Are crypto-currencies a viable option for mainstream financial services? Will they even gain enough traction to become a bigger thing than they really are?

It’s an exhausted debate, and everyone who has been following Bitcoin will have probably heard most of the points for and against this alternative to real money, and drawn their own conclusions in the process.

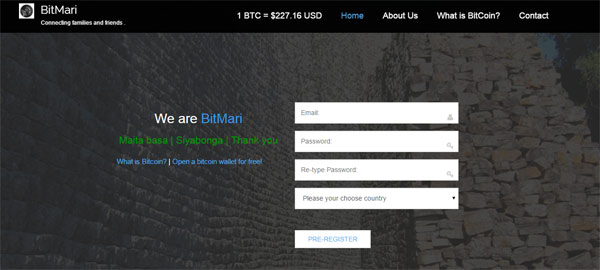

We’ve seen some advocacy for Bitcoin locally as well, and now some people are starting to integrate Bitcoin with other common financial services. Take Bitmari, for example. This is a new Bitcoin-based money remittance service for the Zimbabwe market.

BitMari How it Works

Although the platform is partly operational and signing up users to accounts, it will have its official launch in the next few weeks. Bitmari allows people outside the country to send money to local recipients using the Bitcoin through a Bitcoin wallet like Coinbase.

The startup, founded by Sinclair Skinner, an American Bitcoin Evangelist, Engineer and entrepreneur, also kicked off a £8,000 crowdfunding round on Startjoin.com. This is meant to help raise funds for a remittances licence.

Like other Bitcoin remittance services like rebittance.org, its value proposition lies in lowering costs of remittances, which have been identified as one of the more pressing challenges for the community of people who send money home regularly.

While Bitmari hasn’t displayed any transaction costs, reports on the service have stated that a typical Bitcoin transfer costs 0.0001 bitcoin (BTC) per transaction. That’s insignificant, considering the going rate for Bitcoin right now is $229 for 1 BTC

With a huge Diasporan community supporting the Zimbabwean remittances market, Bitmari is zeroing in on a very solid market. The challenge, however, will be in cultivating trust for cryptocurrencies while going up against traditional remittances services like WorldRemit that have struck partnerships with mobile money providers like EcoCash.

Without looking at the way providers like Western Union, Mukuru and WorldRemit all jumped at mobile money, these sort of arrangements have a lot of merit in Africa because of the strong presence of mobile technology and mobile money services.

To its credit, Bitmari is also working on such a partnership, although details on the exact arrangement and which platform this is with weren’t available when we published this.

If it does gain a lot of momentum, Bitmari just might create a greater awareness for Bitcoin. In a world with exchange rate slips and volatility, another currency option might just be what we need. Just ask any Zimbabwean.

36 comments

“…..In a world with exchange rate slips and volatility…..”. Reason I don’t like BitCoin is it’s volatility. Let’s be honest, the ZAR is by far more stable than BTC especially over long periods. To make maters worse, the BTC market is a US$10 Billion market, with the majority of people holding BTC for speculative purposes. For most Zimbabweans, who are concerned about stability, the US$ is the best option

Actually, the question of volatility is irrelevant in this case. Bitmari locks the price of your bitcoin in the US dollar equivalent the instance you send the money. So neither the sender nor the recipient has to worry about volatility. I will add that, for most of the uses of Bitcoin, the question of volatility is irrelevant when you look at Bitcoins advantages. But of course if you hold Bitcoin for speculative purposes your fingers can get burn. But then again, those people who do that understand the risks and know what they are getting into

My bro Tawanda Kembo a.k.a Bitcoin Evangelist, what you always keep forgetting is that Bitcoin has no central governing banks or authority.

That’s the best thing about Bitcoin. It’ s a free market which has no centre. Fiat currencies are systemically flawed because the government or the bank is the single point of failure that will start printing more money to cause inflation or that will eventually shut down on you before you have a chance to withdraw your money.

Bitcoin takes power from governments and banks gives it back to the people. Where it belongs. Because of technologies like Bitcoin, this world is now a better place.

ofcourse bitcoins hv some dark sides, bt honestly I dnt mind to invest my usd on it as long if it remains stable. these bitmari guys must give us more details about their company because once u send yo bitcoins its over no returns guaranteed unless the receiver decide by him/herself to refund them. bt mind u, are u awre tht u can buy almost anything with bitcoins online? and it cost about 0.05 cent transaction fees (depending with transaction priority) thts cheaper than pay pal!!!

That is exactly the genius of Bitcoin

VaKembo makutinyepera manje, since when bitcoin locks value of coins kumadollars? Let me make this clear Last year I saw my bitcoins sky rocketing from $12 to more than $200 in less than a month , and they started to fall back ( thanks heavens for th big brains , I managed to sign up with web money inorder to exchange my coins to USD. And they credited me $170+) So I dnt knw what u r talking about

I’m not saying that Bitcoin is not volatile. It is. But by locking it’s value I mean that once you convert your bitcoins to US dollars, the value remains locked in that US dollar amount. Let’s use an Alice/Bob example here:

Let’s say Alice is in London and she wants to send Bob $100 in Zimbabwe and she knows she would have to pay $10-$15 in fees if she decided to use Western Union so she decides to use Bitcoin to send the money because it’s way cheaper. She uses the $100 she has to buy $100 worth of Bitcoin. She then uses Bitmari to send the $100 worth of Bitcoin to Bob in Harare. Let’s assume that Bitmari will not charge any transaction fees (& I’m not saying that they don’t). Bitmari receives the $100 worth of Bitcoin from Alice and promise to give Bob $100 USD. If the price of Bitcoin goes up or down after that, Bob still gets the $100 dollars. Alice has transferred the risk of volatility to Bitmari. Alice has locked the value of her Bitcoins.

Now let’s look at an alternative scenario:

If Alice were to send Bitcoins directly to Bob and the price of Bitcoin were to go up before Bob converts the Bitcoins to cash, Bob now has to get worried about volatility. Bitcoin is volatile but we’re seeing a lot of startups coming with solutions to these problems. We didn’t have these solutions when I got into Bitcoin and it’s amazing how the world has become a better place since then.

better place yauri kutaura ndeipi iyi?

I have yet to try Mukuru but WorldRemit is way too expensive to transfer money.

The major problem is that we are using the $US and not our own currency. So if lm to transfer money to Zim, there is not much benefit since you will be sending into a strong currency. Lets say you send money to SA, you get 1 is to 10 rand thereby making you feel like

In that sense, every cent counts so any charges on top of what you are sending becomes an issue.

Coming back to bitcoin, if they can do away with high charges thats a plus. It would be much more easier for people to use if it intergrate with banks plus plastic money.

Tawanda Kembo. Question i have always wondered. How do you get around the regulators in using Bitcoins in Zim? My understanding is that it is not “legal tender” as recognised by our Acts. How then can i transact in Bitcoin when the RBZ may wake up one morning and say “bitcoin transactions are illegal in Zimbabwe? Does a bitcoin startup register with anyone to have the public transaction in bitcoins? Where is the legal protection for both a bitcoin service provider and the public like me?

Dude I’m not a lawyer! And anything I’m going to say here is not legal advice and I would recommend that you first talk to a lawyer. Now that the disclaimer is out of the way, let me tell you what I think:

Firstly, legal tender is anything which is recognised by our legal system as extinguishing the debt when offered as payment. So both the US Dollar and the South Africa Rand are are legal tender in Zimbabwe. If I walk into OK supermarket holding Rands and want to pay, they cannot refuse them. They are legally obliged to accept them because they are legal tender. They can also choose to give me my change in Dollars and whether I want them or not, US dollars extinguish the debt because they are legal tender. Bitcoin is not legal tender in Zimbabwe. The Mozambique Metical is not legal tender in Zimbabwe. The Kenyan Shilling is not legal tender in Zimbabwe. But Bitcoin is not illegal in Zimbabwe. Neither is the Metical or the shilling.

When I am in Mozambique, I don’t say: “I’m not going to use the Metical because the government may make it illegal tomorrow”. Similarly, if I want to do a once-off transaction of sending money across a border for next to nothing it does not make sense to say “I’m not going to use Bitcoin (the fastest, cheapest way to send money across a border) because they government may make it illegal in the future”.

It’s not a huge leap of the imagination to think that the Central Bank may one day say that Bitcoin is illegal but that barn will be very difficult to enforce. In fact the only way it can be enforced will be to shut down the internet first. And to shut down ZESA – because you can now send Bitcoin over SMS. But will they do it? Very unlikely! I’m saying so because I am looking at the precedent. Zimbabwe has the friendliest financial services regulations in the world. A Zimbabwean lawyer, Simbarashe Machiridza wrote a whitepaper on this recently. You can read it here: http://www.slideshare.net/simbarashemachiridza/bitcoin-white-paper?qid=5f038447-f914-4b62-ab45-8f8c470b4d65&v=qf1&b=&from_search=1

Now here’s another thought, if you were to take your iphone to Ximex mall and swap it for two samsung phones, you will have used your phone as a currency. Should the mobile phone be regulated by the Central Bank too? Of course not. That’s because the iphone is not like the conventional, government issued currencies and it has more potential uses than just as a currency. Bitcoin too is like this. It’s useful as a currency but it’s more than a currency. I wrote about this in a blog post last year. He’re the link: http://www.techzim.co.zw/2014/03/bitcoin-just-currency-mtgox-bitcoin/

Third, I think it’s a myth that regulators always want to regulate everything. Regulators are smart and they realise that industries that thrive the most are those where there is less regulation not more of it. A good example is the internet industry. Industries that have been heavily regulated have not developed as fast we have seen the internet industry develop. Think healthcare, financial services, energy, transport, chemical engineering… The challenge for regulators is always, how do we create opportunities for businesses as well as protecting consumers. And with all the potential Economic opportunities Bitcoin creates, it will be a good thing if Bitcoin regulation doesn’t come. At least for now. Humanity is better off with less regulation and not more. But that’s just my opinion

The major issue l see here is trust. I do not trust bitcoin to send money to Zim full stop.

Whoever is behind Bitcoin needs to understand that you cannot force trust on people.

If this bitcoin project is not done out of passionate to make a difference l do not see it alive beyond 2yrs in Zim.

There is no immediate profit to be realised from this to sustain one’s life. Until everymen and women in the streets understand it and be willing to use it, its a hard mountain to climp.

Just as an example, check how the bond coin struggled to be accepted.

from my own experince, the one who holds/manages yo bitcoins wallets is the key. the coin itslef has been accepted world wide. As long if these guys give us their company location its easier to trust them because no one z out there to protect bitcoiners from being scammed. and I can even tell u tht aftr the scammer loots pipo coins ,his transactions will b accepted in the system as long the coins are recognised by miners. dont forget tht bitcoins true purpose is privacy

I do not trust any Zimbo with money transfer from my previous experiences.

Western Union is still working fine for

lol honestly M a bitcoin fan, hope thiz guys will giv us more details about their project otheryz tovazora grizzy. trust me bitcoin z the best, it takes a few seconds to minutes to get yo transactions proccessd (it doesnt matter if the sender is in america and th receiver in zim)

You obviously know by now that I have a bias for Bitcoin (& that I see bitcoins in my wet dreams) but if you have trust issues then Bitcoin is the best currency for you. Because Bitcoin is the first true trustless currency. And I explain at length what that means here: http://qr.ae/qfjKL

Bitcoin is not trustless – the trust is transferred from central banking authority to a nebulous ‘majority’. This gives raise to the “51% attack”, whereby a group/cartel that constitutes 51% of computing power at any time can rewrite the blockchain as they see fit (including reversing other people’s transactions) . This is not a theoretical threat, ghash.io[1] achieved 51% and voluntarily gave it up in 2014.

1. http://arstechnica.com/security/2014/06/bitcoin-security-guarantee-shattered-by-anonymous-miner-with-51-network-power/

“Whoever is behind Bitcoin needs to understand that you cannot force trust on people” – Dude. No one is behind Bitcoin. It’s a completely decentralised system. Bitcoin has no centre. Secondly unlike fiat currencies (ZIMRA forces me to pay my taxes in US dollars. If I refuse I get arrested or they garnish my bank account), Bitcoin is a free market. Everyone who is participating is doing so out of their free will. And Bitcoin has been doing great so far. Check out these statistics:

– The thousands of individual who are (out of their free will) contributing computing power to verify Bitcoin transactions and keep the Bitcoin network secure. The Bitcoin mining network is now over 8 times bigger than 500 of the world’s fastest super computers. Combined! (http://www.geek.com/news/bitcoin-mining-network-8x-faster-than-top-500-super-computers-1554946/)

– The market capitalisation is over US$ 3 Billion. And some people still think that Bitcoin has no value (https://blockchain.info/charts/market-cap)

– The largest recent Bitcoin transaction (culled from the last 50 thousand transactions) was over US$23 million worth of Bitcoin. (https://blockchain.info/largest-recent-transactions)

– Now you’re probably asking how many transactions happen in a day anyway – over 100 thousand Bitcoin transactions have been done today alone (https://blockchain.info/charts/estimated-transaction-volume-usd?timespan=30days&showDataPoints=false&daysAverageString=1&show_header=true&scale=0&address=)

– And those transactions are worth over US$50 milllion (https://blockchain.info/charts/estimated-transaction-volume-usd?timespan=30days&showDataPoints=false&daysAverageString=1&show_header=true&scale=0&address=)

I agree with you however that for most startups there is no immediate profit to be realised but in the last 3 years, Bitcoin has been the fastest growing area of Venture Capitalist funding. At an annualised 151%, it grew faster than even photosharing and space travel (http://www.indiabitcoin.com/bitcoin-is-the-fastest-growing-sector-for-venture-capital-99bitcoins/)

Forgive my optimism passion. I’m just a guy who came back from the future to get some cheap BTC

You are surely not in Zim. XIMEX MALL is long gone… There is metropolitan parking where it used to be our favourite mall

Ximex mall lives on. It’s not the building, it’s the people!!

🙂 I agree! XIMEX mall will live in our hearts and our souls forever.

Started off sceptical about bondcoins myself but the last I heard in combis people prefer them! All we need is to understand how Bitcoin works, use it and the trust will come. We cannot take away the very low cost associated with remittances using Bitcoin. If I had such transactions to make I would not hesitate as that is just moving money. I’m more concerned right now with how an ordinary person in Zimbabwe can get/buy Bitcoin. Maybe light on that Tawanda Kembo?

Let me tell you a story that happened to me last weekend: I went to visit my grandmother. She is a fantastic story teller so I let her do all the talking becasue I enjoy listening to her stories (I have ever since she started telling us nyaya dza Tsuro na Gudo). There was a point when she was telling me about her church and she told me about how a computer was recently donated there. I asked her if there was internet at her church and then she turned back to me and asked me what internet was. Because she is on whatsapp I assumed she knew what the internet was (because she uses it everyday) but that was a wrong assumption. And here is where the story gets exciting. I am a computer science graduate, I started an internet business but I could not explain to my grandmother what internet was. And it’s said that if you cannot explain something to your grandmother then you don’t really understand it.

I got away with it by telling her that the internet is Whatsapp. And I know what you’re thinking now but I don’t even feel guilty because at one point in my life she told me that if I eat water melon seeds then a water melon tree will grow inside my stomach so I think we’re even now.

What’s interesting here is that if I had tried to introduce her to the internet in 1999 (long before technologies like Whatsapp), I would have failed dismally. It’s now easier for everyone else to use internet because we now have innovations such as Whatsapp.

Bitcoin today is like the internet in 1999.

??

Lets just say until bitcoin becomes popular and people enjoy using it without knowing what it is and how it come to be, thus is the time l will do my first trial.

Yes Tawanda, in 1999, if you had told someone that Kodak (remembers those cameras), would be overtaken by your current digital cameras and smartphones

Jn fact, Bitcoins will be used seamlessly, to the extent that people won’t realise that they are using them.

i have dealt with cryptocurrencies on the clearnet and the deepweb and one thing i have found to be the largest hurdle is the conversion of cryptocoins to money. the way in which these coins work puts an enormous risk on bitmari because all it can take is a change in policy in a western nation and the price drrops. plus all the other crypto-coin like doge-coin, dash, anon coin, etc are becoming more popular hence a price drop in bitcoin.

i honestly belive bitmari to be an ExitScam

Do you mean like what we experience during the zim dollar time when people in the know were selling Zim dollars out and keep the US dollars under their beds?

Purizi explain!!

Hi Nigel, thanks for the update. Good luck to Bitmari! Remittances is a very competitive field, and there are no success stories for Bitcoin remittances just yet. Just in the last 2 months, 37Coins and Beam were shut down or pivoted away from Bitcoin.

Hopefully, Bitmari could learn from their experience. You might be also interested in our analysis: https://www.saveonsend.com/blog/bitcoin-money-transfer/

my miss trust of bit coin is precipitated by the recent arrest of BitInstant CEO Charlie Shrem on charges of money laundering in 2013 and Mark Karpeles, CEO of the collapsed MtGox bitcoin exchange, over the loss of nearly $390 million worth of the virtual currency this July. It really makes it seem like a pyramid scheme. Just to ask what happens if i already have bitcoin and decide to send it through Bitmari to a friend, do they accept? if they do how do they handle conversion rates? You say the value of my bitcoin is locked to the currency equivalent that i have deposited but say i deposit $200 and you lock the value of my bitcoin to that and i decide to trade my bitcoin elsewhere on the open virtual market, speculatively say in China where i have discovered a demand in bitcoin.

Hopefully someone from Bitmari will answer your question about locking your $200 deposit but let’s talk about the first part of your comment. Bitinstant was a centralised company being run by individuals who commited a crime. MtGox was a centralised being run by individuals and it went bankrupt. Bitcoin is a decentralised cryptocurrency. I can understand why you would mistrust centralised Bitcoin exchanges but I don’t understand why that would make you mistrust Bitcoin, they decentralised cryptocurrency. It’s like saying that you don’t trust the US dollar anymore because your bank got robbed.

Secondly, Bitcoin is not a pyramid scheme. In fact, Bitcoin is the furthest you can go from a pyramid scheme. In a typical pyramid scheme, the people who start it persuade those who come in to put in their money and promise them that they will profit. Bitcoin doesn’t make any such guarantees. Bitcoin has no central entity. A pyramid scheme is a zero sum game. In a pyramid scheme, early adopters can only profit at the expense of late adopters, and the late adopters always lose. Bitcoin has many possible win-win outcomes. The earliest adopters profited from the rise in value as Bitcoin adoption grew. All adopters benefit from the usefulness of a reliable and widely-accepted decentralised peer-to-peer currency. & currency is just he first app

the pyramid example was to illustrate the it being unregulated and lacking control measures to insure every one plays by the rules. the lack of a third party means who do you go to to recover your money when the other party does not play by the rules? Theft of bitcoin has been documented on numerous occasions. At other times, bitcoin exchanges have shut down, taking their clients’ bitcoins with them. A Wired study published April 2013 showed that 45 percent of bitcoin exchanges end up closing, thus they remind me of pyramid schemes. They is more that’s needed to convince people other than “those guys are not like us”. To me a pyramid scheme is one that is unregulated and a guy with the wallet encryption can just disappear with the wallet, before you ask yes they are banks that where established with short cuts on regulation that fall in this category.

please explain what you mean by centralized and decentralized coz i thought all Bitcoin was decentralized under regulation from FinCEN in 2013?

If I am not mistaken the MtGox issue involved the CEO being suspected of having accessed the exchange’s computer system to falsify data on its outstanding balance that resulted in it going bankrupt. my worry is that i think the reason why trading money is relatively expensive it is regulated and they are cost to insurance etc. if my bank is robbed the security deposit commission compensates me so no worries.According to reports ” In March 2014, a month after filing for bankruptcy, MtGox said it had found 200,000 lost bitcoins.The firm said it found the bitcoins – worth around $116m – in an old digital wallet from 2011.”to me that makes me a skeptic. Further the origins of bitcoin make me a skeptic because when it begun it used a proof-of-work algorithm with cryptography fans who were sending bitcoins for low or no value, having at one point experimented with the idea of Bitcoin mining (i think it’s still happening) i think they is many challenges concerning security. Bitomat,MyBitcoin,Bitcoinica,Bitcoin Savings and Trust,Bitfloor, Instawallet, Flexicoin are other examples of Bitcoin operators losing peoples money and failing to pay them.

These are a few of my personal worries, not saying they is no future in Bitcoin simply saying these are some of the issues that need to be fixed to create confidence.

Bitcoin tends to attract people who tend to view regulation as a bad thing. Lack of regulation also attracts a lot of unscrupulous or downright criminal characters. The irony is that to build trust, the most obvious solution would be a voluntary regulatory body that governs bitcoin exchanges

Personally, I believe this is a great Opportunity for every innovative Zimbabwean to come up with Start ups which will add or trigger local economy in the FinTech.Let’s think outside the box and accept the Fin Tech changes we are been exposed, and use them to solve our everyday problems. Today, we are facing the liquidity problems in our country, and Bitcoin can ease the pain we are facing with. Let’s tell for an example. A university student, needs cash for his topping up his laptop, his phone airtime, buy lunch, transport costs, now with bitcoins he is able to get those services (Ask me on how to do that, using bitcoins). One can generate “mine” those coins from a small investment, and then invest (trade) with them to get a daily profit, of which he meets his daily needs.There is a lot more about bitcoins than to think of negative aspects.

There has been positive stories and success about Bitcoin:

Microsoft now allows you to use it in its app store https://commerce.microsoft.com/PaymentHub/Help/Right?helppagename=CSV_BitcoinHowTo.htm

Some countries have allowed it, some banned it https://en.m.wikipedia.org/wiki/Legality_of_bitcoin_by_country

But when it comes to money transfers, lm not yet sure Bitmari will convince me.

seems we needs a naming committee and convention, I mean first Zimpad and now Bitmari ..they all sound like fake ripoffs of the real thing …we Zimbabweans seriously need to get innovative with product naming in order to create lasting impressions and products