What do you do when you realise you have a talent and you’re underutilising it? You share it with the world – that’s what. That’s what NMB is doing with its tech department, setting it up as a separate company called Xplug.

They say they realised they had a competent team that had been developing bespoke tech solutions for the bank for years. According to them, they recognized that no one on the market could have created those solutions for them.

Locally, NMB says they saw a gap in the tech development space, there aren’t really any serious tech solution providers in their reckoning. I know a few people who won’t agree with this.

Internationally, they saw overpriced and non-custom solutions that ended up tweaked so heavily as to look virtually indistinguishable from the original.

That’s when the idea came. What if this competent-according-to-them team could offer similar services to other organisations? What if NMB’s tech department could lend its skills to the rest of Zimbabwe, and Africa too?

Xplug

Xplug Technology services is a subsidiary of the NMBZ Holding Group. Our main thrust is to use technology to transform any size of business in the business sector into achieving business growth, agility and composability.

That’s what Xplug was made to be. They say “As long you can name it, we can build it.” That’s limited to end-to-end technology solutions though, they won’t build statues for you.

This end-to-end tech solution business simply means Xplug will handle all of a system’s hardware and software, including installation, implementation, and maintenance.

A good example of what is being talked about here is the work they did for their sister (mother?) bank, you know, back when they were just a department within the bank.

Work for NMB Bank

They built a digital banking omnichannel banking solution for NMB Bank which they say is focused on customer service. Their solution has the following channels; USSD, a mobile application, web-based Internet Banking, and a Branch Service Portal.

It has bill payments and also allows customers to open full KYC accounts remotely.

They also say were able to reduce the time required to configure, test and deploy software solutions in the process.

I think you get a picture of what they are talking about. What you may be asking yourself is, ‘Don’t all banks have almost all of that? What’s special about that?’

The deal is, in NMB’s case, their solution was built from the ground up with NMB and NMB only’s needs in mind. So, it was cheaper to acquire (develop) than some other banks’ solutions. That’s not even mentioning how the solution is lean and light as it does not include any unnecessary features.

We know for a fact that some banks are saddled with complex solutions that are expensive to maintain as they were developed by foreign companies. On top of that, they only use a fraction of what the software packs as they are not custom-made for them. Or it could be that the custom jobs were not done that well.

So, it is banks and other businesses with expensive to maintain and yet not-custom-enough solutions that Xplug is looking to serve. Or those who don’t have the ability to develop the systems that they know they need.

Xplug already has foreign clients

Xplug already has clients. You will recall that this was an NMB department before and so while it’s being launched now, it has technically been in existence for years. That’s why a company that was launched yesterday already has clients.

Most of their clients are foreign at the moment and only a few are local.

They have gotten digital transformation consultancy gigs for clients in Tanzania, Zambia, Mozambique and a few other countries. Most of the businesses they are working with right now are in the financial services sector but Xplug will work with any business.

Xplug says they are interested in all businesses, however small. So, if you feel you have need for services like these, don’t tyira kure, talk to them. One client of theirs engaged them in a deal where they pay for their solution as they use it. They didn’t have to empty their piggy bank at the start.

My 2 cents

Xplug sounds like a good idea. We have spoken to many startups and executives in larger, established businesses and we often hear complaints that getting good developers is a challenge.

That’s for many reasons by the way. Some of it comes from the economics at play in Zimbabwe and how local salaries cannot match those in other countries, leading to the good ones leaving the country or working remotely for foreign companies.

Whatever the reason, I think many companies would benefit from what Xplug is offering.

Just how good are the Xplug developers though? Well, you can look at the NMB suite of tech solutions and make your own judgement. I guess you will also have to look at what they are doing for those foreign companies too.

One company in the financial services sector in Zimbabwe employed Xplug to develop an omnichannel digital banking solution from scratch and is apparently happy with what they got.

The Xplug team says it was a custom job and not a repurposing of the NMB solution and so you won’t be able to tell which organisation it is they did the job for.

That’s something there. You can look into it further and see what else Xplug has done here.

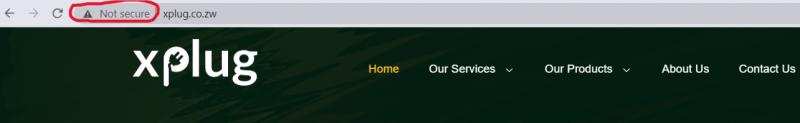

Personally, I have enjoyed the NMB Connect app for years. Don’t know what that’s worth. I leave you with this screenshot of the Xplug website though:

That’s it. I am curious to know what you think of this. Do leave a comment if you have something to say.

Also read:

NMB Connect says give up your location or no banking for you. What’s that all about?

NMB on a security mission, finally deactivates magnetic stripe cards

NMB Remit joins crowded domestic remittance market, can it make a mark?

What’s your take?