We have to talk about Telecel again. Every time we get information on the country’s smallest mobile network operator, the picture gets darker. You would think it can’t get worse than:

But it gets darker, my friend. I wonder what their financial statements would reveal.

We don’t have those financial statements but we have the Postal and Telecommunications Regulatory Authority’s (Potraz’s) sector reports. We will continue to glean whatever we can from them.

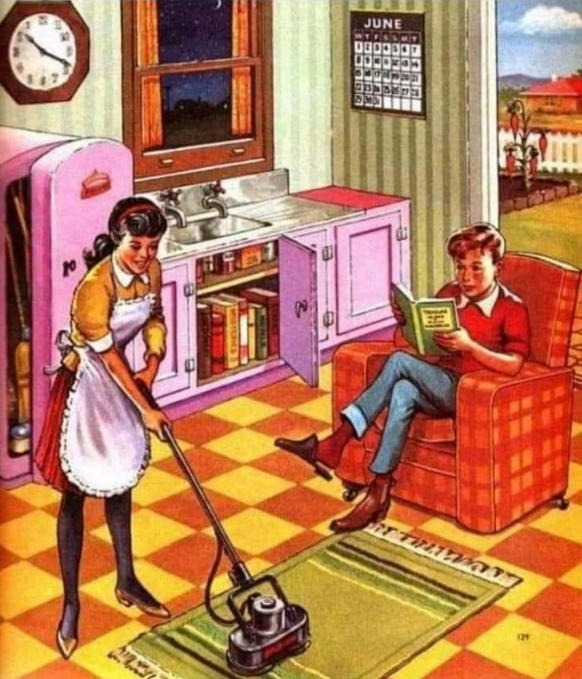

I will warn you though, looking at Telecel’s situation is like looking at those pictures where it gets worse the more you look. Much like the picture below:

Some of the problems are; it’s both night and day at the same time, there is a keyhole on the fridge, brooms in the fridge etc. The more you look at it, the worse it gets.

Telecel subscribers

From Q3 to Q4, Telecel lost 16.9% of its subscribers. Going from 469,489 to 389,951 subscribers to close out 2022.

A 16.9% drop in subscribers would be concerning regardless of the circumstances, but when it’s just following a trend, then it’s Armageddon. Just a year prior, Telecel had 533,545 active subscribers and so in a year they lost over a quarter (27%) of their customers.

Over 2 years they have lost 337,143 customers, going from 727,094 in 2020 to Q4 2022’s 389,951, close to a 50% drop (46%).

When we look at Telecel’s performance on this metric against the competition, the picture gets darker still. They now control a measly 2.7% of the active subscriber market share. Down from 5.5% in 2020 and 3.7% in 2021.

Where Telecel dithers around with 390,000 subscribers, Econet has 9,988,105 (69.9%) and NetOne has 3,922,734 (27.4%).

One hopes they are pulling in all-nighters over at Telecel to try and reverse this. There is such a thing as digging a hole too deep you can never escape. With each quarter of decline, Telecel is approaching that stage, if it’s not there already.

Over 5 years here is how it looks:

Revenue per user

One gripe I have with Potraz’s sector reports is that they are not consistent with the data they present. One quarter they give you a metric and the next they drop it.

They used to tell us the revenue split for the three mobile operators, they no longer do. They used to tell us how much voice, data and SMS contributed to total revenues, in Q4 2022 they decided we didn’t need to know all that.

I think it has to do with trying to hide just how dominant Econet is, after all, we have to remember that NetOne and Telecel are both government-owned. That’s my little theory, I have no evidence for it but it makes sense to me.

When we last had some of that data in Q2 2022, we found that Telecel was making only 64 US cents from each customer per month.

Potraz withheld some of the information we need to make those calculations. However, it still looks like the situation has gotten worse.

- Telecel’s share of voice traffic was 0.8% then, in Q4 it was 0.7%

- Telecel’s share of data and internet traffic was 0.5%, in Q4 it was 0.2%

- Potraz didn’t give us SMS traffic share this time around

I don’t imagine Telecel raked in more revenue in Q4 2022, where their subscriber count tumbled, and their voice and data market share also fell. So, in all likelihood, Telecel is now making less than 64 US cents per customer per month.

Revenues

I think we can assume there wasn’t much of a change in revenue contribution per service for mobile operators. In Q3 2022, voice contributed 44.3% and data, 39.2%.

Let’s assume in Q4 voice contributed 45% and data 40%. That would mean, of total sector revenues of ZW$119.5 billion, voice contributed ZW$53.8 billion and data, ZW$47.8 billion. Telecel’s share of that would be:

- Voice (0.7%) – ZW$376.6 million (US$405,000)

- Data (0.2%) – ZW$95.6 million (US$102,800)

Voice and data contribute around 85% of all revenues and so we can say 85% of Telecel’s revenue is approximately US$507,800. Or a rough 100% figure of US$597,000.

So, if we were able to factor in their actual traffic share of SMS, VAS, USSD etc, we would come up with revenue that does not exceed US$600,000. That’s three months’ revenue by the way. So, monthly revenues of at most, US$200,000.

That means a revenue per user figure of 51 US cents in Q4 2022, down from 64 cents in Q2 2022.

Let that sink in, the average Telecel customer now recharges half a dollar a month. That’s not enough for someone to have a WhatsApp bundle for the whole month.

It is not because Telecel is charging too little, their monthly WhatsApp bundle offers 250MB for ZW$1900. Econet’s offers 240MB for $1833.80. Their weekly USD WhatsApp bundle costs US$1 and so the average customer is not even getting that.

Telecel infrastructure

Telecel has fallen behind on infrastructure. Here is their share of base stations:

- 2G – 13.4%

- 3G – 13.3%

- LTE – 1%

- 5G – 0%

Telecel still has their old 2G and 3G base stations, they were still a contender when those technologies still ruled. By the time Econet became the first to introduce 4G/LTE in 2013, Telecel was struggling and did not manage to install LTE infrastructure.

Now, with data continuing to contribute more to total revenues, Telecel simply doesn’t have the infrastructure to compete. Hence why they have a 0.2% share of data traffic. Without that infrastructure, they will not be able to dig themselves out of the hole they dug for themselves.

The other problem with this scenario is that for those 2G and 3G base stations, Telecel will have the lowest number of subscribers per base station. It could be possible to be the only user connected to a Telecel base station at some point.

That’s why some Telecel subscribers will tell you that Telecel provides the best experience, it may be mostly 3G but when you have a base station to yourself it will beat Econet and NetOne’s 4G which is frankly, mostly disappointing. This is expensive for Telecel.

Having 13% of those base stations but only getting 0.7% of the voice traffic and 0.2% of data means they are underutilising their infrastructure. It costs Telecel more to serve its customers than the competition.

This explains why Telecel is now known for network downtime. Right now, I tried my friend’s Telecel line in Mabelreign and there is no connectivity, at all. It has been the case for months. There’s probably like one person in my neighbourhood with a Telecel line and it doesn’t make sense to fire up their generators to serve that one customer.

It is a vicious cycle. Telecel need customers and to improve revenue per user to be able to offer better service but they need better service to get those customers or get them to spend more.

It’s inevitable

If this keeps on, Telecel will shut its doors in the near future. Something has to give. They have to sort out their shareholder mess, which is mostly responsible for the predicament Telecel finds itself in.

Whoever gets control of Telecel after that will have to fork out billions to revive the sleeping mobile operator. They will have to rebrand, run massive marketing campaigns and that whole shebang.

It will be difficult because here is the situation in summary:

- Revenue per user per month – 51 US cents

- 0.2% of the data traffic market share

- 0.7% of voice traffic market share

- 1% of LTE infrastructure

- 2.7% of the subscriber market share

As bad as that is, you have to remember that it’s getting worse by the quarter.

What do you think about all this? Do you see Telecel turning it around at some point? I am not holding my breath. Or should we just look to licence a different player altogether?

Also read:

Telecel revenues down 95% from 2015 levels, from US$14m to US$0.7m per month in 2022

Should we give Econet, NetOne and Telecel a pass for shoddy service? Maybe

USD LTE data bundles compared. Econet, Telecel, NetOne, Utande, TelOne and Liquid Home

31 comments

The biggest problem with Telecel is the shareholder issue, there have been shareholder fights since it was formed. Gvt has no business being involved in this sector other than being a regulator. In this case better to just license another operator

There will be no investment until there is an uncontested ownership structure. Without that investment, Telecel will continue losing both subscribers and skilled employees. Worsening the situation with every loss. I agree that the govt has to step away.

And here in Marondera the Mash East province headquarter yavo yakavharwa , meaning to say if any troubleshooting occurs you have to go to Harare , kuitavo here ikoko

Its really sad but i think they are tired shame they don’t know what is going to happen to them tomorrow

Telecel needs a shareholder address and remove Government

I remember at one point MTN wanted to take it over i don’t know what happened but those days thats when it introduces fancy services like call backs and extra extra

It’s been over a decade and none of the shareholders will budge. Looks like they would rather see it die than concede control.

They charge more for their data bundles.. just compare their USD DATA bundles they r ridiculous.. and compare them with other..network providers…. they can get out of their situation by focusing on data more…. they should revise down their USD data bundles and get more subscribers to buy the USD data bundles… nowadays data is the king so why Chase away people with charging more than other competitors…..and yet you are in a terible situation… they should see what the market is all about and model business likewise.. people want and use data these days so they must hit that angle wisely

Their approach should be top down…. first they should install Both 5G & 4G most in the urban areas take down 2G and use that spectrum for 4G & 5G include things likes

netflix packages

…look at LIQUID HOME they introduced netflix bundles on their packages why coz they know people use that service

youtube packages

…again LIQUID HOME did add them to their data packages

…VOIP)

On voip look at AFRICOM Maswerasei its working

look at LIQUID HOME their Wibronicks USD bundles start from $1(1GB) they r not crazy… they know their market… on telecel $10 u get 7GB …netOne $10 u get 15GB netOne has 4G so they r killing themselves. They should revise their data bundles down and they will see people subscribing… and add more to their packages it will save them

They actually do not have capacity to serve more customers. They need funding first to install LTE infrastructure. If they lowered their prices today and let’s assume a miracle happened and many people actually bought and recharged Telecel lines, they would have a terrible experience.

There is also a problem in competing on price, I think they wised up on not trying to undercut Econet. It’s just that they don’t have the network to back up their services.

Reading the whole article is hectic trust me, I wish you could try to write your articles in summary like manner. Too much staff and questions in your story. Nevertheless, it is just but informative.

i agree, reading this s h ! te is like eh ah um ok

Noted.

Thanks for the feedback. Next time around when it’s one with too many figures and the like, a summary (TL/DR) should be in order.

The figures are still necessary because without getting into it, it won’t be clear how we got to the conclusions we got to. In the example above, we had to work around the limited information in the Potraz report and look to past reports to be able to approximate that Telecel is now making 50 cents per customer per month. So, a summary of the nuggets uptop and the weeds of how we got to that for those willing to check.

Visual aids such as graphs and charts could help break down text for the reader

tis time to pull the curtains down

It might be, seriously. Guess the shareholders are waiting to see who will blink first and flee.

FYI: With all this load shedding, you can keep brooms in the fridge…

🤣🤣 I detect no lie here. Better use it as a broom cupboard than watch it gather dust.

I just removed my telecel line a day ago after many years of use, reason being since January i cannot check my balance *122# not working for months.

Thanos it’s vonsical

It’s ridiculous. There is a workaround for the balance check but that’s not working either.

In Bulawayo the *122# is not working in Some areas, in my area m the only one using the base station, its very fast like I don’t know, problem is when no power its totally off no back up power.All Telecel base stations around Bulawayo have no security guarding them, the grass has over grown in them.

Telecel cannot afford to use diesel power when there is no electricity and to be fair, even Econet and NetOne don’t use diesel for each and every base station. NetOne told me that in my neighbourhood, when there is no electricity, there are no data services. With Telecel making only 51 cents per customer, there is no way they would be able to do better than that.

But it’s crazy that they have all but neglected some base stations. Shows you that they are incapacitated.

Keep up the good work Leonard. I love your stuff

Thank you for the feedback. Will work to keep improving.

Haa zve telecel inini zvandityora mabhonzo. In Rusape hakuna netwk since January and I have almost forgot that I have a telecel lone and I last recharged it last year coz I don’t see the need kana richiita more than 4 months no ntwk. The other thing is that telecel should solve it’s shareholders messy. Gvt should sell it’s shares and also those clowns calling themselves empowerment corporation should follow suite , then paouya a new one with capital and Ari well organized. In my view telecel can be revitalized if pakauya a good investor

Eish, looks like all over Zimbabwe, many people have not had Telecel network for months. And your response is the rational one, why would you recharge it when you are not sure you will have service. That’s why Telecel keeps losing subscribers each quarter. With each customer lost and remaining customers recharging less, Telecel is doomed to not have the funds to and manpower to work on those network disruptions.

Indeed telecel can be revitalized. Look at Bill Gates with Microsoft…he stepped down…and Melinda took over…. Dr Strive stepped down and Tsisti took over… they know that any business needs a new / fresh mind ..fresh approach.. the share holder must not only be interested in taking ….. they must take and re-invest….. havasi business minded…thats what i see… the empowerment coperation ….and other share holders must solve their issues and see the business progress

I don’t know about Melinda taking over but the general point is good. We should learn to let go at some point. Empowerment Corporation is stubborn and so is the govt saka Telecel iri pama1. Even if EC wanted to invest, they can’t until they know that they would be the beneficial owners.

we are now getting $50 US per month.

US$50 per month? That can’t be $50 from each customer, so is that what they are paying out to employees now?

Telecel should just close. Period!! I see Netone losing subscribers too. Their service has been bad of late and nomatter how cheap your data is, we need to actually use it first for us to enjoy the price. Manje yakutomboita ma periods of blackout. Kutoshaya kana 1 bar re network. In Zim we are abused by service providers, ah 😔.

Love your articles by the way. So detailed I can literally see the graphs in my head. Hameno vari kuti too much information kuti vanorevei 😅. Keep up the good work.