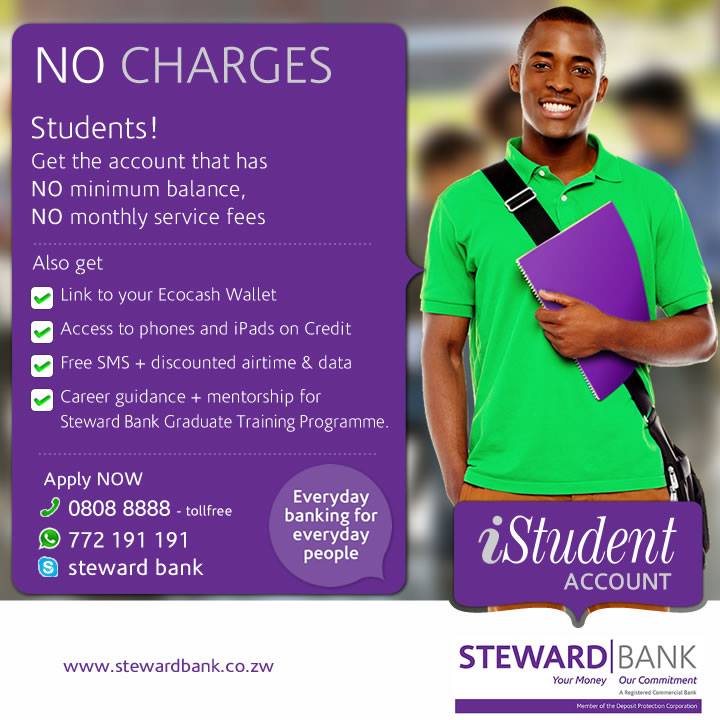

Local financial institution and Econet Wireless subsidiary, Steward Bank, is on a drive to increase its bank market share by offering students from tertiary institutions the chance to pay for an entry level smartphone, the ZTE V795 at $3 a month as an incentive for opening their iStudent account.

According to press adverts, the banks also throws in a free WhatsApp bundles sign-off which is, in fact, just a WhatsApp Lite subscription for one month.

The account is qualified for by students upon necessary confirmation from the tertiary institutions which then allows one to apply for a phone on credit scheme of $3 per month for 24 months, or $6 and $9 for 12 months bringing the cost of the device to about $72. The difference in the packages will mainly be in the extras thrown in, including discounted airtime and data.

The iStudent account in itself is not a topical issue, as most other banks also have a iStudent version of their own. For me the main highlights are threefold: Steward Bank is issuing unsecured loans (credit), complimenting Econet by investing in new markets for telecoms and contributing to the overall smartphone penetration.

The current economy is not conducive for reckless lending, something compounded by the recent labour law changes. These developments ultimately affect the students under the guardianship of employed parents who usually qualify for the bank employer guaranteed or employment contract based loans.

Steward Bank is taking a risk offering a facility which is only secured by the perceived resilience of, and resolve of one to get their degree in spite of financial challenges along the way.

By issuing out phones on loans, the bank has invested in a new market of school leavers for banking and consumption of telecoms products and services. Steward bank has always been distributing devices and this move compliments the practice in a new market most of who did not have cell phones in high school.

There are some 3,000 students enrolled at the University of Zimbabwe yearly and if Steward bank is to offer similar packages at all the tertiary institutions, for all level of students, it might very well have a decent stream of new customers with a predictable deposit pattern of twice a year at every semester start. These same students are most likely to maintain both their accounts and their lines beyond University, depending on their customer experience.

Lastly, Steward Bank is playing its part in improving Zimbabwe’s smartphone penetration, currently around 20%. The ZTE V795 is a basic smartphone and when Econet introduced it, the device was going for $55.

While the device itself might not be the issue here, the entry-level smartphone debate is becoming a focal point even for large companies like Google as they extend their markets. GTel and Astro Mobile have also been offering similar packages which have undoubtedly been modified to incorporate the latest labour changes and state’s Treasury constraints.

One response

Yes. Let’s launch their lives in debt that they wont be able to pay back, given the economic situation

The rest of the world is struggling to get rid of debt and understands how credit has dented the global economy.

Then this wise bank decides to start the lives of these already bleak futures in debt.