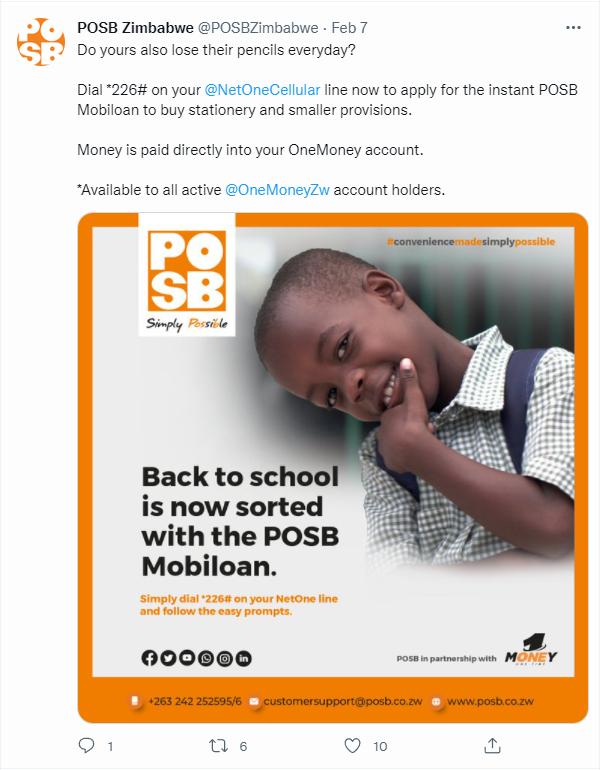

POSB Zimbabwe has announced a new micro-loan facility for OneMoney account holders called Mobiloans. The loans are akin to what Steward Bank and EcoCash have been doing with their Kashagi loans which were reintroduced last year.

Dial *226# on your @NetOneCellular line now to apply for the instant POSB Mobiloan to buy stationery and smaller provisions. Money is paid directly into your OneMoney account.

*Available to all active @OneMoneyZw account holders.

POSB on Twitter

What is POSB offering

If you are a OneMoney mobile money account holder, POSB is offering a maximum of ZWL$1,500 through its Mobiloans program. The loan is payable in 30 days and we reached out to POSB’s contact centre to find out what the terms of the facility are and we were told:

- Interest Rate is 7%

- Administration fee is 1%

- Self Insurance fee is 3.5%

We were informed that if an individual fails to pay back the loan in the stipulated 30 days, they will get an additional 5% penalty on whatever balance remained. If the loan is not fulfilled in 90 days then POSB will blacklist that individual with the Credit Bureau.

What are the use cases for these loans…

ZWL$1,500 is not a lot of money, it’s about US$12.00 at the auction rate and nearly half that if you are going by the varying street rate. So if you are in a bind and you need cash they could be an option but personally, the interest rates and fees associated are not enticing.

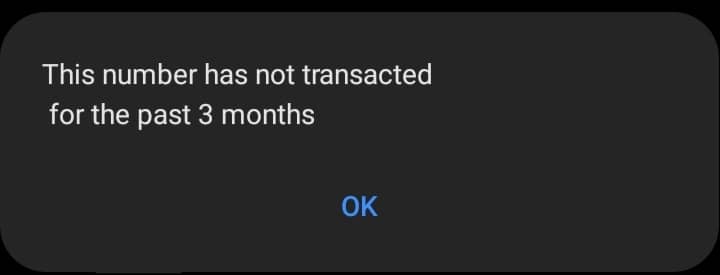

But, if you are in a tight spot that might be a cost worth paying. I tried to give the POSB’s Mobiloans a try for myself by dialling *226# and I got an error that read:

So it looks like you’ll need to have used your wallet in the past three months to qualify for POSB and OneMoney’s micro-loans.

Also, it would be remiss of me not to go back to the Kashagi comparison because it appears that OneMoney is trying to get people to use its service. However, unlike EcoCash, OneMoney doesn’t have a sister company that is a fully-fledged Bank to support a credit facility.

It’ll be interesting to see if this works and if you have applied for POSB’s Mobiloan facility, let me know in the comments below.

6 comments

https://chat.whatsapp.com/Immll2e9uKzE5uAGiXWAi2

Ccc app link…ngaapinde hake mkomana

That error msg has nothing to do with transaction period, I last used my 1money wallet on the 07th February 2022 at 1316hrs (less that 24hrs ago) but am getting the same error msg.

Using this posb facility is a bad idea, you are better off using the ecocash kashagi one. With ecocash you can effectively pay back whenever you want and you won’t be blacklisted

Isu mbinga hatitori tuzvikwereti twevarombo utwu 🤣🤣🤣. Ndoidii sikisi dhorasi. Sorii zvenyu varombo kkkkk

I qualify to borrow 465bond

🤣🤣🤣🤣 haaaaa apa hapana zviripo apa