Cassava Smartech recently released its annual report for 2020. The year for the group was characterised first by the pandemic which gutted business and caused the major shift to digital that is roaring on into this year. The second thing that Cassava endured was the regulatory battle it’s subsidiary EcoCash was locked in with the RBZ and the government. The third and one that has been more perennial is the hyperinflationary economic environment that Zimbabwe has called home for a very long time.

Regulatory pressure on EcoCash

EcoCash, one half of the fintech segment of the business was hard hit by a number of regulatory changes in 2020. The major ones were:

- The National Switch directive which brought EcoCash in concert with all other mobile money and financial institutions.

- Agent lines being permanently banned by the Reserve Bank of Zimbabwe

- Individuals being limited to one mobile money wallet per mobile money operator (MMO).

- The ZWL$5000 a day transaction limit which then became the ZWL$35 000 a week limit.

The final 2 measures impacted the transaction volumes that EcoCash was able to process and the number of subscribers. The other thing that the regulators have been undertaking is a forensic audit of EcoCash and other mobile money operators.

This audit was what delayed Cassava’s half-year report for 2020 and despite it still being undertaken the Group decided to move ahead with releasing its 2020 report.

Financial performance

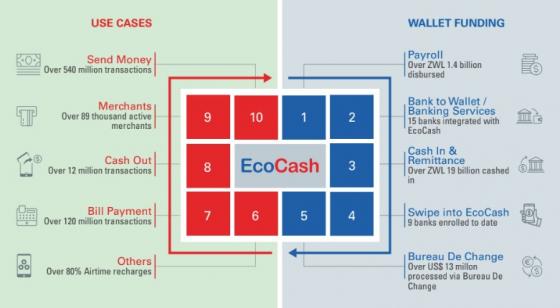

As is to be expected mobile money and banking account for the largest proportion of Cassava Smartech’s earning. EcoCash and Steward accounted for more than 89% of the group’s total income as was reported in its February 2020 year-end report.

One of the biggest revelations of the report was EcoCash’s lifelime transaction ticker which is now at ZWL$93 billion.

This is an impressive milestone for the nation’s largest mobile money operator. EcoCash even though it under restrictions is still depended upon as a primary financial service by many Zimbabweans.

EcoCash isn’t lying down

Even with the regulatory pressure, EcoCash and the folks at Cassava aren’t down yet. The mobile money operator has embarked on a few promotions and programs like the much-derided Rewards program that pushed EcoCash up from the Q2 2020 slump in Q3.

EcoCash has also recently re-launched the KaShagi microloans in partnership with Steward Bank. These initiatives (and I am sure there are more to come) will keep EcoCash above its competitors. As well as improving the prospects of EcoCash passing the ZWL$100 billion mark in the not too distant future.

You can read the full Cassava 2020 report with the link here.

One response

1. Ecocash rewards that’s absolute bull. You have to transact for 500usd (eqvt) to get $1 reward. Is this worth the agony of receiving a message telling you the points accumulated after every transaction?

2. 93 billion figure in hyperinflation is hard to make any meaningful financial sense out of it. I also strongly suspect that those guys at Econet created fictitious cash into their accounts, making millions of real usd from the parallel market. This is Zim I cant totally rule out this. Yes, I agree too that the major cluprit also is the RBZ and entire political landscape.