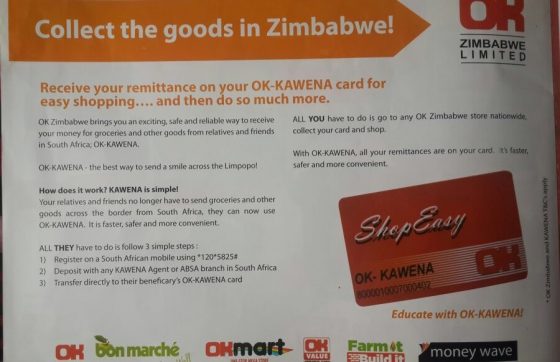

OK Zimbabwe Limited which runs some of the country’s most popular retail outlets (OK, Bon Marche and OK Mart) recently re-launched its remittance service OK-KAWENA in partnership with KAWENA, a South African distribution company.

According to KAWENA’s website, the main concept behind the partnership is that Zimbabweans living in South Africa could transfer money directly to a beneficiaries e-wallet in Zimbabwe, the beneficiary can then use their OK-KAWENA card at any OK Zimbabwe Ltd. retail outlet to buy their groceries.

How Does it Work?

The sender in South Africa has to follow three steps to register for the service which includes:

- Registering on a South African mobile using *120*5825# (on any SA mobile network)

- Depositing the grocery money at any KAWENA agent or ABSA Bank branch in South Africa

- Transferring the money directly into the recipients OK-Kawena card

What’s the catch?

We had a look at the OK-Kawena Terms and Conditions and found some interesting points:

- The Shop Easy card may only be used to purchase goods and services: – from any OK Zimbabwe stores (including OK, Bon Marche, I-tech and OK Mart) by the Cardholder whose name is on the card, in the presentation of the Shop Easy card and positive national ID if the signature on the card corresponds to the customer’s signature and provided there is enough credit balance on the account

- Once registration is complete the OK Shop Easy card is issued with a unique card number. No transactions will be allowed at OK Zimbabwe stores or OK Zimbabwe affiliates without the OK Shop Easy card.

- The daily deposit limit is ZAR 3,000 and monthly deposit limit is ZAR 10,000 per customer and not per account. However, daily limits may be amended by Kawena.

- The E-wallets will be in ZAR (Rand), transfers will be in ZAR and at the time of transacting in OK Zimbabwe it will be converted to USD

- All accounts will be in Rands (ZAR) and will be converted to United States Dollars (USD) at the time of the transaction depending on availability of currency ( we guess that means in Bond Note)

- A maximum withdrawal limit of $250.00 per day or $2500.00 per month can be transacted at any OK stores. Depended on the availability of currency.

Why now?

With the introduction of Bond Notes and the Diaspora Remittances Incentives Scheme (DRIS) by the RBZ, the OK-KAWENA remittance service got a new lease of life on an otherwise shelved project.

The DRIS gives a 5% export incentive, 2% to the service providers and 3% to the recipient, making the idea of remitting money back home through formal channels more attractive. With this scheme in lace OK Zimbabwe has seen an open opportunity te re-launch their product which according to feedback from customers we read, failed dismally back in 2013.

Also, it is in OK Zimbabwe’s interesting to kee some money in South Africa to purchase its imported goods in case things go south with the RBZ ability to make foreign currency payments.

Will it work?

OK Zimbabwe has a large client base in Zimbabwe and when matched with the estimated 2 million Zimbabweans living in South Africa they are bound to find quite a few customers interested in the service.

However, their past attempt at remittances did not go down well with customers complaining that the transfers took over a week to reflect in the beneficiary accounts, rude shop attendants when inquiries were made, failure to get through to customer support and a whole host of issues relating to service delivery.

If OK Zimbabwe has been able to fix the reported issues and not just re-launched the service through marketing it could work, we don’t expect it to blow the competition out the water but they could attract a relatively small market which may grow depending on the economic situation in Zimbabwe.

4 comments

I don’t think businesses really understand the harm that comes with rude staff. Thanks for raising that.

It’s very speculative, trying to link the revival of the service to the 5 rbz incentive. It’s not a fact, rather it is an assumption or opinion.

Remittance services are now being pushed hard, e.g, Steward bank partners with 6 services, to allow the local partner to build up forex reserves OUTSIDE Zimbabwe which eases their ability to import supplies and settle outside debt, without dealing with local red tape.

can’t register.get cut off continuosly.need help.

It simply failed because they stopped caring or/ and had accumulated enough rands. So they started charging 30 per cent grocery plus charges effectively taking a big chunk of your money.

Will it succeed again? Well that depends on the competition which takes us back to good customer service.