The term “credit is king” is one that I have bandied about over the last year or so because as we wade through Zimbabwe’s never-ending economic struggles, lines of credit are valuable in order to make moves in this fast-moving digital age. Now, traditionally one would go to a bank or a microfinance institution to get credit but the process is friction-filled and is far removed from the digital touchpoints we have grown accustomed to during the pandemic. Well, there is a new app called InstaCash that has an interesting twist on loans or credit.

Peer-to-peer loans

InstaCash is a peer-to-peer lending platform or simply you can lend and borrow money from anyone in your contacts on the app. Getting started is really easy, all you need to do is to download the application from the Play Store (link here). After that you’ll need to enter:

- Phone number to validate the install with a One-Time Pin (OTP)

- Name, surname and ID number

- Set a pin

You’ll then have to allow a couple of permissions, one for your SMS and the other for your contacts. These permissions are to allow the app to invite someone you know so you can lend or borrow money through InstaCash peer-to-peer.

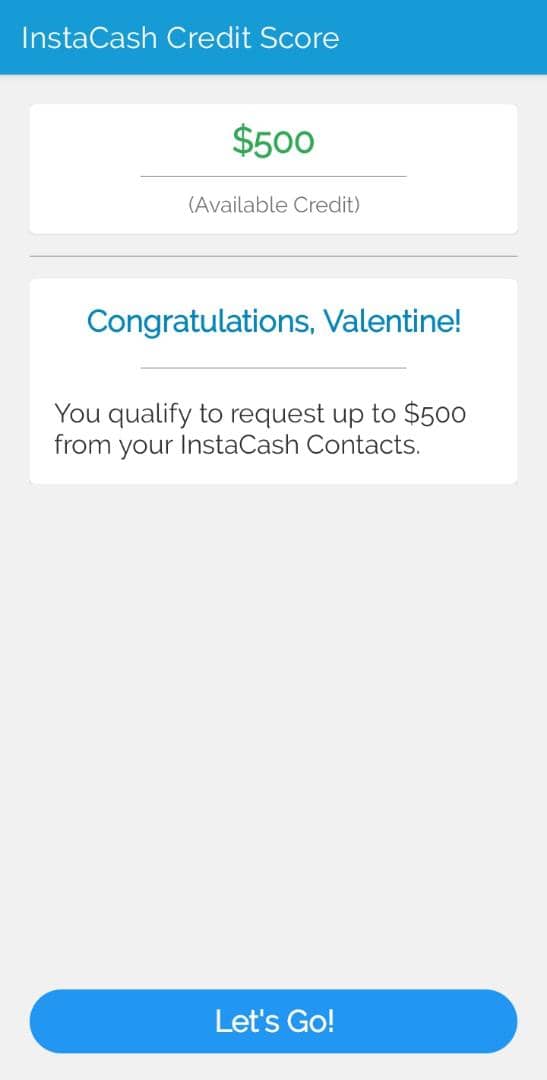

When all of that is done, InstaCash will then give you what credit is available to you. This is part of the application’s credit score feature and since I am a new user ZW$500.00 might be what it will allow me for now.

After hitting “Let’s Go!”, you’ll then be transported to your dashboard which has a tab for requesting funds and lending funds and this is where things get interesting.

Setting your own terms as a borrower

You can ask for a loan up to the amount which is available to you at that time or depending on your score. The cool thing about this is that you can set the pay back time as well as the interest that you will pay. The slider for interest starts at 10%, while the loan repayment time is up to a year.

“Borrowers can offer to pay a minimum of 5% APR and a maximum of 30% APR when requesting a loan.”

InstaCash App Description

To receive the funds you’ll need to set an account. InstaCash covers a number of banks as well as mobile money and KYC lite accounts.

| Banks | Microfinance Institutions (MFI) | Mobile Money |

| Africa Century | GetBucks | EcoCash |

| AgriBank | EmpowerBank | OneMoney |

| BancABC | Telecash | |

| CABS | ||

| CBZ | ||

| EcoBank | ||

| FBC Bank & Building Society | ||

| First Capital | ||

| MyCash | ||

| NBS | ||

| Nedbank | ||

| NMB | ||

| POSB | ||

| Stanbic Bank | ||

| Standard Chartered | ||

| Steward Bank | ||

| Success Bank | ||

| ZB Bank |

To set your bank you’ll need to enter your financial services provider, branch and account number.

Lending to your contacts

InstaCash has an invite feature where you can bring in any of your contacts. If you have an arrangement with someone then you can use this app as a go-between in the deal. InstaCash can be particularly useful if you want to make your money work for you. However, the limitation might be doing this initially with people you trust and know. The old “grab and dash” is common in these parts even if you have to enter your personal details in the app.

Aside from my apprehension, the folks over at InstaCash have included features that will keep your creditors abreast of their obligation:

- Contact borrowers directly when following up payments

- Send automatic reminders to borrowers

- Limit your portfolio to trusted contacts

- Get notified when repayments are made

The maximum that you can borrow at a time is ZWL$20,000 but that depends on your score.

What’s your take?