients. I mean, don’t you trigger alarms if you try to walk in with bond notes?😂😂😂

I stumbled upon your blog post, and I must say it left me spellbound. Your words wove a captivating tapestry of thoughts, effortlessly touching the heart and mind. Thank you for sharing your remarkable insights with the world.