NetOne re-launched a revamped OneWallet product at their Kopje Plaza offices in Harare this afternoon. The OneWallet product was previously launched in 2011 and this re-launch is in response to a re-engineered platform that has just gone live. Here’s all that you need to know about the revamped OneWallet product:

The new

- The most touted improvement is that OneWallet can now handle cross network transactions. OneWallet customers can now send and receive cash on OneWallet to any other network in Zimbabwe.

- Another improvement is they have adopted the use of agents for deposits and withdrawals as has been done already by market leader, EcoCash.

The old that stayed

- The platform is still powered by Gemalto’s mobile money solution.

- OneWallet SIM cards are supplied by Gemalto, an international digital security company, which offered similar services on the first OneWallet product.

- OneWallet customers still need to swap their current SIM cards and get the 128k SIM to be able to “effectively” transact. ‘Effectively transact’ because customers with their regulars SIM card can still receive cash but will be unable to perform cash-send functions.

Transacting fees

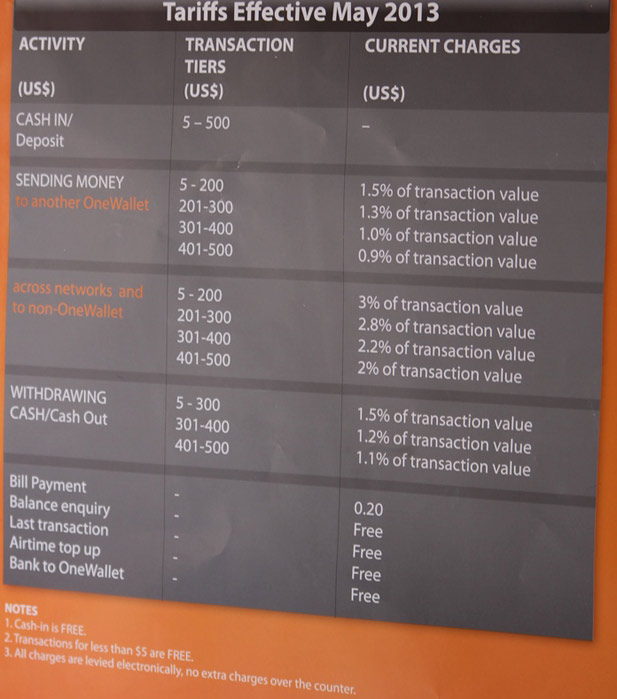

Unlike the market leader EcoCash, that charges specific sums on different tiers, OneWallet charges a percentage of the transaction value, pegged in tiers.

Cash-in is obviously free but what seems confusing is that transactions less than $5 are also free but the minimum that can be sent is $5. So presumably, this means you can buy your airtime and cash out amounts less than $5 for free but sending cash is not free at any level.

NetOne MD, Reward Kangai was quick to highlight the competitiveness of their rates. “NetOne’s OneWallet is going to offer the most attractive tariffs for those transactions. The charges are very reasonable. I can assure you,” he said at the launch.

Well we have the charges for you to judge for yourself. Do you think this new revamped OneWallet can challenge EcoCash’s dominance?

10 comments

You Techzim guys need to stop focusing on what platform the service is built on. As long as the stuff works who cares really? Consumers don’t care if Facebook was written in PHP or COBOL. That whole ‘The platform is still powered by Gemalto’s mobile money solution’ makes it seem as if it’s stupid to do so. Comviva or Gemalto or Mazunzahomwe, we don’t care who makes it, as long as they have security approval and the stuff works. So unless you are going to do a head-to-head between Gemalto and Comviva to show us why we should care, spare us the jargon please.

You are right, too much Jargon, does the relaunch under similar arrangement as EcoCash confirm EcoCash is the king, They saw the light before anyone did? I know Telecel has also photocopied Ecocash by copying even the naming convention “Telecash” that fellow heading their mobile money seem to have copied and pasted everything from EcoCash coz ndoo kwaakabva. There is no need to recreate but there are market perception risks with unwise copying because you may as well be confirming that your competitor is smarter. Tichapfidza nema relaunch gore rino. Mid month Telecash is having its second still birth. Net one and Telecel are like cats with 9 lives, now they are on life number 2!

Econet needs some serious competition

which one is cheaper and in which transaction ranges?

all these innovations will fully benefit clients when Potraz finally effects Number portability or mobility – whatever they call it. Otherwise subscribers are unlikely to switch service providers in search of these deals and lose all their contacts unless they already have dual lines.

Who is NetOne’s banking partner?

Chirau, are you bitter because Eco-cash is based on a cheap platform from India? Technology partner is an important aspect of any product development. Their capacity to support the product, evolve with customers needs and management of full product life cycle cannot be downplayed. African strategy and footprint is also equally important. We can no longer depend on remote account management from the that part of the world. The Comviva office is yet to employ the 4th person in their SA based office as opposed to 300 already supporting the Gemalto African strategy workforce based in JHB, Nigeria, Egypt and Kenya and soon to come in Zimbabwe.

“OneWallet customers still need to swap their current SIM cards and get the 128k SIM to be able to “effectively” transact. ‘Effectively transact’ because customers with their regulars SIM card can still receive cash but will be unable to perform cash-send functions” – good luck at the Police station with your sim swap!

LOL

marketing ye netone kudakwa?..they had real opportunity here with cross-network advantage but eish?