Earlier this week President Mugabe gazetted Statutory Instrument 133 of 2016 providing the necessary legal framework for the “legal” introduction of bond notes as accepted legal tender in Zimbabwe.

Following the gazetting of the SI, Zimbabwean Banks have now started to amend its client terms and conditions in a move that looks to protect themselves against any if not all legal liability in the Bond Note era.

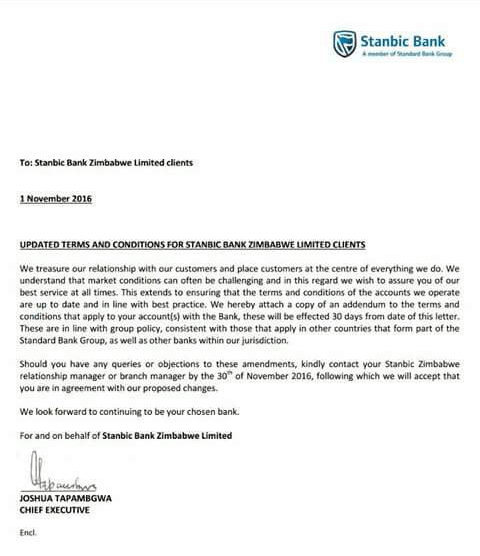

Stanbic Bank is the first bank to publicly introduce the new terms and conditions in a letter to all its clients dated 1 November 2016. Below is the communication between Stanbic and its clients:

Stanbic Bank may have been the first to publicly inform its clients but we expect more banks to follow suit in the next few days. If your bank has not communicated it is advisable to contact them directly for an update on your terms and conditions. Stanbic quite interestingly offered its clients room to object to its new conditions by 30 November 2016 but did not offer information on the course of action thereafter.

Here is the full extract of the extensions made to Stanbic Bank client terms and conditions:

ADDENDUM TO GENERAL TERMS AND CONDITIONS APPLICABLE TO ALL LOANS, OVERDRAFTS, AND ALL OTHER BANKING FACILITIES OFFERED BY STANBIC BANK ZIMBABWE LIMITED PAGE 7B SECTION 10 (continued)

16. Withdrawals Availability — [You, the Client, the depositor] acknowledge that a deposit, regardless of the currency of such deposit, may not be immediately available for withdrawal by you. The withdrawal of funds from the account(s), regardless of the currency of such deposit or the currency of the funds withdrawal request, is not unconditional and may be delayed and subject to:

(i) the availability of such currency notes; and/or

(ii) any interruption, interception or suspension to the banking system; and/or

(iii) compulsion by any authority to apply or convert the proceeds of deposits to other asset classes or currencies which may not be freely exchangeable, redeemable, convertible, negotiable or otherwise immediately available for withdrawal by you. In addition, the Bank shall be entitled to impose withdrawal limitations or restrictions and may from time to time impose requirements for prior written notification of your intention to make a withdrawal. Payment in legal tender recognised in Zimbabwe – The Bank reserves the right to pay funds in one or more other currency or currency unit recognised at that time as legal tender. Any conversion from one currency or currency unit to another shall be at the rate of exchange quoted by the Bank alternatively, if such rate of exchange is not quoted by the Bank, then the rate of exchange shall be the official rate of exchange recognised by the Reserve Bank of Zimbabwe for the conversion of that currency or currency unit into the other. Limitation on liability – You agree that neither the Bank nor any of its affiliates shall be liable for any cost, loss, liability, expense or damages (special or otherwise) suffered by you or a third party which arises directly or indirectly from any action or omission by the Bank pursuant to the terms of these provisions. You assume all risks associated with the availability of currency notes and the conversion of currency exchange.

17. Counter terrorism financing, anti-money laundering i. To comply with anti-money laundering laws, counter financing of terrorism laws, regulations and policies, including our policies, and any restrictions given by a competent authority, reporting requirements under financial transactions legislation and request of authorities, the Bank may be:

a. Prohibited from entering or concluding transactions or maintaining relationships involving certain persons or entities or required to report suspicious transactions to an authority; and

b. Transactions impacted include those that may:

1. Involve the provision of finance to any person involved or suspected of involvement in terrorism or any terrorist act;

2. Be relevant to investigation of an actual or attempted evasion of tax law, investigation of or prosecution of a person for an offence against any applicable law. ii. The Bank may intercept and investigate any payment messages and other information or communications sent to or by you or on your behalf and may delay, block or refuse to make any payment and payment screening may cause a delay in processing certain information.

iii. The Bank is not liable for any loss arising out of any action taken or any delay or failure by us in performing any of its duties or other obligations, caused in whole or in part by any step taken as set out above.

18. General

The Bank may at any time amend these terms and conditions subject to giving 30 days written notice. Any amendments will not constitute a cancellation of the Agreement.

1 November 2016

We are yet to see if these amendments will extend to fin-tech and mobile money platforms. Statements and amendments like these usually hint at a lack of confidence in the banking sector.

4 comments

It seems there is no option of withdrawing in USD?

kubva tambirisei mumaoko mariyacho

Shm

You will need your head examined if you deposit any USD currency into your bank after this. This points only to one thing, the USD will be trading at a premium very quickly, and the bond notes will not last.