The article below is a statement issued by ZimSwitch on the state and progress made with the ZimSwitch Shared Services payments switching platform. The statement was issued to us as part of the research that we made over the past few weeks for the article Zimbabwe: Of banks, Mobile Money and EcoCash.

It has been a busy year for ZimSwitch and our customers, the 19 member financial institutions.

It has been a busy year for ZimSwitch and our customers, the 19 member financial institutions.

With well over 2 million Zimbabweans now holding active bank accounts and an exciting and convenient array of new products and services either available now or coming soon, we believe that now more than ever, It is “better to be banked!”

ZimSwitch has been offering its members inter-bank shared services for nearly twenty years. Initially POS and ATM switching, and more recently Mobile and Internet based transactions. We consider these four delivery channels the cornerstones of any financial sector.

ZimSwitch members include: Agribank, Allied (formerly ZABG), BancABC, Barclays, CABS, CBZ, FBC Bank, FBC Building Society, Interfin, Kingdom (Afrasia), MBCA, MetBank, NMB, POSB, Stanbic, Standard Chartered, Tetrad, Trust and ZB Bank.

A primary concept ingrained within the ZimSwitch ethos is that of “interoperability”. We believe that the key to success is to ensure that all entities can connect with each other and create a shared “ecosystem” where all entities can participate fairly and benefit from a collective strength. This approach ensures the lowest costs and maximum convenience to the most important players in any financial system…. The customers.

But actions speak louder than words… In a heavily regulated and controlled sector, new product innovation is never an overnight process. We and our members are closely monitored and advised by the Reserve Bank of Zimbabwe, whose tireless efforts ensure that all services offered through any of the bank’s channels are comprehensively audited, secured and approved before they are activated for public use. ZimSwitch serves the banks, who in turn serve their banked customers. Different banks focus on different markets, and it is our job at ZimSwitch to do everything that we can to assist them in ensuring that their service is as secure, convenient and interoperable as possible. Hopefully some of the details below will show that while it has taken us some time, there really are many great reasons why it is “better to be banked”.

Traditional ZimSwitch – back in 1994 ZimSwitch started offering interbank POS and ATM purchases. Dollarisation caused a steep decline in the monthly transactional volume, bringing it down to near zero. Today our member banks process tens of millions of dollars’ worth of purchases and withdrawals every month through the 4,500 POS devices and 500 ATMs connected through ZimSwitch. A truly national infrastructure with a massive footprint.

ZimSwitch Mobile – is a shared USSD mobile banking platform enabling banks to connect their customers through standard cell phones requiring just one bar of normal signal. The platform connects to all three MNOs – Telecel, NetOne and Econet – and is currently active or in a final integration stage for 16 of our member banks. Each bank offers their customers their own flavor of USSD functionality, but as a rule this includes balance enquiry, mini statement, internal transfer, airtime purchase (for self and other), bill payments, ZIPIT to Bank, ZIPIT to Cell Phone, HotCard, and PIN Change. The platform is processing approximately one and a half million successful transactions per month (about 10 million USSD legs) from over 250,000 active customers, growing at about 15% per month.

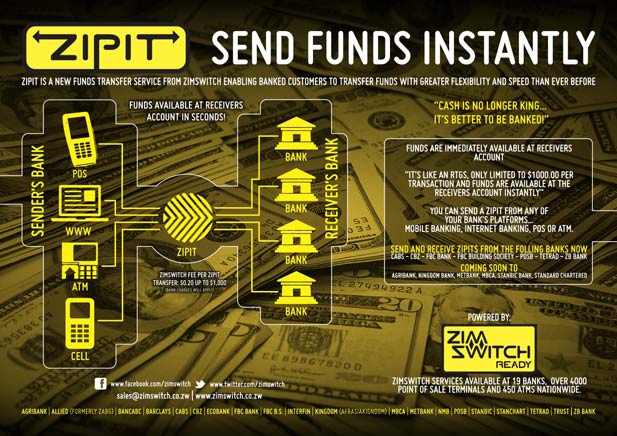

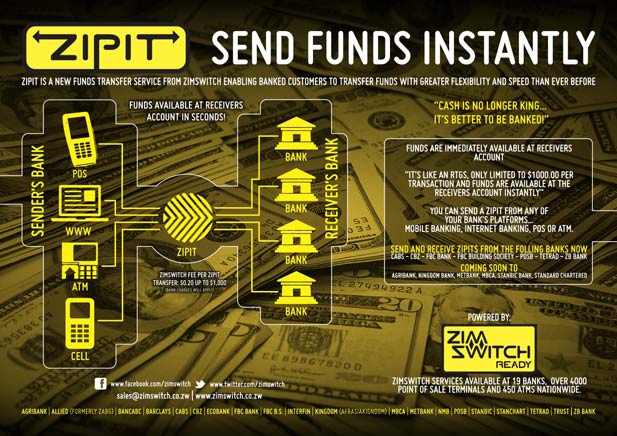

ZIPIT – ZimSwitch Instant Payment Interchange Technology – is a new transaction set that enables banked individuals to send funds instantly to any other ZIPIT enabled bank account or to any un-banked cell phone owner on any network.

14 banks are either certified on the ZIPIT to Bank transaction set or in the final stages of implementation. A typical ZIPIT bank charge for a ZIPIT to Bank transfer is $1.00 flat rate charged to the sender. The receiver is not charged. ($10.00 to $1,000 transfer amounts). With new products emerging such as Instant Banking and an ever growing number of banked individuals in Zimbabwe, this means that most Zimbabweans will be able to send funds to each other at a lower than ever cost with maximum convenience and security. ZIPIT to Bank is also now available as a 3PP interface (Third Party Processor) meaning that non-financial institutions can integrate into the service as long as they have a partner bank.

ZIPIT to Mobile is in the process of being enabled as an “interbank redemption”… meaning that a ZIPIT to Mobile funds transfer from one bank sent to a cell phone recipient can be redeemed by any ZIPIT certified agent (see Bank Anywhere below) even through a different bank. This opens up the entire ZimSwitch POS infrastructure and ensures that recipients never have far to go to get their cash! The PCEPA (Plastic Cards and Electronic Payments Association) recently agreed that the interbank agent fee for redemption would be 2% of the amount due to the acquiring bank. This is charged to the sender. The recipient is not charged.

ZimSwitch V-payments is about to launch nationwide – with new functionality and ease of integration to make life simple and affordable for all who wish to participate in the exciting new world of eCommerce. The BuySafe option introduces an “escrow” concept to the platform protecting customers form less well known sites, while the Super-Merchant IPSP (Internet Payment Service Provider) functionality enables larger organisations who are not a registered financial institutions to create their own sub-merchant network as well as individual “one-off” sales for the seller who just wants to sell his or her old bicycle or cell phone! Hundreds of new merchant sites are integrating and a comprehensive Vpayments shopping environment will definitely be completed in time for Christmas.

The new Vpayments release is due this month and will include a collection of new “user-friendly” features such as a simpler registration process, sample PHP integration code and free Vpayments payment modules for download by merchants who do not wish to integrate using their own development skills. (Currently available for OpenCart, Magento, Joomla and OSCommerce – with more to come) A separate press release will be published to TechZim this month detailing the full suite of new services – some of which we are confident will create nationwide excitement.

(Please note that Visa eCommerce is already available through CBZ which provides a legal mechanism for accepting international eCommerce payments rather than using international gateways that do not necessarily satisfy Zimbabwean legal merchant payment requirements)

Branchless/Agency Banking – over 1,000 branchless/agency POS banking services are already available nationwide and growing fast. In the coming weeks banked individuals will be able to perform most of their everyday banking services wherever they see the “ZimSwitch Ready Bank Anywhere” sign. This will include merchant stores such as supermarkets and cover transaction sets such as inter-bank deposits, withdrawals, balance enquiries, ZIPIT to Bank Sending and ZIPIT to Mobile redemptions. Other transaction sets such as Bill Payments and airtime purchase are already available.

Bill payments – Zimswitch member banks are now offering bill payments functionality for most major service providers including DSTV, COH, COB, TelOne, CIMAS, Insurance policies, funeral plans, ZIMRA, ZESA – with more coming online every month. These are generally available through all four primary delivery channels – POS, ATM, Mobile and Internet.

International remittances – various international remittance services (inbound) are already available through many banks receiving funds from all over the world, with many more expected live this year to ensure people can “send money home” with the upmost convenience and lowest possible charges.

Instant banking – is a new low cost service offered by some of our members, (CABS Textaca$h and FBC Mobile Moola are examples) enabling lower income “non-banked” individuals to become “banked” in minutes – with low or even zero monthly account costs.

We at ZimSwitch believe that this is the most exciting time ever for the financial sector, and that the various services offered by Zimbabwean financial institutions today and in the coming weeks and months show that while we were a little slow to start, Zimbabwe is leading the way to 21st century banking in Africa.

22 comments

Thanks TechZim for posting… We hope the TechZim readers find the above informative. Please feel free to post any questions, concerns or suggestions you might have. Every bit of input is very valuable to us! For more specific technical queries email: support@zss.co.zw.

Thanks Adam. Hopefully this article demonstrates the continued collaboration between ZSS and the Banks to give the zimbabwe consumer efficient and cost effective payment solutions. May be we need to spend more time on promoting our ecosystem.

This has been much awaited. Ecommerce can roll now.

Cant wait for the web sandbox…the zim money revolution is just starting. And escrow service is most welcome, no more cons.

Hi Kudzi and Farai. Thanks for the comments! We are very excited about all the new financial services… but we feel that eCommerce is especially exciting! The new Vpayments will make it very simple for anyone to integrate.. especially the new (free) snapons for the most popular cart systems. (available in the next few days) Do you guys plan on integrating? Do you have sites? Our team is here to help if you need assistance.

Please provide your contacts

You’ve got mail Adam.

aroscoe@zss.co.zw or 0732138111. You can get the standard support team on support@zss.co.zw…

For an additional layer of safety against key loggers, try using the keypad like CBZ (https://fcdb.cbz.co.zw/B001/ENULogin.jsp)

Or a mix of different user provided answers e.g. after username and password, provide the number you get from adding the last number from your address to the 6th digit of your cell number.

Thanks Farai. We have looked at Key Loggers… and definitely a good idea! What do you think of the random debit element? It is obviously a great security measure but an inconvenience… security vs usability!

Well, besides the fact that my CABS account was rejected (wrong length for this bank etc), the random debit breaks the deal for me. I have to make a trip to the bank for that one and am not really motivated given the current merchant list. Give me a solution I can do entirely online, without relying on a third party visit/transaction and we can do business.

Hi Farai. Could you send me an email with your details (aroscoe@zss.co.zw) or drop me a line (0732138111) and I will get the CABS team to check why you received the wrong length card number error during your Vpayments registration.

The random debit is a bit of an annoyance… but it is also a one time process and protects against fraud on your account. You mentioned you are with CABS… Have you signed up for their USSD Mobile Banking or Internet Banking? If you have, then you can see the random debit amount without leaving your computer (just do a mini statement). The same goes for most of the other banks… What do you think? There are well over 250,000 people registered for USSD Mobile Banking through ZimSwitch Mobile, so our hope is that a lot of people have convenient ways of finding out the random debit amount.

Hi guys – fair point from Farai on the merchant list.. Kind of a chicken and egg problem… but we have to start somewhere if we really want local eCommerce in Zimbabwe! Just to let you all know there some BIG names coming online in the coming weeks… and literally hundreds of merchants and shopping options… (more to come on this in next weeks press release..)

Hey Farai, do you have mobile banking or internet banking? I bank with CABS and signed up to VPayments with no problems (account number wise), I then just checked my mini statement on my mobile banking as was able to use that to complete my signup

Thanks for the response, am using a Gold Class account, havent signed up for both mobile and internet banking, will do that tomorrow.

Just been to the site for vpayments. Its very promising. have downloaded the sample code and am still studying. Unfortunately I am yet to see a sandbox for testing implementations. Please make it a priority to provide otherwise tingafa nematransaction charges during testing for integrations

Hi Purple

Thanks for the message. For the sandbox, could you have a look at the lab environment: https://secure.zss.co.zw/lab/vpayments

Hi Adam

I opened the link but i was not able to download the joomla plugin. The link for it seems to be wrong.

Hi Purple

OK – let me get the team to have a look… it is a new feature on the test side so probably just a mis-config..

GM,

I have been dealing with SCB for 50 years and their service has always be up to date except when it come to ZIMSWITCH they cannot help me so I am addressing your company direct.

My complaint is that when you get your bank statement there is an withdrawal and in the description col it has ATM WDR-SWT AT ZIMSWICTH then a code number some 20 figures but that all is hogwash to me as it dos not tell me where the withdrawal was made. A withdrawal everywhere else in the world has name next to it why not in Zimbabwe???

Please send me a list of all your codes and I can then find them my self or rectify your system and bring it into the first world banking system.

Regards,

HWL

[…] Shared Services (ZSS), is one of the country’s leading financial services provider. They offer services that range […]

[…] Shared Services (ZSS), is one of the country’s leading financial services provider. They offer services that range […]