It is well-documented just how much financial inclusion can change people’s fortunes. That’s why I find Know-Your-Customer requirements imposed by regulators to be so frustrating.

According to Silvio, a study found that 64% of MSMEs did not have bank accounts in 2022. One of the main reasons cited was the difficulty in registering their businesses and applying for bank accounts. The same is true for individuals.

I am frustrated that so many MSMEs and individuals do not have access to bank accounts. Fortunately, mobile money stepped in to fill the gap. It is much easier to open a mobile money account than it is to open a bank account. However, upon further scrutiny, it appears that it may be too easy to open a mobile money wallet.

InnBucks

Check out this crazy true story:

A scammer created an Innbucks account with the name Unki Portal, pretending to be the Unki mining company. This is possible because Innbucks does not require users to verify their identities when creating accounts.

The scammer searched Facebook for a person who offers handyman services. In the case at hand, a plumber was found. Let’s call the plumber Cyril.

On a Sunday,

The scammer checked Cyril’s Facebook friends and called one of them. The scammer tricked that friend into believing they were an old acquaintance.

The scammer said they were looking for a plumber for a big job at Unki Mine. The friend said they actually knew a plumber and called Cyril, saying “Hey, someone I worked with a long time ago is now at Unki Mine and needs a plumber.”

Cyril was pleased. He called the Unki man (the scammer). The scammer claimed to be Engineer Moyo and expressed his delight that the plumber had called because he trusted people recommended by that friend in this Wild Wild West of untrustworthy people.

The scammer claimed to have recently constructed ten houses for mine workers in Shurugwi and required solar water heaters installed in all ten houses. They asked for a quick pricing guide. Cyril provided an estimate, and the scammer responded, “You’re charging too little. Unki pays a lot more for this type of work!”

The scammer requested the plumber’s full name so they could arrange entry passes to the site. They then sent the plumber a gate pass code via SMS using a NetOne number. The scammer may have chosen NetOne because they believe that people are not sure how to check for a name on OneMoney.

The scammer claimed that other contractors had already submitted bids for the job and that they had all paid a $350 fee for the tender documents. They said they preferred this plumber because they had been recommended by their friend.

They instructed the plumber to come to Unki Mine’s Finance department in Shurugwi on Monday to pay the fee in person. The plumber agreed, as this was a major opportunity for them.

It’s Monday morning,

The scammer called to inquire about the plumber’s progress in getting to Shurugwi. The plumber was still gathering the $350 fee and had not yet started their journey. The plumber assured the scammer that they were getting ready and would be on their way soon.

The scammer became agitated and said, “You are delaying. We need to make a decision, and you haven’t even purchased the tender documents yet. Please hurry up and don’t let me down.”

The plumber finally managed to borrow $350 from friends and informed the scammer that they were on their way. The scammer stated, “You took too long. Please send the money ahead of your arrival so I can pay for you and have your tender documents and contract prepared for you.”

The plumber was hesitant, but this individual had worked with a friend in the past. What could possibly go wrong?

The plumber still called an Unki Mine number from Google to verify if they had an Innbucks account that suppliers could use to pay for tender documents. The individual at Unki stated, “We typically do not use Innbucks, but I’m not sure. Let me check with my colleagues and I’ll call you back.” They never called back.

The scammer called again, this time even more insistent because they really believed that the plumber was the right person for the job. The plumber decided to just send the money and then got on a bus to Shurugwi.

As the plumber passed through Gweru, he tried to call the scammer to let them know that he was on his way. However, the scammer’s phone was not reachable. The plumber kept trying to call, but the scammer never picked up.

The plumber then called Unki Mine to verify the information that the scammer had provided. Unki Mine informed the plumber that they would never use Innbucks for company business and that there was no such project that required geysers.

The plumber realized that he had been scammed. He called Innbucks to report the incident. Innbucks informed him that the money had already been withdrawn and that they could not really assist him. They advised him to report the matter to the police.

It’s not just Cyril

Unless you are in the top 1% in Zimbabwe, you can understand Cyril’s pain. $350 is a significant sum of money in Zimbabwe, where the average salary is less than that.

It is important to be aware that scams like these are becoming increasingly common. I find it especially despicable that these scams target honest, hard-working people who are simply looking for a chance to succeed. We have seen job seekers fall victim to similar scams in the past.

Another colleague at Techzim had a relative who fell victim to a similar scam. The scammers pretended to be from ZANU PF and claimed to be able to help the victim acquire farming implements. They created a scenario in which the victim had to send some money via InnBucks, and that was the end of it.

There’s blame to go around

While some blame can always be levied on the victim, and on Cyril in the case above, I believe InnBucks should take some of it.

It can’t be that easy to open an account in a well-known organisation’s name on InnBucks. The scammer should not have found it easy to register as Unki Portal.

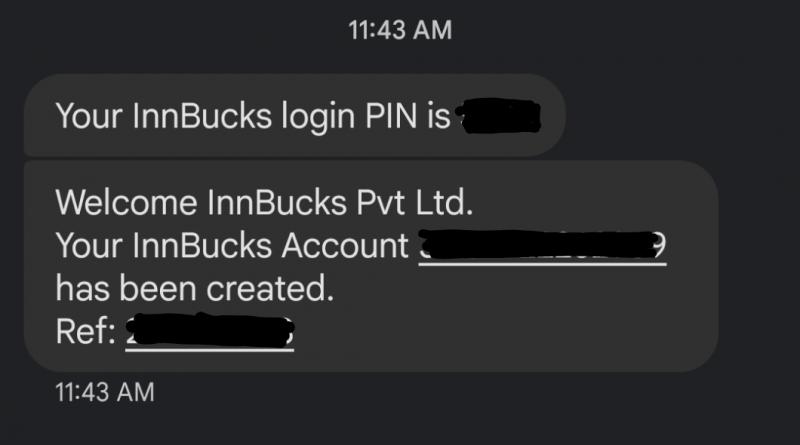

I tested this for myself and registered on InnBucks…as InnBucks.

It is concerning that it is so easy to open a mobile money account. I could do get up to a lot of mischief with that account name. I can’t believe I’m saying this, but I think we need stricter Know Your Customer (KYC) regulations in the mobile money space, especially when it comes to opening accounts.

We need to implement consistent education campaigns to teach people how to protect themselves from scams. However, this is easier said than done when the scams involve social engineering, as was the case with Cyril.

Social engineering scams are designed to exploit human psychology, and they can be very effective at tricking people into giving up their personal information or making payments.

We reached out to InnBucks but they are yet to respond. It appears that’s InnBucks’ strategy – just ignore all of it and hope it all goes away. Well, it won’t go away.

With success comes responsibility. InnBucks has taken a neat little slice of the mobile money pie and scammers are flocking to the platform. So, as stories like Cyril’s come up, InnBucks should be getting ahead of it and tweaking things.

We will update you once we get a response from InnBucks.

However, as we part let us remember the age-old advice, “If it sounds too good to be true, it probably is.” In Zimbabwe and in this age, we can tweak it to say, “If it does not sound like bad news, if it sounds like the break you were praying for, be very wary.”

Also read:

InnBucks now giving loans, here is everything you need to know about them

19 comments

You just gave me an idea 💡!!!

I need shares in the project 😂

But, how were these people communicating? You say “he called”, how?

If he was in doubt, it would have been more logical to ask about the tender, or if an Engineer Moyo actually existed than just call Unki to just ask if they use InnBucks.

Anyway, though I sympathise with the victim, people must understand that golden opportunities rarely seek you out, especially up to the point of harassment.

The scammer first sent a message on Messenger to Cyril’s friend. Then after convincing him he was an old acquaintance he asked for a phone number claiming it was business.

The friend gave Cyril the number that the scammer had used to call.

Your advice is golden. If an opportunity is that golden it’s unlikely that it would pursue you.

You’re right, maybe not full KYC but some authentication at the very least. Requiring BP numbers for companies won’t solve it. An individual can say their name is Old and their surname is Mutual like I did with InnBucks. I registered my first name as InnBucks and surname as Pvt Ltd.

I’m not calling for proof of residence stuff. Just that InnBucks make sure there is an ID with a name before allowing you to register it. Or something like that.

Mukoma lenso. You threw a sucker punch. InnBucks responds with great defence.👇👇

GREAT NEWS! Complete the KYC on our APP to get HIGHER LIMITS! Plus RECEIVE MONEY FROM SA to InnBucks wallets! Tell SA relatives to visit

How was the money withdrawn from Innbucks without an ID? The agent who completed the transaction should be investigated.

Ne pressure yepamaline ku innbucks haaa most hardly check ID akangoona like u holding ID bhora mugedhe

Cyril comes to town

That can still happen whether you have Innbucks or not. Why would you send money to someone you have never seen in your life or visited their place of business? Those scammers can still ask you to send the money to their accounts. They can still say they work for a big corporation or that they are its agent. So please do not blame financial institutions for such glaring personal shortcomings.

Ummm thanks , I m one of them. I was tricked the same way, but mine was a bit silly. Someone called me and said I had won a tractor from zanu pf and said I was supposed to pay for transport before 2pm that day. He then gave me an ecocash number to send the money and spoke to a friend who is money changer to the transaction. The amount was 60000rtgs equivalent to 140$ by then. By the time he made the payment, the number of that guy was switched of and he was never reachable. I phone ecocash about the incident, they checked their system and said the money was moved to another account and they blocked it. I made a police report and I m still waiting for a refund. Nothing yet. I have the number for the guy and even his name on ecocash but I gave the police all the information but nothing was done. Still waiting maybe one day these people will be arrested and face justice.

The scammer may have chosen NetOne because they believe that people are not sure how to check for a name on OneMoney.

How do check name on One Money?

The same way you check a name on EcoCash. Using your NetOne sim card, dial *111# & proceed as though you want to send money to a Netone number. Before final confirmation it will show the registered name for that Netone sim card.

Insightful article. Am still trying to surf the InnBucks waters and be assured this comes in very handy.

#siyavukasiyezamafuthi

Scammers are virtually never caught. Why? Because all the details they supply to service providers are fake. Some use dead people’s names and IDs. Let’s always be on thd lookout guys!

“ZIMRA” called me and told me I was in trouble coz my Tax books weren’t in order. They confirmed all my details, “proving” that they were indeed from Zimra. The demande $1000 bribe, I paid $200 advance payment. They kept asking for more and I realised I had been duped of my $200. Could have lost much more!! Innbucks calls not answered, emails not responded to etc. They have virtually automated everything.

The biggest challenge we have guys is that sometimes scammers work with bona fide employees of a company. The latter supply the scammers with accurate details of the targeted victim. The hardest part is failing to believe the scammer once they give you accurate info about yourself/ company! I am told some of these scammers are ex employees of companies thet purpot to represent.

Let’s share more stories guys to keep each other alert I am sure each one of us has been duped at some point 🤣🤣🤣🤣

I also lost money two times on innbucks after i sold my dp2p the person sent me a blank msg which matchtes innbucks. Current batch numbers for that day ..what stocked me is the msg came through the same thread or portal where genuine inbucks msg come through so there was no was to tell the difference..

Then after i conducted innbucks they say they can’t help go to police but its their account which is hacked

Uchingwara wangu

scammers are even using bank accounts to scam people, the police are jus as useless as the bank personel. it’s a real mess