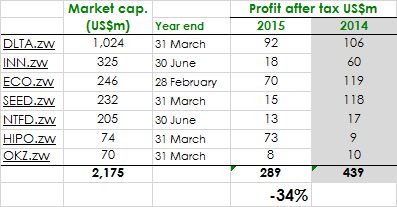

Here’s a table of the Zimbabwe Stock Exchange top listed companies’ earnings over the past 2 years in Zimbabwe. For those companies that have reported their recent earnings, year-on-year earnings are down 34%.

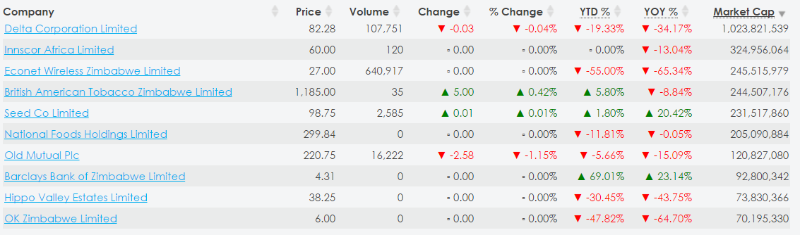

The performance above is reflected in their respective companies’ share prices. Here’s a snapshot of the Zimbabwe Stock Exchange website, top 10 page:-

“Year-on-year earnings are down 34% for top ZSE listed companies. Share prices are down too

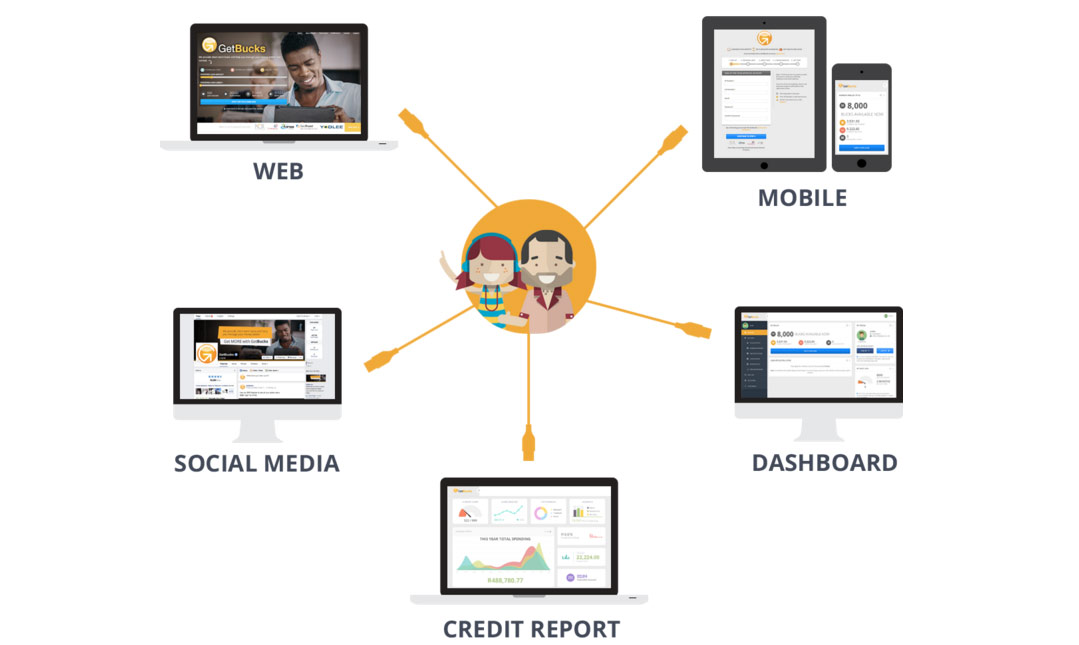

The Zimbabwe economy is collapsing and any company wanting to enter this market and engage investors in an IPO, is going to have to pull out all the stops to raise the money they want. Thankfully with the Internet and social media, getting in touch with investors is easy: the issue then becomes what to say, when and how.

In this article, I provide insights into how the Internet can be used effectively by the GetBucks Zimbabwe IPO announced recently in the Zimbabwe press. If I refer to GetBucks by accident, I am referring to GetBucks Zimbabwe.

Firstly, who is GetBucks Zimbabwe?

About GetBucks Zimbabwe

GetBucks Financial Services Zimbabwe Limited provides salary-backed short-term consumer loans and operates from fifteen (15) branches located throughout Zimbabwe. GetBucks Zimbabwe is 55% owned by GetBucks Limited, a South African-based credit provider to consumers in Malawi, Botswana, Kenya, Zambia, South Africa, Poland, and Zimbabwe. The other 45% is owned by Brainworks: Brainworks Limited is a Mauritius-registered, investment holding, consulting and advisory company, focused on Zimbabwe and select markets in Sub-Saharan-Africa.

The Company has built a diversified portfolio of assets in the Financial Services, Hospitality, Real Estate and Energy Logistics sectors in Zimbabwe.

GetBucks Zimbabwe has grown its loan book to over USD 8 million with over 14,000 customers since it began operating in 2012. On 16 July 2015, the company was granted approval by the Reserve Bank of Zimbabwe to convert its licence to a deposit taking microbank. GetBucks was given up to 6 months to commence deposit taking activities.

“GetBucks Zimbabwe’s vision is to become a leading provider of financial services by leveraging the latest technology to provide innovative and cost effective solutions to a wide customer base in Zimbabwe.

Details of the IPO

The Herald newspaper announced the IPO on 22 October 2015, suggesting that 20% of the company was valued at US$3.7m post the IPO, the equivalent market capitalisation of US$18.5m. The article further states that their loan book stands at US$11.6m and their after-tax profit for the year ending 30 June is US$4.5m (representing a PE ratio of 4.11 times). No details of the IPO have been released formally by Brainworks yet on their website news section and neither has the ZSE formally announced anything as of yet.

Here is a recommended strategy for the GetBucks Zimbabwe IPO to succeed in the challenging environment that Zimbabwe provides:-

No. 1 – Make every effort to ensure that new investors are supported in the establishment of their CSD accounts

The KYC (“Know Your Client”) requirements for setting up trading and settlement accounts in Zimbabwe are as onerous as international markets. Since this is a new phenomenon, it’s important that investors know what to do and get their applications in and approved so that they can buy. Numerous stockbroker websites, theChengetedzai website and the SEC website are valuable sources of investor relations information.

No. 2 – Disseminate the PDF prospectus online as widely as possible

It’s important to spread the GetBucks Zimbabwe investment opportunity as widely as possible online. Here are some ideas on how best to do this:-

- Create an email list of every key investor and stockbroker and send them the prospectus as soon as it is out. Tell recipients that they can contact the Getbucks IPO Investor Relations Officer at any time with queries.

- Ensure that in all media content the link to an online investor relations website

- Disseminate the news via Twitter and Facebook at different times of the day to cater for a global audience for the whole period of the IPO. We all know the diaspora’s influence in supporting local families, why not investing in an IPO

- Re-publish media mentions on social media and point these publications to the website where the information can be found

Note: It’s important to ensure that the PDF prospectus that is sent out digitally does not have an application form attached to it. In the relevant Companies Acts of sub-Saharan countries – provisions for the digital deliveryof prospectuses is not catered for. The intention of the legislation is that an investor is fully informed before applying for shares and this can only be so if they have read a copy of the prospectus. Regulators in African markets (not sure about Zimbabwe) have been concerned that people copy IPO application forms and share them willy-nilly with people that just apply for shares, without fully informing themselves of the investment opportunity and the risks. And without this they are not protected. As they say:-

A fully informed investor, is a fully protected investor

Anyway, just to sure the Getbucks Zimbabwe IPO should ensure that any PDF prospectus should not have an application form attached.

Conversely GetBucks prospectuses and their application forms, need to be widely available through banks and the GetBucks outlets. This raises another spectre, that of costs of hardcopy prospectuses. Not an agenda item in this blog but the sooner that the hardcopy requirements for prospectuses and annual reports are dropped for digital delivery the better.

No. 3 – Monitor what is being said on social media and engage those talking about it

The power of social media to create perceptions in a flash can be a blessing and a curse. As they say “perception is reality”. When it’s the latter, it’s important for GetBucks Zimbabwe to know that they can influence the conversations being held on social media and point people to the correct information (if needed), or engage them directly. A fully comprehensive investor relations website is the educational tool of choice here combined with an online media centre (see below).

There are many specialist social media monitoring tools that can pick up the moment someone mentions “GetBucks IPO” on social media. GetBucks Zimbabwe should subscribe to these tools and monitor closely what’s being said online. This can happen in real time and can, therefore, be an amazing PR monitoring tool.

No. 4 – Set up an online media centre and encourage GetBucks IPO investors (and stakeholders) to register to receive email alerts

Second to the social media monitoring, this is probably the most important thing that the Getbucks Zimbabwe IPO could do. Here are the advantages of setting up an e-mail-driven media centre:-

- GetBucks Zimbabwe creates a direct and immediate communications channel with GetBucks IPO investorsand stakeholders: very important if one has to deal with crisis communications but also very important for another reason….

- Getbucks Zimbabwe creates a database of investors to which it can communicate and receive feedback after the IPO. Being in the industry of creating investor communities for clients, I know how difficult it is for companies to grow a large list of investors that can be used for corporate communications – there are many barriers to doing this effectively – it does not happen fast. BUT, an IPO, with all the interest and the hype, is a fantastic way of doing this, almost overnight.

- The results of the GetBucks IPO can be sent to registrants immediately. In an over-subscribed IPO, people are desperate to know how many shares they received and whether to order more once the company is listed. This interest can act in a company’s interest, commercially, and from an investor relations perspective.

- It drives traffic to comprehensive online investor relations website where investors can research the company in full. Examples of companies with comprehensive investor relations websites in Zimbabwe are:-

Seedco | OK Zimbabwe | Meikles | NMB

No. 4 – Engage the Zimbabwe Stock Exchange to use their website and email alert service to keep investors informed

The Zimbabwe Stock Exchange website is comprehensive and complete and highly functional and enjoys high visibility online. All news and data is published through their Facebook (6,500 fans) and Twitter (3,014 followers) pages too. Whilst the ZSE is a regulator, obtaining visibility on the ZSE’s online platforms and email alerts service, may be a quick and effective way of getting the message out to investors.

No. 5 – Treat every GetBucks IPO shareholder like a prospective GetBucks customer

GetBucks Zimbabwe should target its thousands of customers and present the investment opportunity to them because GetBucks Zimbabwe has their customer contact details in any event.

It’s clear that Brainworks’s listing of GetBucks Zimbabwe has benefits beyond raising the US$3.7m they want to raise. A listing on the ZSE adds credibility, a high level of regulation and visibility. GetBucks’ shareholders are potential customers too.

It’s interesting to note that the origins of good investor relations practices can be traced to major companies like General Foods, Proctor & Gamble, General Motors (GM) and Chrysler, Exxon and Mobil, American Telephone, Gillette and a host of others, particularly those in consumer product industries, targeting shareholders as customers.

Shareholders are a captive market. This is a point that is lost to many listed companies in Africa today.

In 1950, the Ford Motor Co. made a large public offering of its common shares and required its IPO underwriters (the companies mandated to sell the shares) to focus their sales efforts on buyers of 200 shares or less, and provided extra incentives for them to do so.

Ford’s goal was to create a new pool of customers for Ford cars and trucks — and to put themselves on an equal footing with GM and Chrysler, who were long since taking full advantage of their shareholder base to boost sales. The same can and should be said for any listed financial organisation in Zimbabwe.

Back in the old days executives were quick to see, too, that more demand for shares helped push prices up which helped finance growth and was especially helpful in making options or other share-based compensation pay off. Managing an IPO in a challenging environment surely justifies a similar approach.

No. 6 – Keeping the relationship with shareholders going post the IPO

It’s obviously important to keep dialogue going with shareholders after the IPO. Here are 10 recommended online investor relations activities for GetBucks to keep their relationship with their new investors going:-

- send the email registrants at IPO stage (and thereafter) regular news and updates on the company, including the weekly GetBucks share price. This is called “push technology”

- ensure that investor data such as the Getbucks share price is published in social media every day

- ensure that investor presentations and or investor conference calls are also published on the corporate website for all shareholders to access – this important investor relations content should be published as soon as it is available

- ensure that the GetBucks Zimbabwe website has an RSS feed so that global news companies (such as Bloomberg’s) can automatically access news

- ensure the GetBucks Zimbabwe share price is updated daily on its website and preferably ensure that the daily valuation parameters such as the PE Ratio and Price-to-Book-value ratio are updated daily. A share chart is a valuable tool to enable investors see, at a glance, the performance of their investment.

- ensure that all corporate documents and news items are archived on the GetBucks Zimbabwe website for access by any investor at any time.

- ensure that the GetBucks Zimbabwe business model is well described and clearly illustrated on the GetBucks Zimbabwe website – the micro-loans business can be very profitable – it will be important to explain to investors on an ongoing basis the performance of GetBucks Zimbabwe in the current economic environment. Zimbabwe’s economic situation will not persist forever – and so it’s important for GetBucks Zimbabwe that this long-term value proposition is articulated consistently and persistently so investors invest for the long term.

No. 7 – Ensure the GetBucks website and the investor information on it, is mobile friendly

I’ve analysed our top client websites and between 30 and 50% of website visits to them are from mobile devices. That’s between 1 in 2, or 1 in 3 visits from a mobile device. Internationally over 80% of visits are from mobile devices.

If investor and company information is to be published online, then ensuring easy and quick access by mobile devices must be a priority for GetBucks Zimbabwe.

No. 8 – Make sure the prospectus is written in a way that the man in the street can understand

Lastly, i’ve noticed that many prospectuses are presented like highly technical documents that the ordinary man in the street cannot easily read. Yes, I understand that a prospectus is a technical and a regulatory one, but it ispossible to present the investment opportunity in an easily readable format. I am reminded of the definition of investor relations, which underpins my recommendation:-

“Investor relations is a strategic management responsibility that integrates finance, communication, marketing and securities law compliance to enable the most effective two-way communication between a company, the financial community, and other constituencies, which ultimately contributes to a company’s securities achieving fair valuation.”

(Adopted by the NIRI Board of Directors, March 2003.)

This article is a guest post authored by Rob Stangroom, the CEO Big Law Management Consultants. The article first appeared on AfricanSENS.

17 comments

Actually, the first thing that they need is a properly functioning website

Informative article.

Is this a sponsored article? If so, you should clearly indicate that. The article is generic, I could easiliy replace “GetBucks Zimbabwe” with another company’s name, and it wouldn’t make a difference to the reader. Raising the question why you chose to focus on “GetBucks Zimbabwe”.

Not sponsored. See these for examples of sponsored articles on Techzim:

http://www.techzim.co.zw/laptop-deal/

http://www.techzim.co.zw/every-persons-constant-fear-lose-critical-data-anytime-not-paranoid/

So, why is it GetBucks specific? It could have been titled “How to use the Internet to boost your startup/company”. Because that is what the article is actually about. There’s nothing in there that is specific to GetBucks as a company.

You’re right on the 8 thing themselves. Having GetBucks in the title is for the GetBucks listing and how that can be assisted by the internet. ZSE and GetBucks information is about 20% of the article so article can’t have a generic “startup/company” title

Yes. Repetition of the name “GetBucks Zimbabwe” accounts for 20% of your article.

really?

Wow… IPOing when there’s blood on the streets. these guys are smart going after the one business that thrives seriously when liquidity in an economy is low.

Thanks very informative article. I am quite impressed to see an IPO for consumer credit in Zimbabwe u work for consumer lending business in Aus and I am wondering how these guys will make their money. How are people going to pay back interest when they don’t have money? I need note info but I am keen to buy a few shares for the IPO to learn this business model in Zimbabwe. I’m curious!!

They are salary based short term loans. i think for people that have to borrow to pay for their monthly expenses or stuff like school fees, a new phone, a TV…. Pay back when salaries hit the account – and then borrow again.

yah, I am aware that they are salary based lenders, I had a look at their business. I work for a similar company check cashtrain.com.au I am wondering what percentage of salary earners we have in our country. In Australia people earn consistent salaries, now I’m wondering how Get bucks will do this when very small percentage in Zim are employed and earning consistent salary. I am running on old statistics that Zim has an unemployment rate that is over 70%. generally this business, relies so much on people that get paid into bank accounts not cash in hand or inconsistent salary. How do u think they will succeed?

I think they rely a lot on civil servants – teachers, police, soldiers etc… – whose numbers have likely remained the same over the years despite high unemployment in other sectors. That said I don’t thin Zimbabwe is their biggest market right now or will be in the short-medium terms, hence what I think is a modest annual profit of $4.5M for a company in their business or the targeted US$3.7M IPO

Sure Zimbabwe will most likely not be the biggest market, but its interesting what you say and how you have predicted the$ 4.5m profit potential. I think they will do well none the less otherwise they wouldn’t be going for Zim if that wasn’t the case. Do you think this business will help bring some liquidity into the macro economy of Zimbabwe, considering that Zimbabwe is not very liquid at the moment. And if I would like to follow up on applying for shares in the IPO, where can I go for updates and forms. Apart from getting the news here on techzim.

Sorry I meant the micro economy. Will it help make up for a part of the liquidity needs pf the country.

Didn’t predict the $4.5M. That’s “their after-tax profit for the year ending 30 June is US$4.5m” – see in article.

On GetBucks’ contribution to liquidity I’m not sure. From the little I see about such a business (I’m not informed much on it) they mainly bridge a salary gap for civil servants. I don’t see how this bridging increases liquidity overall. it may do so in the short term, that is 30 days short. In the long term the recipient of the credit is paying more for the goods the are buying (salary based means it’s for consumption and not revenue generation) so they are worse off – they can’t save and not being able to hurts the economy.

Also these loans being non-revenue generators (this is an assumption – I may be wrong about how recipients use the money) means there’s no growth in income for the recipient or their family – just advance consumption.

Ok that’s interesting to know. So I want to know where I can go to get more IPO information? For this particular one. Any offices in Harare? Or should I call them