The most annoying problem for businesses and customers when dealing with US Dollars is that of change. We’ve all experienced this, ‘for your 50c change shall I give you water or add some toppings?’ InnBucks aims to solve this problem and more for all Simbisa Brands chains i.e Chicken Inn, Bakers Inn, Pizza Inn and Creamy Inn.

Their marketing material mentions those four brands only but their customer service staff includes Steers, Nandos and so on.

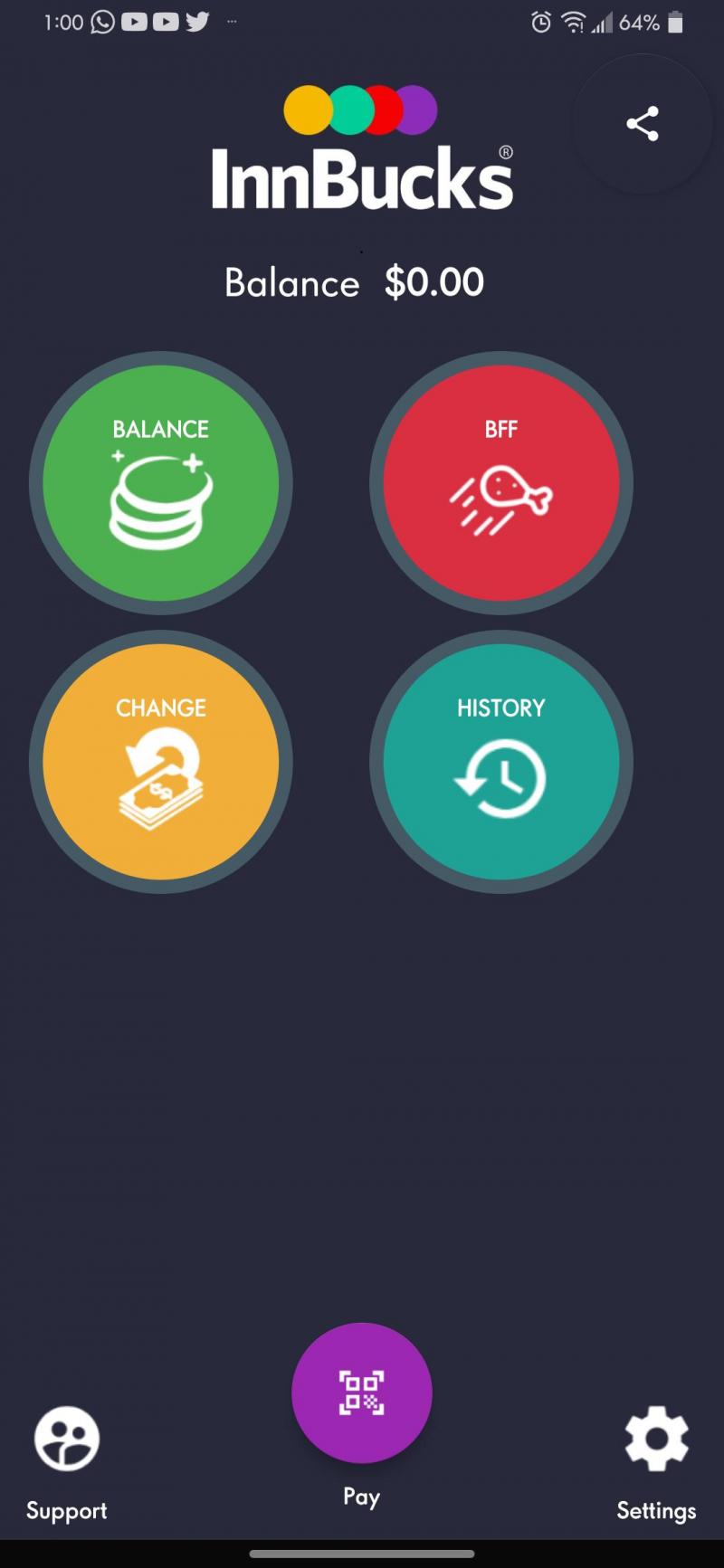

InnBucks as a loyalty and rewards program

InnBucks is a loyalty and rewards program. It is the Wafaya for local residents. If a user signs up for the service they can expect:

- discounts of at least 1% off every purchase

- regular exclusive ‘VIP’ specials, which are special prices for participants

- rewards for every purchase, i.e. points for loyalty to Simbisa brands which can eventually be enough to purchase a meal

The mini bank features

That is in addition to the the convenience of the mini bank they are offering where:

- You can deposit up to US$200 into your InnBucks account

- That cash can be withdrawn from the account

- You can purchase in store with that money

- You can pay for others. They call it BFF, Buy For Friend.

- You can store your change in the account, instead of being forced to spend it on what you don’t want

- There are no transaction charges for all these services

Although there are no transaction fees, users should note that if the InnBucks account is inactive for 2 months, they will start charging US$1 per month to maintain the account. They will deduct that US$1 per month until the account balance reaches zero.

If you decide the service is not for you, it is not as easy as deleting the app. Per the terms and conditions, you will have to contact them via email at admin@innbucks.co.zw. This is no doubt meant to lock users in. I hope it is oversight in writing the terms and that easier ways to terminate accounts will be available.

Users can join in the fun by downloading the app from the Google Play Store or Apple’s App Store. Those without smartphones are not left behind, they can dial *569# and register that way.

The app is fun and designed well. Although the terms and conditions reveal that it was probably a white label application developed in iOS first markets. Some marketed features, like the store locator will be coming in future updates.

Why do InnBucks exist?

Like all loyalty and reward programs this one is meant to improve sales and lock in customers. Specifically though, InnBucks are meant to increase USD sales. You will note that you can only top up your InnBucks account with USD, not RTGS$. All this no transaction fees business is meant to remove any barriers to users joining. Fair play methinks.

They might as well go all out to attract more USD through sales because they are not getting anything from the forex auction. They do not apply by virtue of having USD inflows daily. However, some of their sales are still in RTGS$ and they need to secure the value of that money.

Going to the parallel market is illegal and impractical and so the strategy is to de-incentivise customers from using RTGS$ in the first place. In keeping with that, InnBucks will incentivise USD use. Hence the promise that, “A user’s USD cash will remain as USD cash.”

Simbisa was in a bit of bother recently when their invoices showed they were valuing US$1 at ZWL$200 at Bakers Inn outlets. The government insists that the auction rate should be used and so is investigating that.

That government directive complicates things as using a 1:87 rate would just lead to most sales being made via RTGS$. To ensure the RTGS$ amount is respectable whilst maintaining the 1:87 the USD price would have to be increased. Which would reduce USD sales. Tough spot to be in.

The InnBucks as a currency

A currency is a medium of exchange for goods and services. The InnBuck qualifies as it can be exchanged for food at Simbisa branches. At launch 1 InnBuck = US$1. The InnBuck is therefore more valuable than the RTGS$ at this moment.

The fact that you can send your InnBucks to a friend means it is as good as sending USD but without transaction fees to worry about. It is the cheapest way to send US$200 within Zimbabwe right now. This could shake up domestic remittances if only the InnBucks were accepted at more locations other than Simbisa branches.

The InnBuck is only ‘legal’ tender at Simbisa branches. However, just like we saw with fuel vouchers , if the InnBuck becomes popular, it can be used as a medium of payment in other circles.

The key is that the InnBucks can always be converted to USD cash at one of the hundreds of Simbisa branches. If customers find that service to be reliable, I believe the InnBuck will have utility as a currency, regardless of whether the holder actually wants deep fried chicken.

That is because there are always thousands of Zimbabweans everyday who will want that chicken and so the InnBucks retain their value.

In closing

Finance history buffs will remember how cigarettes were essentially currency in hyperinflation ravaged Germany 100 years ago. Non smokers held them as currency and traded with them.

In the end, the chicken-backed InnBucks are better than fiat currencies like the RTGS$ and even the USD which are backed by thin air. Fast food fan or not, the InnBucks should have utility for most.

With that said, it will be interesting to see how the regulators respond when the InnBuck gains popularity and increases in usage. I hope there won’t be any cease and desist orders exchanging hands.

26 comments

l have 2k usd worth of zash and want to buy other cypto currencies which exchange should i use ?

LOL its sad we got people who still fall for these ponzi schemes

He was being sarcastic

Its a good idea but i feel like it should also include all of Simbisa Stores such as gains because it will make life a lot more easier for us.

Truth be told. The regulator and finance ministry is coming to them with Finance act. Zvavari kuita is illegal. Imagine said Starbucks yaidaro. They will be the biggest bank. Kan Facebook libra yakarambidzwa muno EcoCash is regulated what more innbucks, does it have a licence to do that. In actual fact kuita inter remittance like city Hopper and what banks are now doing panotodiwa rezinesi. Apa they are trying their luck chete. Izvi hazviite

Now we are in 2023.

It’s working.

how much do they charge to tranfer money form my account to BFF

how much do they charge to tranfer money form my account to BFF

People getting very desparate,

1 % what ?

Hello hie, this is the fifth time trying to reach out but iiiii. I lost my innbucks pin. How best can I regain it back so that I can use my money

What are the charges of sending $200 USD …and also how much is charged to the one receiving the money

I

My inn bucks is saying transfer failed exceeds maximum limit

I forgot my pin. How do l access it?

I forgot my pin .how do i access it?

Which are the details needed when sending someone money

i forgot my pin how do i access it

I made a mistake typing my ID when I was registering. What should I do?

You jus lose the money

i fogotot my password how do i reset

They should make it easy to do a P2P transfer, thank you.

I lost my pin how do i access it

I lost my pin how do I recover it

I lost my pin with the lost phone. Can’t remember my pin coz l never changed it.

You jus lose your money

Whats the minimim cash in

How do I delet my innbucks account