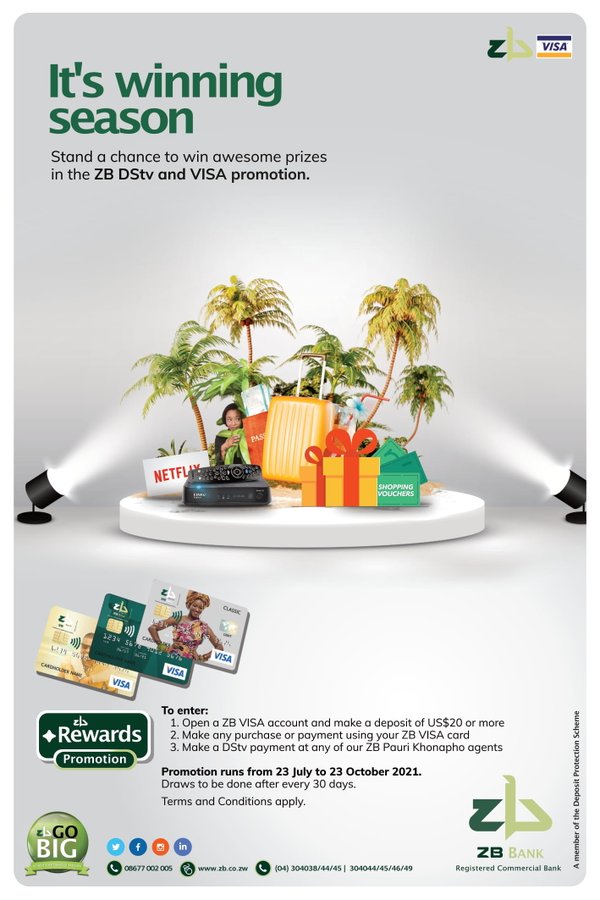

A few weeks ago we wrote about BancABC’s latest prepaid Visa promotion where you stand a chance to win a Chicken Hut meal if you order their prepaid Visa via Branch X. Now it seems ZB has entered the fray with their own promo as the scramble for customers heats up.

Don’t look at me like that. Even I didn’t know that ZB bank has a prepaid Visa card. When it comes to prepaid cards the names we usually think of are FBC’s MasterCard, BancABC’s prepaid Visa, Stewward’s prepaid Visa, CABS’s prepaid MasterCard and Ecobank’s prepaid Visa. So I have to say ZB bank has already succeeded with their promotion and more people including me now know they have their own prepaid Visa.

Are these promotions worth it

As already said almost every bank with a prepaid card is running some sort of promotion. We have already mentioned BancABC’s rather unconventional promotion but they have had plenty of promotions in the past including one where they would pay for your Spotify or Apple music. Steward has a competition where you stand to win as much as US$3 000 if you spend $20 or more using your Steward Prepaid Visa.

The question I have is that is this worth it? How many customers are these banks even fighting for? Do people really change their cards based on what promotions banks are offering? Personally, none of the promotions have tempted me to make the switch. Have you dear reader been tempted to make the switch based on what promotion a bank is offering? If so let us know in the comments.

It’s hard to gauge how big the prepaid Visa/MasterCard market is. One thing I should mention is that most Visa/MasterCards in Zimbabwe are prepaid. If you want to make a quick international transaction this is the easiest way to do so. The alternative is to open a Nostro account and wait for about 10 or so days in order to get a card linked to that account. It’s an option most people do not go for.

As for the effectiveness of these promotions, it’s hard to tell whether they are achieving their goals or not. One is tempted to conclude they’re effective otherwise banks like BancABC wouldn’t be doing one promotion after another. Besides these promotions come with different aims. Some are meant to make current customers spend more while others are meant to spread awareness. Take for example the ZB promotions. It has made us aware of ZB’s prepaid Visa. I and probably a lot of other people didn’t know this. So that’s a tick in their book.

For me though the thing that matters for me most when it comes to choosing a card is not some promotion. It’s the fees and features that are on offer. Normally I look for the following:

- What are the transaction fees involved?

- Can I withdraw cash from the card?

- How easy is it to check the card’s balance? Some cards require you to email customer care in order to get the balance/ statement. That’s just ridiculous in my book.

- What are the card’s limits e.g. withdrawal and payment limits?

- How easy is it to get the card?

- Are you charged to reload the card?

- Does the card come with an app?

- How many online services accept the card? The Ecocash prepaid card has been an utter dissapointment in this regard.

- How easy is it to reload the card? Some banks have fewer branches while others allow you to walk into a supermarket and reload there.

These rather than promotions are the things are I consider. But that’s just me. Maybe others are more tempted by the prospect of a free meal.

5 comments

For me i look at the requirements first, proof of residence,does it require proof of income,does it need to open FCA account first, passport photos ?

For me BancABC visa card is the easiest so far to get.

http://www.totemnetwork.blogspot.com have covered all Banks that offer Visa/Mastercards in Zimbabwe.

You need a Visa card and a Mastercard, usually if one fails (for a myriad of reasons) the other will work. Beyond 2 cards, it’s too much effort to effectively protect each and every card and your cash becomes to spread out to be useful.

Imagine having 100 USD spread out over 5 cards, yet you can’t make a 30 USD purchase because none of your cards, individually, has enough money.

I’m always getting stuck on getting one. It’s not that easy, I’m in Mwenezi and the closest place to get one is either Masvingo or BeitBridge. Can’t they generate like Econets VC such that we can get a card number then then card later on 😓

Wow! That’s a real predicament. Unfortunately, VCC come with their own issues too. A lot of sites detect and reject them.

I have failed to make a successful international payment, i get declined and get a notification ‘my bank did not approbe the payment’. I am not sure how to proceed. I alsofaio to check my nalance online since i am outside the country at the moment, great inconvinience