On Friday last week, Econet launched EcoCash, a mobile money service that so far looks like a game changer. On the local market at least. The concept is a tried and tested one. M-PESA has worked phenomenally well in Kenya, and Econet has read the M-PESA story cover to cover. In fact it is its similarity to M-PESA that gives Econet the game changing potential it has with EcoCash.

On Friday last week, Econet launched EcoCash, a mobile money service that so far looks like a game changer. On the local market at least. The concept is a tried and tested one. M-PESA has worked phenomenally well in Kenya, and Econet has read the M-PESA story cover to cover. In fact it is its similarity to M-PESA that gives Econet the game changing potential it has with EcoCash.

But to subscribers everything boils down to the cost.

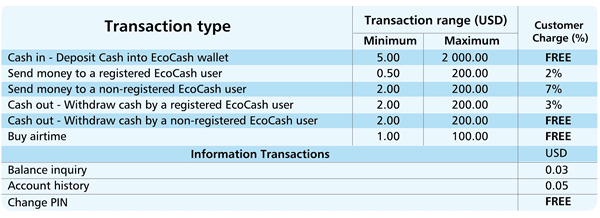

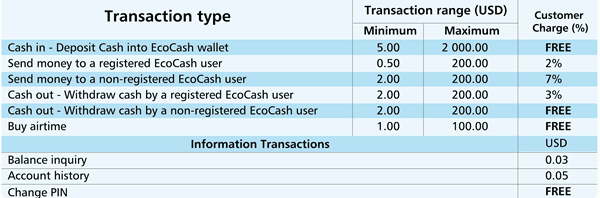

The decision to use EcoCash or not for most people will be based on the cost of transacting. Especially that of sending and receiving money. Econet did publish the EcoCash transacting charges on its website.

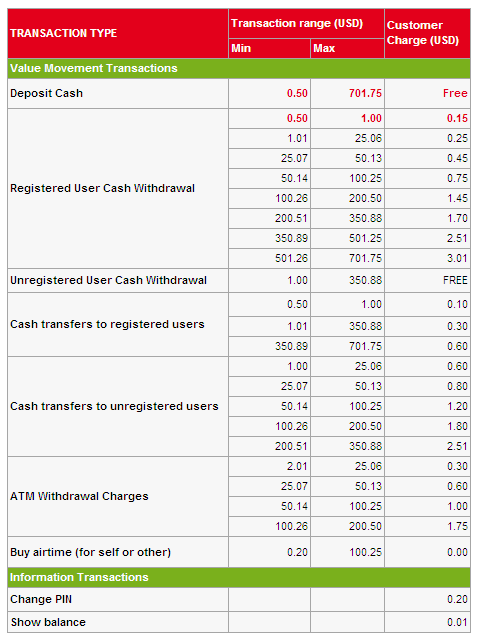

The layout of the tariff schedule is curiously similar to the M-PESA one so we’ll just post the M-PESA one here too for comparison. Needless to say, M-PESA tariffs were in Kenyan Shillings so we converted them USD. The conversion rate at time of posting was 1 USD : 99.75 KShs.

Here’s the Econet one:

And here’s the M-PESA tariff schedule:

Here’s the summary of the differences:

- Where EcoCash will charge percentages of the money being transferred, M-PESA has fixed charges for transaction ranges.

- To transfer US $200 to an EcoCash subscriber, a subscriber will be charged US $4. For the same transaction, an M-PESA subscriber will be charged US 30 cents.

- To transfer US $200 to a non-EcoCash subscriber, a subscriber will be charged US $14. For the same transaction, an M-PESA subscriber will be charged US $1.80.

- To withdraw US $200 cash, an EcoCash subscriber is charged US $6. An M-PESA subscriber is charged US $1.70 for the same transaction.

46 comments

Econet wants to reap us off …. again!

Did you complain this much when Kingdom launched their mobile money transfer?

HAS been reeped of my 10 dollars cannot trace it

Please help me, how do I register with the network if Im a South African and would like to send money via ecocash.i would be performing transactions monthly. “I get error access denied” how do I send fro m SA to zim?can it be done?

Hmm so once again econet is fleecing customers for as much as they can in as little time as possible as they traditionally have with airtime and bandwidth. Heres hoping someone makes a go of starting some credible competition else we will never end get out from under their thumb.

Another example is the banking sector, which is crying because of lack of customers, yet it is cheaper for my brother to use his British VISA card from an atm here than it is for me to withdraw my own, in country, cash from an NMB branch. Simply baffling how companies take us for a ride then wonder why no one uses their services.

Economics 101, law of supply and demand

Nice coverage………….but can you shed a bit of light on the transaction tariffs with banks, so that we map our options. Another early bird approach (ripping off before competition) by Econet. Lets share this information widely…………..if everyone realise what a farce this is, there will be low uptake and hope for a down revision. Nxa! As it is…..taking the money yourself is better option for the majority

Costs 2Washingtons to withdraw money from an FBC Bank ATM!!

Econet in my opinion “rips” ideas from other countries/services, establishes them locally and charges a premium on them. i hope people dont jump on this rip-off service. as NGTH mentioned, overseas cards cheaper to use than local services such as Eocash.

Why invent the wheel? Take the idea, customise it and sell. That’s business

What’s the point? Im keeping my money, greedy bastards.

Guys dont be narrow minded. This is how Econet keeps creaming. They invest in sound market research. All Econet prices are monopolistic. In proper marketing management you do not reduce a price for the sake of it. If the market tolerates the price or has no other choice (Zim scenario) then theres no need to change it. Put simply they use first mover advantage and cream before any buggers join in the fun.

if it were only that simple. you are speaking from the capitalist perspective. we are consumer and there demand a fair price, the shame is that the other player in zim telecoms market cannot offer a competitive challenge to Econet. so i guess we must suffer on until proper competition comes along, or maybe potraz will start doing its job.

There are other options- Kingdom CellCard and NetOne’s OneWallet, and the obvious one- send your money by bus or via bank transfer system

we need more people who think like yu

I hate econet and all they stand for.

I like their innovation and business muscle.

I hate their arrogance and stupidity in not allowing their website not to be accessed if you are using some ISPs like ZOL or Telone.

i knew there was a catch somewhere, but charging 13 time the price of an equivalent service might discourage consumers. i wonder who is the head of marketing at econet? Econet should be patient and not expect a full return on investment in such a short space of time.

why would Econet charge for a balance enquiry?

Yeah! Good question! That bit of bandwith usage perhaps?? Ki ki ki ki ki!! Bottom line is though, they want to make as much as possible out of this “conception”. Thats why the whole idea was taken up anyway! Money, money, more money!

They invested a lot in equipment and software, and they pay licence fees and support fees yearly (regularly, OK). So the people who enjoy services from this system should pay for all these, and also leave some profit for Strive and company

Great article to compare these! And fow sure, Econet are reaping people off! $14 to send 200!

However, the article missed the point that there are already other very successful Mobile Money products on the market – like Kingdom CellCard & ZB e-Wallet & e-Mali. There are other ones just starting – like Cabs TextaCash & FBC Moola. The NetOne one seems a failure already. These are doing very well and are charging less. For example – you can send money with the ZB e-Wallet for 25cents.

Maybe you should do an article that compares EcoCash vs CellCard vs ZB e-Wallet vs other local products.

Ditto that!

Charges are definitely higher than one would have expected, especially worried by the levy charged on receiving. But, perhaps a more relevant comparison than Techzim’s impulsive (and, must be said, predictable) M-Pesa comparison would have been to compare the cost of sending money over Ecocash, with that of others on the local market. If, today, I wanted to send a 100 bucks to rural Masvingo, how much would it cost me, compared to what Econet is charging? If I wanted to transfer $50 via RTGS to a friend in Mutare, how much would I have to pay? How much do I get charged on NetOne? One Cabs, Cellrd etc…These are the options available on the market – THE LOCAL MARKET – today, and it would be interesting to see where Ecocash ranks. Makes no sense to me pining over prices in other markets, when most of us here charge more in our own businesses here than they do in similar businesses elsewhere. It’s the economy and all of us, Econet too have to change. So let’s compare like-for-like.

At the end of day Econet sells convenience. They ask themselves; How much is the market ready to pay for the convenience? It’ i not cost based. That’s why they used to price SIM cards at USD $15 despite the fact they were getting them produced and ready for market at less than a dollar.

EcoCash is clearly and by far more convenient than any of the existing mobile money systems. A more useful comparison with other local services would be convenience and not price: How many EcoCash agents Vs how many bank branches. Distance to nearest EcoCash agent Vs distance to nearest bank. What time does an EcoCash agent close Vs time the bank closes. Can you send anyone cash via RTGS Vs can you send anyone cash via EcoCash. How long does it take for the cash to reach the recipient etc…

EcoCash beats all of them hands down. Econet knows this. They find themselves in the fortunate position where they are at liberty to price convenience quite high and still manage to sell it. They have 70% market share remember. It’ll be hard for a lot of people not to find EcoCash useful.

So what is the price of convenience?

One of the only services that exists globally that is very similar to EcoCash in terms of convenience is M-PESA. Hence this article.

So, what is the price of mobile money convenience? M-PESA says US $1.80. Econet says US $14.

You miss the point Kabweza. A comparison of EcoCash with a product that is not operating under the same condition or offering the same service is not a fair or justified comparison. Optimus Prime is quite right, you need to compare apples with apples … the impression you have successfully given your redaers is that Econet is ripping off the Zimbabwean populace and yet you haave not given your readers the opprtunity to compare the Eco-Cash offering relative to similar competing products offering the same service and operating in the SAME market, where it would become quite apparent that Econet’s pricing is quite competitive. I dont know how this article would help you readers therefore make an informed decision.

M-Pesa does not compete with EcoCash as they do not serve the same customers nor can any one of your readsers then decide to use M-Pesa instead of ecoCash so your comparison is of little value in that respect. If you wnat to find something to blame for the higher pricing in the Zimbabwean economy, blame the economy, not Econet, which is an important reason why it cost more to send US$200 in Zim than the rest of the world. You have not considered how much it has cost and will continue to cost Econet to offer the convenience you speak so boldy of. It would not have taken you much Kabweza to compare like with like, and I’m sure you’re fully aware of this.

Ditto

EcoCash vs Kingdom Cellcard

I am not sure EcoCash has more agents than Kingdom at the moment.

They use the same type of agents such as shops which are everywhere (hopefully Econet will not muscle current Kingdom cellcard out of it’s existing network of agents)

Kingdom Cellcard fees: $1.30 per month fixed, balance enquiry fees are $0.03 per

enquiry, withdrawal charges are minimum $0.10 and maximum $1 and

transfers to account holders are $0.15, transfer to non-CellCard

account $2.

EcoCash does not charge monthly fixed fees. However, their usage fees are based on the amount of money transferred- the bigger the transfer, the more you pay. So if you transfer $10 you will be charged 20c by EcoCash whereas with Kingdom this fee is fixed at 10c regardless of the size of the transaction.

I think it boils down to a user’s pattern of use. If you do a lot of transactions bigger than $5 each in a single month, Kingdom is better. But if you do small transactions EcoCash is better.

Anyway, these types of mobile cash transfer systems are meant for microcash movement, but we will use them here for big transfers because our banking system is not good.

I notice the M-Pesa tariffs charge a fixed levy per range of transfer. The larger transactions will obviously be cheaper. But, can TechZim calculate, as a percentage, whether M-Pesa is not charging more than Econet on the small amounts by setting a fixed charge for the various ranges, as opposed to a percentage of the value. For instance, on M-Pesa, it costs you 10 cents to send 50 cents, the same amount it costs to send a dollar. If I’m reading it right, it also costs you 25cents to withdraw a dollar, same amount it costs to withdraw $25. You are comparing EcoCash, which is using percentages of value, to M-Pesa, which charges a fixed rate on a range of transfers. I know it’s fun and fashionable these days taking shots at Econet 😉 but it’s only fair to compare the same thing. That said, it’s important for Econet to take another look and see if the prices are sustainable.

Econet is a very progressive company that offers key benefits that other Mobile Operators have been failing to give. It’s unfair to compare only tarrifs. What needs to be done is full macroeconomic comparison i.e cost of bread, tomatoes, bus fare etc. It’s cheaper to send money with EcoCash than the bank charges

it costs $5 to send $200 ne RTGS and econet charges $7. justify

My grandmother at Machonyonyo growth point has no bank account, so the only way is a mobile money transfer system.

wotoita kuti homwe i kure coz u will fnd kuti its better kuenda nayo mari yacho wega

nekti its gonna cost u think abt it man

Do not compare with bank charges, compare with Kingdom cellcard and other cash mobile transfer services.

By the way, when your loved one is seriously ill in the rurals and need cash for treatment (or bus fare) you do not think about price of bread or tomatoes. You think convenience.

Inspired to Rip your World!!!

i’m just sayin…its my catchline, not associating it with anyone

econet the ripper

won’t eco-cash fade away like eco-life????????????

If they get greedy and decide to buy the company that sold them the software, YES.

EcoCash and Kingdom Cellcard are basically the same system. The difference is in how they handle the risk involved in handling the movement of cash and in marketing the service.

Kingdom cellcard works primarily off Telecel, which mostly decided not to take the risk involved in handling money and pushed them to Kingdom. Also I think Kingdom has a better brand name and more marketing and sale experience than Telecel. Hence Kingdom became the promoters of the service.

The opposite happened with EcoCash

My biggest wish on EcoCash:

Allow Econet clients to convert airtime money into EcoCash account, just like you allow them to convert it to data bundles. That definitely will be convenience

With more services like the ZimSwitch backed mobile transfer services etc, Econet will have to resort to subbortage the competition by depriving them of their large subscriber base, disabling toll-free line they may provide to the competitors or using bulk SMS in order to discredit them. The competition is hot and EcoCash fee are high.

Here is a competitive offering in the market that I found out about from my CABS branch. You can send money across all networks just like Ecocash but you also have the option to do your banking. You have to have a telecel line to do it but they give you one if you don’t have one. Here are charges compared to eco cashTEXTACASHECOCASHTRANSACTION TYPETRANSACTION RANGECUSTOMERTRANSACTION RANGECUSTOMERMINMAXCHARGEMIN MAXCHARGEDEPOSIT CASH0UNLIMITEDFREE$5$2,000FREE SEND MONEY TO REGISTERED USER $10$1,00020c + 1% cash amount$0.50$2002% cash amountSEND MONEY TO NON-REGISTERED USER$10$1,00020c + 1% cash amount$2$2007% cash amount REDEEM CASH RECEIVED ON CELL PHONE (REGISTERED USER)$10$1,000FREE$2$2003% cash amountREDEEM CASH RECEIVED ON CELL PHONE (NON- REGISTERED USER)$10$1,000FREE$2$200FREE BUY AIR TIME$1$10FREE (only Telecel)$1$100FREE (only Econet) BALANCE ENQUIRY FREE 0.03 8c (if card on Zimswitch) MINI -STATEMENT FREE 0.05 MAKE PURCHASE USING CARD FREE on CABS POS N/A 50c on Zimswitch POS N/AWITHDRAWAL FROM TEXTACASH ACCOUNT (USING CARD)$5$1,0001% of cash amount N/A INTER ACCOUNT TRANSFER (carried out on Mobile Phone or POS device) N/ACABS TO CABS $10,00020c N/ACABS TO TEXTACASH $10,00020c N/ACABS TO OTHER BANKS not yet possible – coming N/A

ADVANTAGES OF TEXTACASH CARDS

1. BIGGEST ADVANTAGE – the textacash card (and any other CABS card) can be linked to your mobile phone, so that you can do balance enquiries, transfers and textacash sends from the convenience of your mobile phone – you can be sitting in the bus, sitting at your desk at work, anywhere – as long as you have Telecel network, you can bank.

2. Issued immediately and easily – no need to provide proof of address, no need for photograph, no need to wait 5 working days for issue – simply fill in one form, show a copy of your ID and the card is issued immediately

3. No monthly bank charges – normal bank cards attract a monthly fee. Textacash cards are free

4. No minimum balance required – you can draw down or spend all the money which is on the card

5. No charges on purchases at shops with a CABS POS device – you can buy groceries on your textacash card with no charges at the till (normal CABS cards is 15c charge). N.B. if there is no CABS machine available you can use a Zimswitch device. This attracts a 50c charge

6. Employers can pay salaries onto a textacash card using either Paynet or via their own POS device

7. No need to queue at a CABS branch to draw down your salary – you can go to any OK store or TM store or any other store that has been signed up as a CABS textacash agent.

i think you will also need to consider that in the case of Mpesa…Kenya is using their own currency, they are printing the money on their own. As for EcoCash its in a Zimbabwean enviroment were the cash to be withdraw has to be imported. Importing cash has costs attached to it like insurance and freight therefore we cannot expect to charge the same as Mpesa. And also a point to note is Econet is also paying for the connectivty from Safaricom, its not an excuse but the nation has gone through an econimic stagnation for the past ten years, development of instrastructure had been paralysed whilst some of the nations were expanding theirs slowly and Zimbabwe has to match up with these in a shortest period of time and you will agree with me…fast means expensive. lets hope when we catch up with these nations our tarrifs/charges will go down aswell. Also in other coutries mobile netowrk operators share infrastructure therefore the cost of putting up such is shared and becomes cheap, Zimbabwe now has 3 mobile players and two of them are government owned na dobivously we know what to expect from these two, Econet had to go all the way by itself to provide evryone with the global technology. we cannot compare the two.

[…] Telecel doesn’t have to spend money on these things because they’ve been done for them by Econet. In fact, if you look at Telecel’s tariff schedule, they basically copied the structure of the Econet one and just made the tariffs lower. Kinda same way Econet copied the M-pesa one back when they launched. […]

[…] complaint with mobile money services locally (EcoCash really) is that it’s expensive to use. Since launch. They reviewed the transaction fees downwards once, a few weeks after launch, but EcoCash remained […]